Investors await the outcome of India-US trade talks set to resume this week in Washington.

Indian equity markets ended lower, but the Nifty managed to hold above 25,200 even as global trade tensions between the US and China weighed on investor sentiment. Meanwhile, reports suggest that India and the US are set to resume trade talks this week with a senior delegation visiting Washington.

On Monday, the Sensex closed 173 points lower at 82,327, while the Nifty 50 ended down 58 points at 25,227. Broader markets were mixed, with the Nifty Midcap index rising 0.1% and the Smallcap index falling 0.1%.

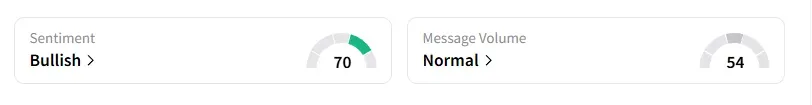

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, FMCG, IT, metals, and consumer durables took a knock in trade, while financials saw some buying.

Tata Motors was the top Nifty loser, slipping over 2% as the auto major prepares to split its commercial and passenger vehicle businesses tomorrow.

HDFC AMC rose 3% ahead of its board meeting to consider a potential bonus issue.

Avenue Supermarts (DMart) ended 3% lower on a weak September quarter earnings show. While Vodafone Idea closed 4% lower after the Supreme Court postponed hearing the telecom giant’s plea against the government’s additional adjusted gross revenue (AGR) demand to October 27.

BLS International Services ended 11% lower after the company was barred from MEA tenders for two years. And Dreamfolks shares surged 15% following its recent fintech partnerships.

Stock Calls

Mayank Singh Chandel flagged a breakout play in Karur Vysya Bank, noting it was trading close to its resistance zone and all-time high. Once it gives a close above ₹231.5, it may start a strong upward move. He recommended entry on a close above ₹231.5, with a stop loss below ₹200 and to trail your profits as the stock moves up.

Priyank Sharma is bullish on Adani Ports. He believes that the retest of ₹1,375 seems a good level of support for it to jump to the targets of ₹1,475-₹1,495 next. Sharma added that this setup is valid as long as the stock holds ₹1,375.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a strong start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <