ISM Manufacturing PMI rose to 52.6 on Monday, its first expansion reading in 12 months.

- Analysts broadly see the data as supportive for crypto but disagree on how the impact may play out.

- Real Vision CEO Raoul Pal said PMI strength is a necessary condition for sustained crypto gains.

- Other analysts remain cautious, citing the low likelihood of a new bull market.

A surprise jump in the ISM Manufacturing PMI to 52.6 on Monday, marking its first expansion in 12 months, split crypto analysts over what the data could mean for Bitcoin (BTC) and the broader cryptocurrency market.

The reading marked the highest level the ISM Manufacturing PMI has been at since August 2022. It was also a notable improvement from December’s 47.9 reading and beat forecasts of 48.5.

While most market watchers agree that the numbers are positive for the overall cryptocurrency market, they remain divided on the extent of the impact on prices and how it will play out. Bitcoin’s price rose 2.9% in the last 24 hours to around $78,800 – extending its recovery from the weekend flash crash that pulled the crypto market’s value below $3 trillion.

On Stocktwits, retail sentiment around the apex cryptocurrency improved marginally to ‘bearish’ from ‘extremely bearish’ territory over the past day, with chatter remaining at ‘extremely high’ levels.

Analysts Split On What PMI Expansion Means For Crypto

“ISM is not everything, and it doesn’t mean up only yet necessarily, but it is a necessary condition for strong crypto prices over time (as in liquidity),” Raoul Pal, Real Vision CEO, said in a post on X. The former Goldman Sachs managing director is known for correctly predicting the 2011 peak and the 2025 crypto rally.

However, others disagree. Host of ‘Colin Talks Crypto’ and creator of the Crypto Bitcoin Bull Run Index (CBBI) stated that while the uptick in ISM is a “nice start”, it’s more than likely that Bitcoin is still in a bear market. “I give this outcome of ISM causing (or signalling) a 2026 extended bull run about a 20% chance of materializing,” he wrote in a post on X. “It’s possible. I won’t rule it out. But I don’t think it has big odds.”

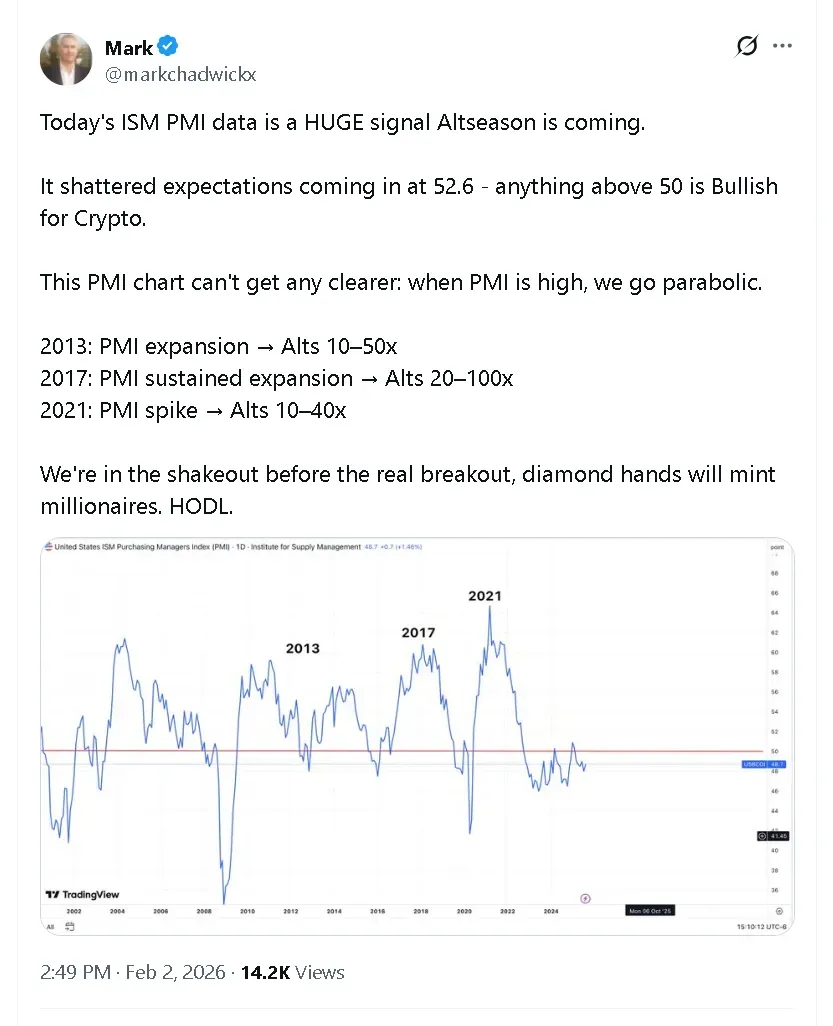

Meanwhile, entrepreneur and investor Mark Chadwick said the PMI reading signals that altcoin season may finally be upon the crypto market. “This PMI chart can’t get any clearer; when PMI is high, we go parabolic,” he wrote on X.

Why ISM Manufacturing PMI Matters for Crypto Markets

Crypto commentator Jesse Eckel argued that the PMI’s move above 50 carries historical significance for the crypto market. He noted that major crypto bull runs in 2013, 2017, and 2021 coincided with ISM readings above the expansion threshold.

“This entire cycle, since 2021, we’ve been below 50 with only tiny blips above the surface,” he wrote in a post on X. “This is by far the largest move up we’ve had this cycle. Run it hot.”

According to Eckel, the PMI itself is less important as a survey and more valuable as an indicator of economic acceleration and liquidity momentum. He explained that when liquidity expands and economic activity accelerates, investors tend to move further out along the risk curve. This usually spells good news for Bitcoin, NFTs, and altcoins across the crypto market. “People don’t invest in the riskiest assets when they are scared; they do it when they are greedy,” he said.

So far, he noted that the currency cycle has been driven purely by narrative, institutional adoption, and “boomer” ETF money. He forecast the current setup could result in a bigger crypto cycle than the one the market saw in 2021.

Read also: Cathie Wood Says ‘I Would Shift From Gold To Bitcoin’ As ARK Invest Buys The Dip In Crypto Stocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.<