Promoter Rising Sun Holdings infused ₹1,500 crore via private placement. The stock is also set to reclassify as a mid-cap by 2026, further boosting investor sentiment.

Indian non-banking financial company Poonawala Fincorp surged 14% on Thursday following a substantial ₹1,500 crore fund infusion by its promoter, Rising Sun Holdings.

Poonawala Fincorp shares hit a 52-week high of ₹513 in early trade, supported by strong volume action. The small-cap stock has risen over 20% in the last three months.

In an exchange filing after market hours on September 17, Poonawalla Fincorp said that its board approved issuing 3.31 crore shares at ₹452.51 per share to the promoter via a private placement, signaling promoter confidence and boosting investor sentiment.

Rising Sun Holdings’ stake will increase from about 62.43% to 63.97%, according to some reports.

Moving To Midcaps?

In other news, a Nuvama report said that the Association of Mutual Funds in India (AMFI) has announced the stock re-categorization and has highlighted the market cap changes in large, mid, and small cap. Based on this, Poonawalla Fincorp, a small-cap with a market cap of ₹34,713 crore, will join the mid-cap segment from February 2026.

What Is The Retail Mood?

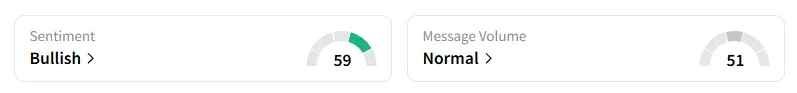

Data on Stocktwits shows that retail sentiment improved from ‘neutral’ last week to ‘bullish’ following this news development.

Poonawala Fincorp has rallied 62% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<