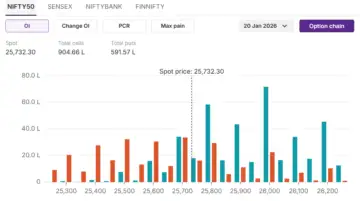

NIFTY50

Max call OI:26,000

Max put OI:25,700

(Ten strikes to ATM, 20 Jan expiry)

The NIFTY50 edged lower on expiry day after a sharp bounce back on Monday.

The index remained volatile throughout the trading session. However, it managed to close above the crucial psychological support of 25,700. Investors and market participants will be closely watching the corporate earnings season.

On the technical front, the NIFTY50 continues to trade below the 20-EMA level of 25,977 on the daily charts, indicating short-term bearishness in the index. The momentum towards previous record high levels can only be expected after a weekly closing above 26,000 levels on Friday.

On the options data front, the 26,000 calls hold the highest open interest, indicating a strong resistance for the NIFTY50 for the coming weekly expiry. On the other hand, 25,700 puts hold the highest open interest, protecting the downside.

Stock Scanner

Long buildup: – ONGC, Eternal

Short buildup: Trent, L&T

Top traded futures contracts: Reliance, ICICI Bank

Top traded options contracts: TCS 3,300 CE

F&O securities under ban:

F&O securities out of the ban:

To access a specially curated smartlist of the most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with a price increase, and short build-up means an increase in Open Interest(OI) along with a price decrease-source: Upstox and NSE.