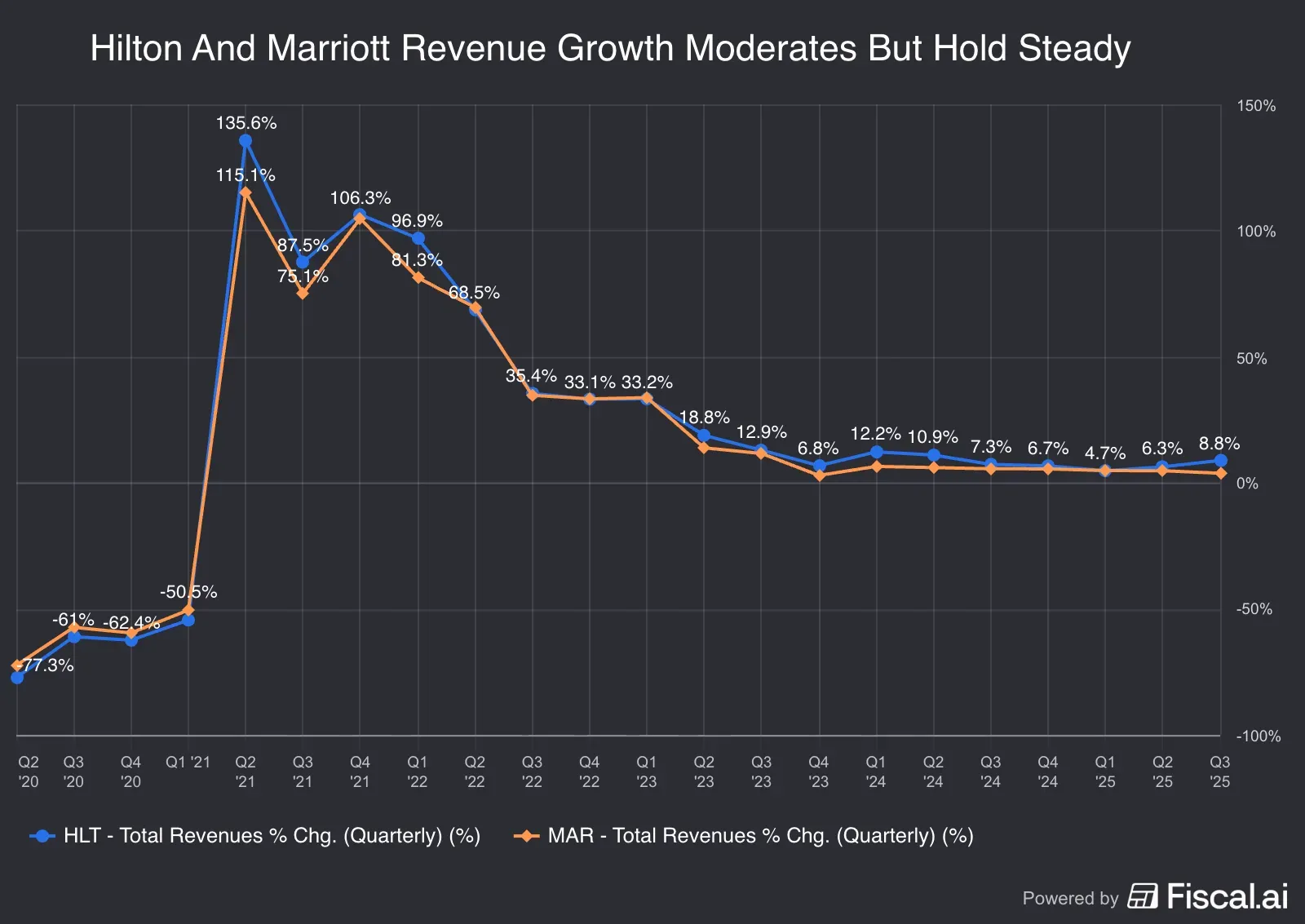

Although revenue growth has cooled, both Hilton and Marriott have continued to beat revenue and profit estimates in recent quarters while rolling out ambitious expansion plans.

- Shares of Marriott International and Hilton Worldwide hit all-time highs this week.

- Both hotel chains have delivered strong earnings in recent quarters and announced aggressive expansion plans.

- Goldman Sachs recently upgraded its rating to ‘Buy’ on MAR and HLT, with analysts holding a cautiously optimistic view.

In a tough year marked by shifting U.S. policy, stubborn inflation, and geopolitical unrest, the hospitality sector has staged a late-year pullback, buoyed by a rebound in leisure and international travel.

Marriott International and Hilton Worldwide Holdings, top stocks in the space, hit all-time highs earlier this week. In fact, the relative strength index (RSI) reading for both stocks jumped to around 62, according to Koyfin, signaling a healthy uptrend. RSI is a momentum indicator that measures how overbought or oversold a stock is on a scale of 0 to 100.

After A Tough Start, Hotel Chains Rebound

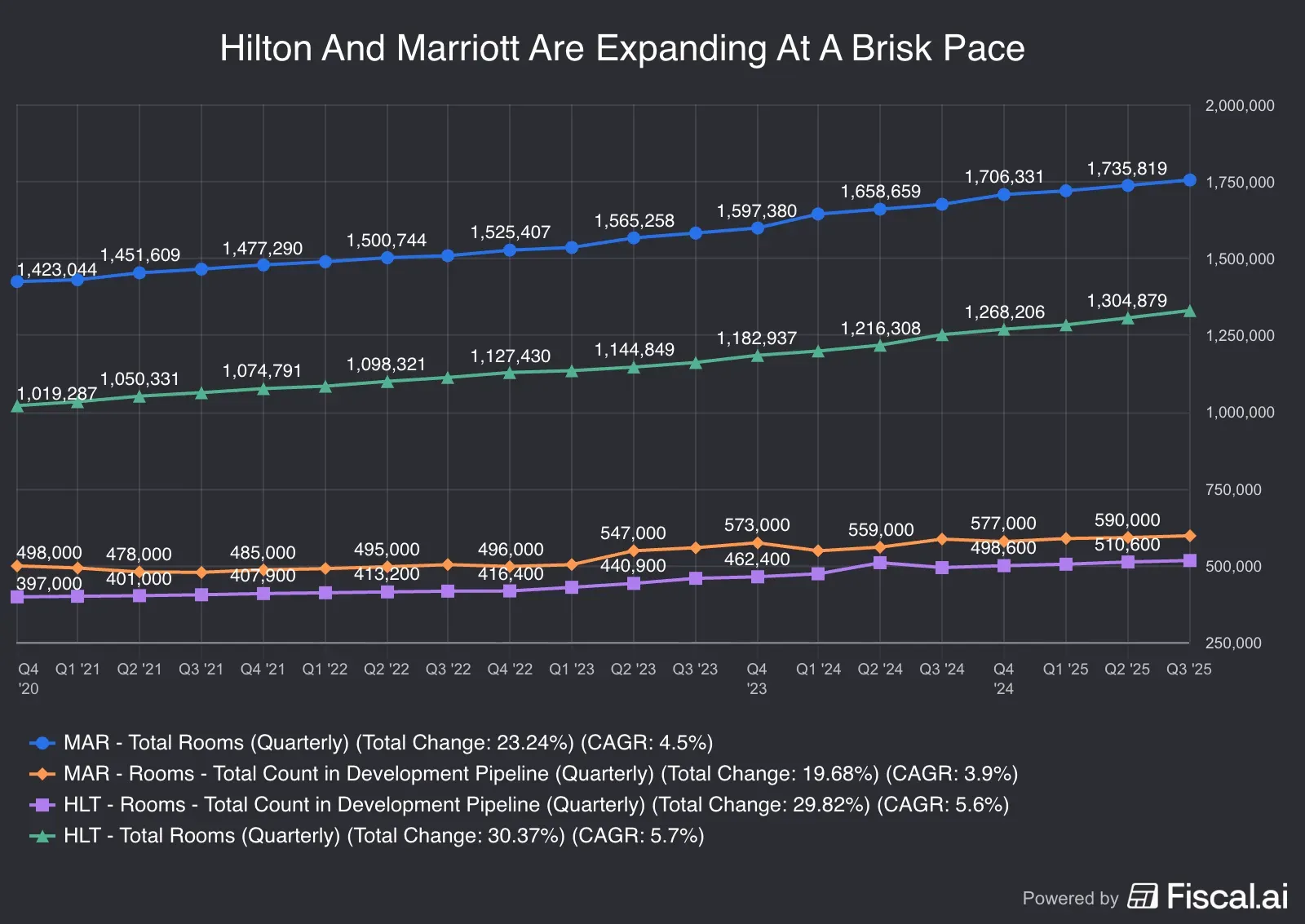

The hospitality industry struggled at the start of the year, partly due to the U.S. cutting federal budgets (and later the government shutdown), which led to a drop in government business at major hotel chains, and weak travel trends in Asia. Travel trends have since bounced back, with hotel chains expanding at a brisk pace, further driving investor optimism.

Although revenue growth has moderated, both Hilton and Marriott have consistently beaten top and bottom-line estimates in recent quarters. In the most recent quarter, Hilton forecast 2025 profit above analysts’ expectations, and Marriott raised its full-year profit view.

Hilton management flagged weakness in middle-income and lower-income consumers – a view shared by several consumer-facing firms in the past quarter – and said luxury stays were doing rather well. Similarly, Marriott’s upscale segments, including Ritz-Carlton and St. Regis, cushioned the impact of slowing demand in its budget and select-service offerings.

Aggressive Expansion

Buying investor interest is their aggressive expansion. Hilton has announced new properties in Turkey and Mexico and is developing the UK’s iconic Admiralty Arch, which sits just opposite Buckingham Palace, into a luxury hotel. Marriott is set to open new properties in the U.S., Japan, India, and Papua New Guinea next year, and has just announced that it has reached 100 property deals for its City Express midscale hotel brand across the U.S. and Canada.

Analysts Cautiously Optimistic

Top analysts have bumped price targets on the two stocks in recent months, with Goldman Sachs upgrading its rating to ‘Buy’ for them just this week. The research firm forecast upbeat room uptake trends for next year, with some help from the upcoming FIFA World Cup, which will be staged across the United States, Canada, and Mexico from June 2026.

That said, there is caution. Fourteen out of 27 analysts on Marriott recommend holding the stock, and 11 rate it a ‘Buy’ or higher; For Hilton, 13 out of 26 rate it a ‘Buy’ or higher, and 12 have a ‘holding’ rating.

On Stocktwits, MAR and HLT have had comparatively low levels of retail interest, with their watcher counts increasing by only 1.5% and 2.7%, respectively, over the past year. As of the last reading, the retail sentiment was ‘bearish’ for both stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<