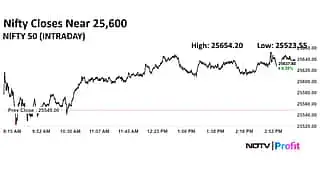

The resistance for the NSE Nifty 50 has shifted up to 26,000, while the support falls at 25,100, according to Bajaj Broking Research.

The positive market breadth, characterised by broad-based sectoral participation, adds further credibility to the ongoing uptrend, it said.

“Going ahead, index to maintain overall positive bias and head towards 25,900 to 26,000 levels,” Bajaj Broking Research said. “The upper band of the recent consolidation range 25,100-25,200 is likely to reverse its role and act as key support in coming weeks.”

During the week, the market successfully cleared the crucial resistance zone of 25,300, and post-breakout, it intensified its positive momentum, according to Amol Athawale, vice president of technical research at Kotak Securities. “Now 25,500-25,300 would act as crucial retracement support zones.”

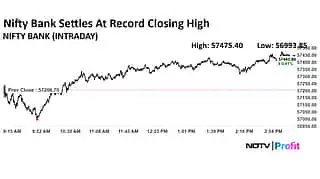

For Bank Nifty, another keenly tracked index, Bajaj Broking projected an upside potential towards 58,000 to 58,500 mark. On the downside, the key support base has been recalibrated to the 56,000 to 55,500 level.

Indian benchmark equity indices closed with gains on Friday, led by share prices of Jio Financial Services Ltd. and Asian Paints Ltd.

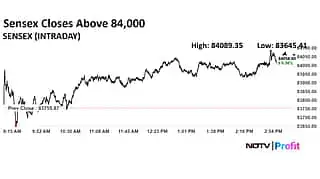

The NSE Nifty 50 ended 88.8 points or 0.35% higher at 25,637.8, while the BSE Sensex closed 303.03 points or 0.36% up at 84,058.9. During the day, Nifty rose 0.41% to trade at 25,654.2 and the Sensex advanced 0.4% to 84,089.35.

The Indian rupee closed 21 paise stronger at 85.49 against the US dollar on Friday in comparison to its previous close of Rs 85.70 on Thursday. The currency’s advance comes amid ongoing market uncertainty and geopolitical tensions.

The Indian rupee closed 21 paise stronger at 85.49 against the US dollar on Friday in comparison to its previous close of Rs 85.70 on Thursday. The currency’s advance comes amid ongoing market uncertainty and geopolitical tensions.