Geopolitical tensions lifted critical metal stocks as U.S. reshoring efforts, government backing, and supply fears drove gains.

- China’s export controls heightened supply risks, pushing rare earths and critical metals into strategic focus.

- U.S. policy support, partnerships, and funding accelerated momentum across the sector.

- Valuations diverged after the rally, with analysts still seeing selective upside despite execution risks.

China’s hard line against President Donald Trump’s tariffs proved a blessing in disguise for at least one industry. Rare earth elements (REE) manufacturers and those making other critical metals shot to prominence amid the bilateral bickerings that threatened to derail the supply chain.

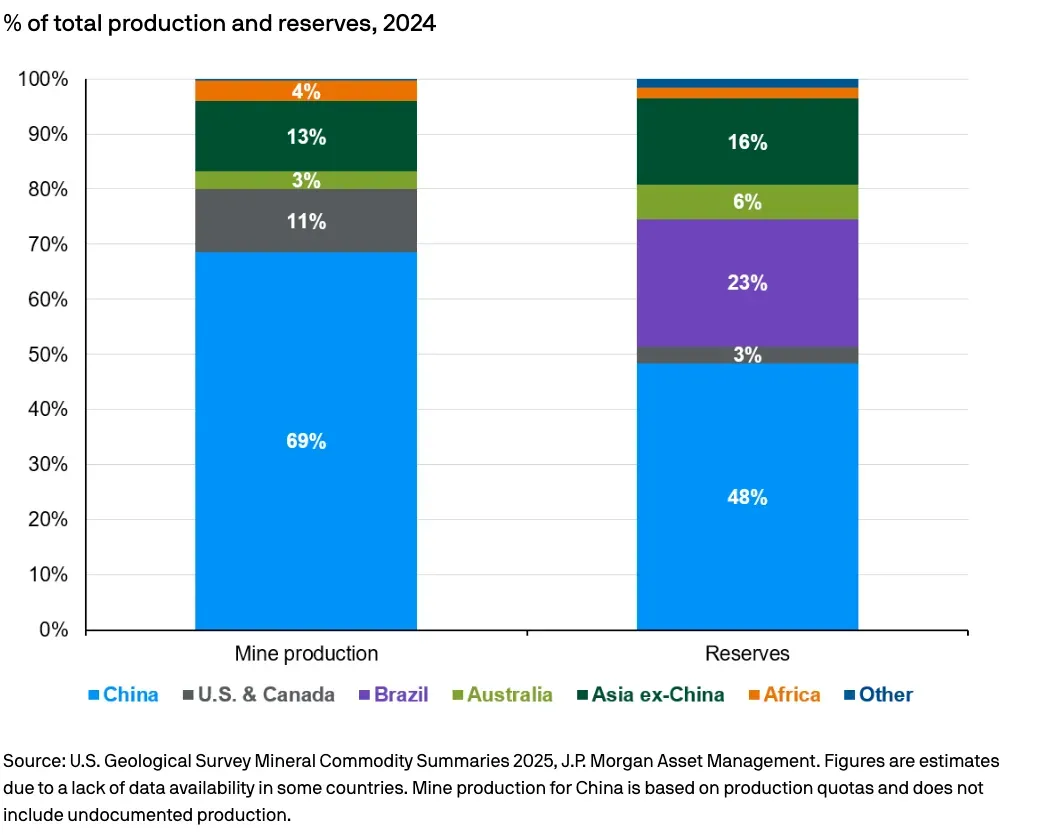

China accounted for roughly 70% of global rare earth production and more than 85% of processing capacity in 2024, JPMorgan said in a report. As trade tensions between the U.S. and China escalated, Beijing tightened controls on the export of critical metals, stoking fears of supply shortages. These metals are essential for manufacturing high-performance permanent magnets, key components in electric motors, wind turbines, and a wide range of electronic devices.

Against this backdrop, the Trump administration shifted its focus to strengthening domestic supply chains for REEs—a group of 17 metals that includes scandium, yttrium, and the 15 lanthanides—to ensure long-term supply security. Highlighting their strategic importance, JPMorgan, citing Oxford Economics, warned that even a partial disruption in REE supplies could shave around one percentage point off U.S. economic growth over two years.

Critical Metal Stocks Take Spotlight

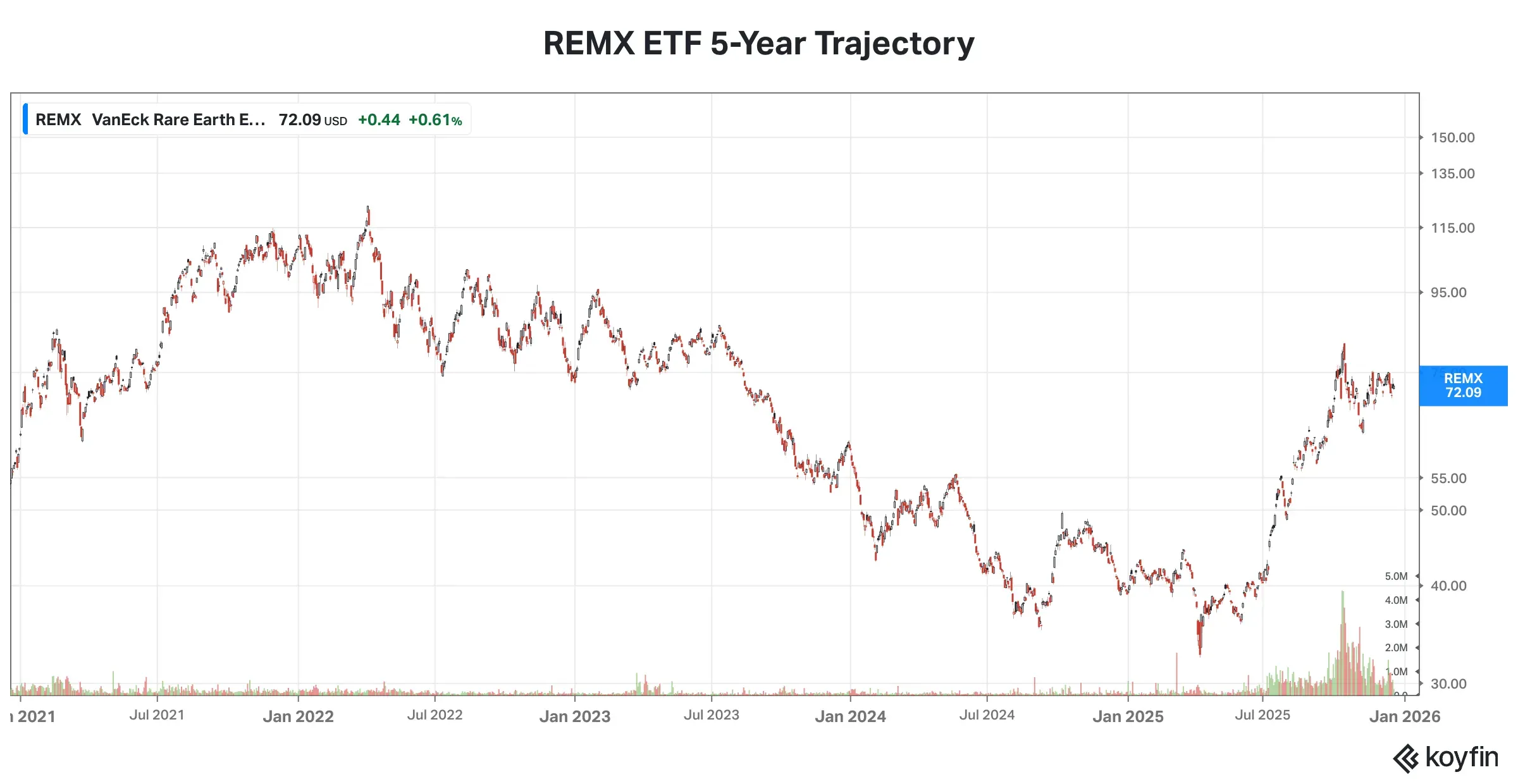

The VanEck Rare Earth and Strategic Metals ETF (REMX), which had been in a secular downtrend since early 2022, regained momentum amid rising geopolitical tensions over rare earth elements. The ETF bottomed in early April before staging a strong rally.

Source: Koyfin<

Source: Koyfin<

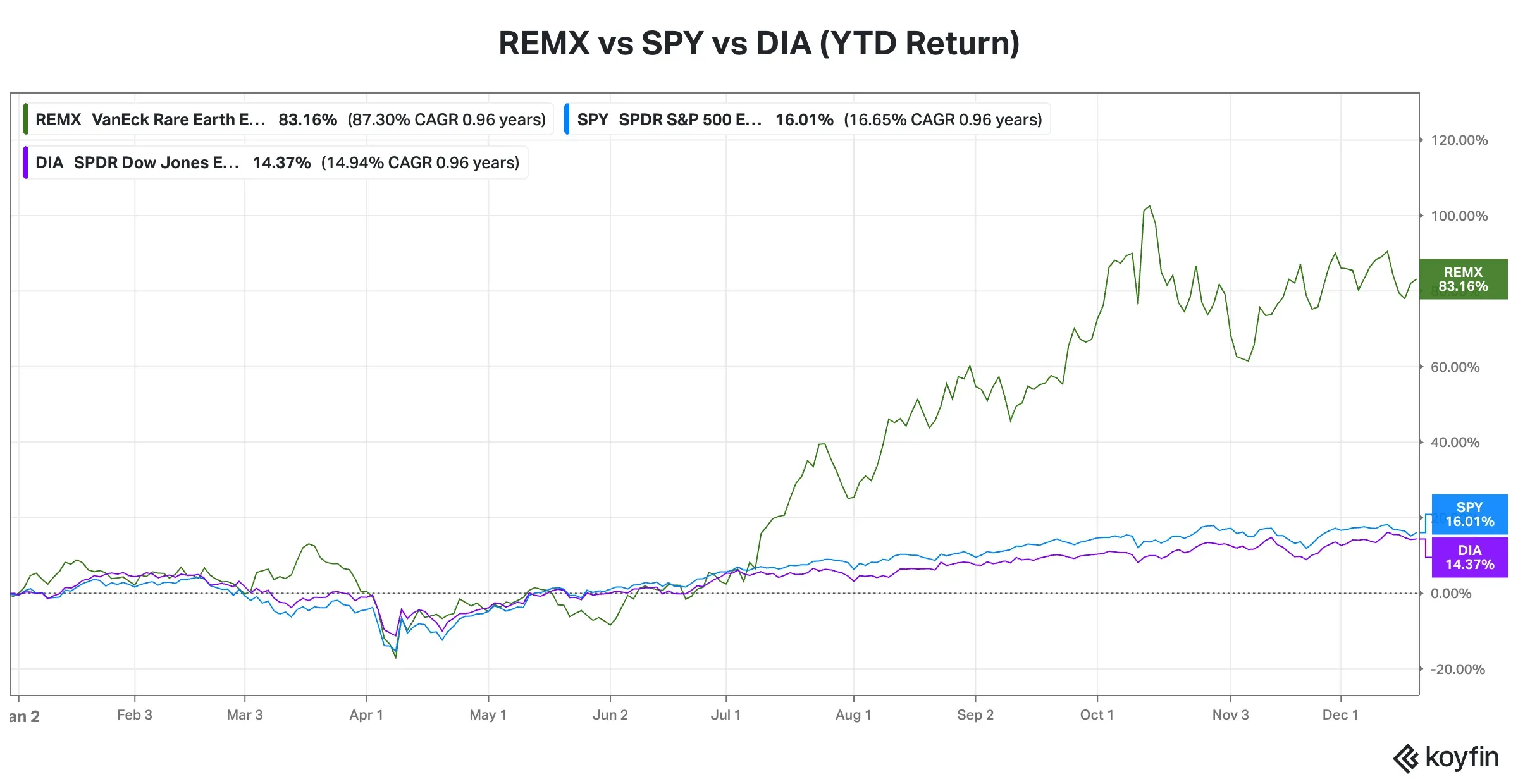

The ETF has generated an 83% return this year, notably outperforming the SPDR S&P 500 ETF (SPY) (+16%) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) (+14.4%).

Source: koyfin<

Source: koyfin<

The industry’s strong performance reflects the government’s focus. The U.S., which is heavily reliant on China for its REEs, has begun to look elsewhere. It has invested $400 million in MP Materials (MP), the only company to have a REE processing facility in the U.S. The Trump administration has also negotiated partnerships with countries such as Australia and Malaysia. While China dominated production, untapped reserves are found globally.

Global Rare Earth Production & Supply

Source: JPMorgan<

Source: JPMorgan<

Top-Performing Critical Metal Stocks

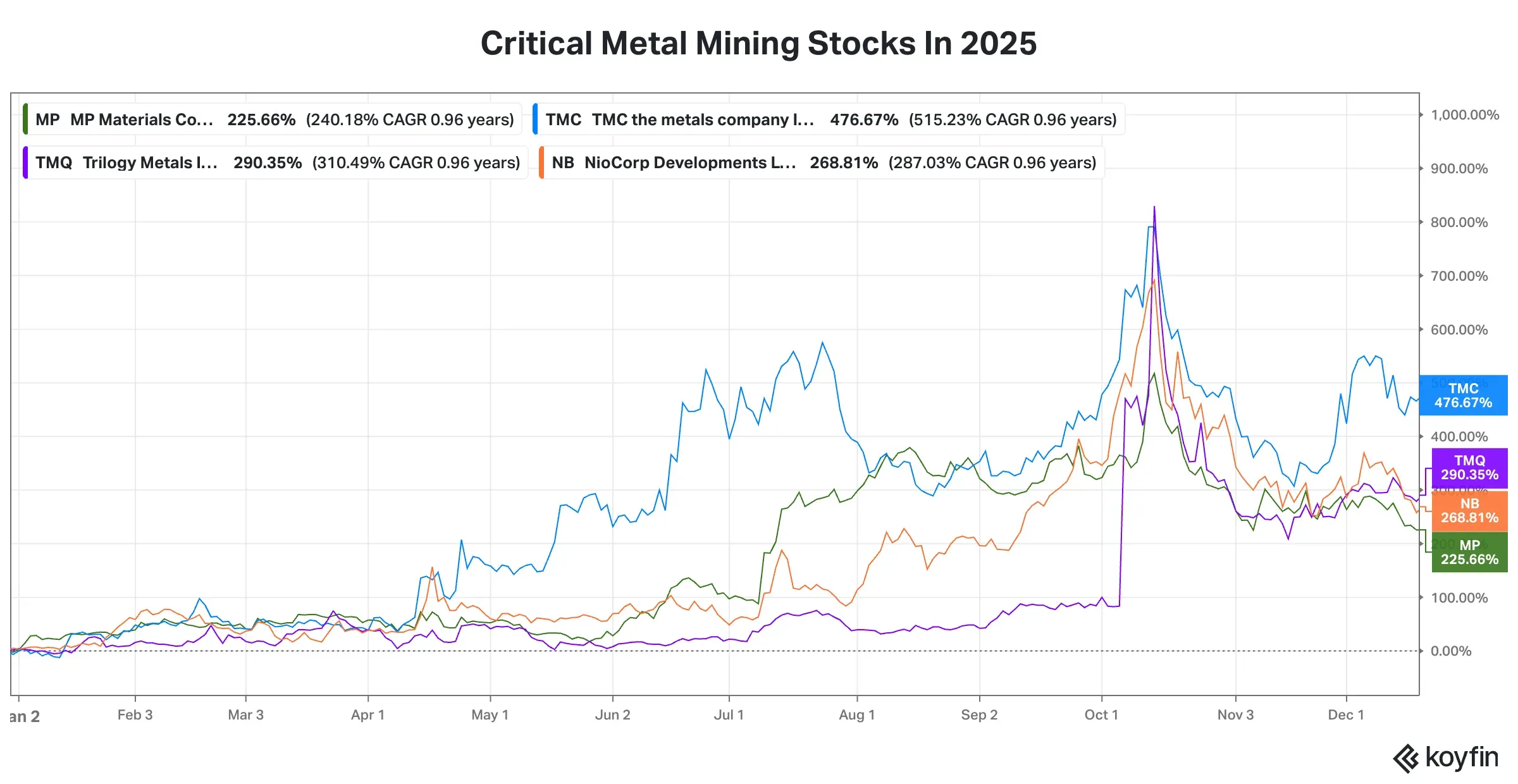

Riding on the wave, some of the rare earth miners have notched up mindboggling gains this year. The Metals Company’s (TMC) stock has jumped over 475% this year. TMC is not a rare earth miner, but is nevertheless engaged in the mining of other critical metals. Canada-based TMC is a deep-sea mining exploration company that mines polymetallic nodules, comprising nickel, cobalt, copper, and manganese in the Pacific.

In June, Korea Zinc announced a strategic equity investment of $85.2 million in TMC, in exchange for 19.6 million common shares.

Trilogy Metals (TMQ) follows with a 290% year-to-date gain. Among other standout REE miners are NioCorp Developments (NB) and MP Materials (MP).

Source: Koyfin<

MP Materials’ stock received a bullish upgrade from Morgan Stanley earlier this month. Analyst Carlos De Alba also increased the price target for the stock to $71 from $69.50. The analyst attributed the action to permanent magnets, and REEs such as Dysprosium and Terbium remained restricted by China.

“We think MP is well positioned to benefit as the US looks to develop a robust ex-China supply chain with MP at the center.”

Morgan Stanley’s bullish stance stems from MP Materials’ partnership with the Department of Defense, which materially de-risks the company’s business model. The firm noted that the company plans to begin commercial production of permanent magnets used in critical military platforms and in green energy applications such as electric vehicles (EVs), wind turbines, and humanoids/robotics by the end of 2025. That said, the firm remains wary of execution risk.

MP Materials recently announced a joint venture with Saudi mining company Maaden in November that could significantly boost its ability to expand its magnetics business. The JV aims at developing a rare earth refinery in Saudi Arabia.

Peer, NioCorp, focuses on developing several critical minerals from the proposed Elk Creek, Nebraska, Project, with a particular focus on three commercial mineral products — Niobium, Scandium, and Titanium — from a single ore body.

Recently, H.C. Wainwright raised the price target for NioCorp to $9.40 from $8.25 and maintained a ‘Buy’ rating, citing the growing popularity of rare earths, the company’s current liquidity position, and its timeline with the U.S. Export-Import Bank, according to Investing.com.

Trilogy Metals (TMQ) is an exploration and development company operating in the Ambler mining district located in northwestern Alaska, with a focus on critical metals such as high-grade copper, cobalt, zinc, lead, gold, and silver. Much of the company’s gains came in early October, when Trump announced that the government would take a 10% stake in the company by investing $35.6 million to support mining exploration in Alaska’s Ambler Mining District.

Retail Mood Muted

On Stocktwits, retail sentiment toward TMC was ‘neutral,’ while retailers held a ‘bearish’ view of the other three. While a bullish watcher said he has never sold a TMC stock since 2023, a few held an outright negative opinion of the stock.

Valuations After Run-up

In terms of trailing price-to-book ratio, MP Material’s valuation is 4.7 times compared to 5.9 times for Triliogy Metals and 4.3 times for NioCorp. TMC trades at a hefty 35.35 ratio.

According to Koyfin, the average analyst price target suggests upside potential of 27% for TMC Metal, 52% for MP Materials, 35% for Trilogy Metals and 142% for NioCorp.

Considering the current valuation and upside potential, NioCorp appears to be a better bet, followed by MP Materials.

The industry is set to make waves yet again in 2026. Morgan Stanley named REEs and critical minerals as one of the key themes for 2026.

“Consensus view is that the U.S. govt will continue to provide financial support for REE/CM reshoring efforts.”

The firm also flagged other efforts the Trump administration has taken to prop up the critical mineral industry, apart from taking direct equity stakes in some companies. These include implementing a 10-year price floor for MP Materials Neodymium & Praseodymium, REEs crucial for magnets, and materials-specific tariffs.

Going forward, Morgan Stanley expects the government support to come in the form of “a more targeted, fiscally contained government framework in which support is delivered through project-level grants/loans and potentially complemented by a Section 232-equivalent mechanism for rare earths and critical minerals.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.<