The US markets ended in mixed, with the Dow Jones loosing 0.4%, and the S&P500 and NASDAQ closed in green. The Japanese markets traded in red on Wednesday afterthe Japanese Yen continued to strengthen further. The GIFT NIFTY futures traded over 100 points higher on Wednesday morning.

On the technical charts, the NIFTY50 closed above the 200-EMA level on Tuesday, after the bounce back in closing hours. The closing above the 200-EMA level of 25,162 indicates buying strength from lower levels. Experts believe the index could remain in the range of 200-EMA ahead of the budget announcement on the weekend.

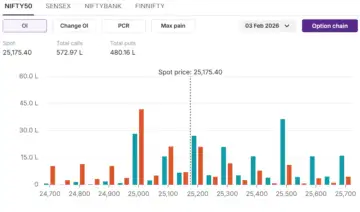

On the options data front, the initial open interest buildup for 03 Feb expiry indicates 25,000 as the crucial and strong support with the highest open interest on the downside. On the upside, 25,500 calls continued to held the highest open interest, indicating a strong resistance.

On the options data front, the initial open interest buildup for 03 Feb expiry indicates 25,000 as the crucial and strong support with the highest open interest on the downside. On the upside, 25,500 calls continued to held the highest open interest, indicating a strong resistance.