Garuda’s stock has gained over 50% so far this year

Shares of infrastructure and telecom companies were in focus on Thursday, with Garuda Construction, GR Infraprojects, and HFCL rising between 2% and 11% after announcing new contracts.

Garuda Construction and Engineering

Shares of Garuda Construction and Engineering surged 11% to ₹209.25 on Thursday. The company received an EPC contract worth ₹143.96 crore from Orbit Ventures Developers for the redevelopment project “Shikhar-B” located in Oshiwara, Mumbai.

The project, which will be executed under an Engineering, Procurement, and Construction (EPC) agreement, is expected to be completed within 36 months. Under the terms of the contract, payments will be made through the allotment of earmarked flats, rather than through direct cash transactions.

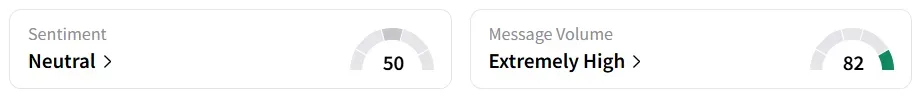

Retail chatter on Stocktwits increased to ‘extremely high’ after the contract announcement, even as the sentiment remained ‘neutral’. It was ‘bearish’ over a month ago.

The stock has seen strong buying interest year-to-date, gaining over 50%. It also recorded its highest intra-day gains in nearly three months.

GR Infraprojects

GR Infraprojects shares rose 5.3% to ₹1,309.8 after the company received a letter of acceptance (LoA) from the State Highways Authority of Jharkhand for an EPC project involving the construction of the Giridih Bypass (towards Tundi) road.

The project, spanning a total length of 26.672 km, is valued at ₹290.23 crore and is expected to be executed within 24 months.

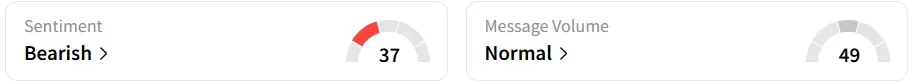

Retail sentiment for the stock remained ‘bearish’. It was ‘neutral’ a couple of sessions earlier.

YTD, the stock has shed 13.6%.

HFCL

HFCL stock climbed 2% to ₹74.8 after it secured export orders worth $34.19 million through its wholly owned overseas subsidiary for the supply of optical fiber cables to an international customer. The contracts are scheduled for execution by April 2026.

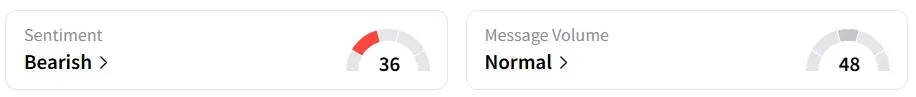

Retail sentiment for the stock remained ‘bearish’ for the past two sessions. It was ‘neutral’ before that.

Overall, the stock has lost more than a third of its value so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<