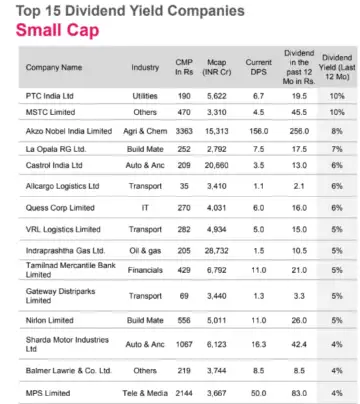

For investors seeking steady cash flow and income generation, dividend-paying stocks have always held appeal. While large-cap companies traditionally dominate the dividend space, a recent study by Axis Securities highlighted that select small-cap companies are also emerging as attractive plays for income-focused portfolios.

These firms not only offer the potential for capital appreciation but also deliver robust cash returns, with dividend yields ranging between 5 percent and 10 percent over the past 12 months.

Dividend yield, a key financial metric, is calculated by dividing the dividend paid per share by the current market price of the stock. It gives investors a clear picture of how much return they are receiving through cash payouts relative to the stock’s valuation. At a time when fixed income instruments continue to deliver modest returns, these small-cap companies stand out by providing consistent payouts that can help investors generate regular income while still maintaining equity exposure.

Top Performers with Double-Digit Dividend Yields

Leading the dividend yield charts were PTC India and MSTC Ltd, both delivering an impressive 10 percent yield. PTC India, a key player in the power trading space, distributed ₹19.5 per share, while MSTC, engaged in e-commerce and trading services, rewarded shareholders with a dividend of ₹45.5 per share.

Not far behind was Akzo Nobel India, a well-known paints and coatings company, which offered an 8 percent yield. The company paid out ₹256 per share as dividends, making it a notable income-generating stock in the consumer sector.

Another significant contributor to investor returns was La Opala RG, a glassware manufacturer, which delivered a 7 percent dividend yield by paying ₹17.5 per share. The company has steadily built its presence in the premium household products segment, and its shareholder rewards underscore its strong cash flow generation.

Mid-Range and Moderate Yielders Add Balance

Beyond the top performers, a range of small-cap companies offered mid-range yields in the 6 percent category. Castrol India, a major lubricants manufacturer, rewarded investors with ₹13 per share, while Allcargo Logistics distributed ₹2.1 per share, each delivering a 6 percent yield. Quess Corp, a player in IT services and staffing solutions, also joined this category, paying ₹16 per share and offering a 6 percent dividend yield.

In the moderate-yield bracket of 5 percent, VRL Logistics distributed ₹15 per share. Indraprastha Gas, a leading city gas distributor, rewarded investors with ₹10.5 per share, while Tamilnad Mercantile Bank, one of India’s oldest private banks, declared ₹21 per share in dividends. All three companies maintained a steady payout ratio, highlighting a balance between reinvesting in growth and rewarding shareholders. Others with a 5 percent dividend yield include Gateway Distriparks and Nirlon Ltd.