Kolkata: India is the fastest growing major economy in the world. It is easy to understand how intense India’s energy hunger is. The demand for electricity is constantly rising and the accent is on clean technology. Shifting from coal-based power to cleaner sources is a focus of the Centre. Though coal is the mainstay of India’s power generation, the government is working overtime to gradually shift to cleaner fuels. This is exactly where nuclear power fits in.

India has a goal of installing 500 GW of non-fossil fuel capacity by 2030 — less than five years away. This is also the year when the country would be generating 50% of its power from renewable energy sources. It has also pledged to achieve net-zero emissions by 2070. If managed efficiently, nuclear power can be a clean source of power generation. The government is taking steps to boost nuclear power capacity as a part of the meeting the 50% energy source from non-fossil fuels. Nuclear power accounts for only 3% of India’s power and seems to have a lot of headroom for growth.

Several companies are active in the nuclear energy domain in India. Here we take a look at a few, which reports say are expected to get tailwinds in 2026. These are Tata Power, Power Mech Projects, BHEL (Bharat Heavy Electricals Ltd) and Walchandnagar Industries.

Tata Power

This arm of the Tata group is in the business of generation, transmission, and distribution of electricity. It has a total generation capacity of 14,381 MW — 8,860 MW of which is thermal; 1,007 MW from wind; 880 MW from hydro, 443 MW from waste heat recovery/BFG; 3191 MW from solar and 3,760 MW renewable capacity under construction. Tata Power has drawn up plans to invest more than Rs 20,000 crore in new projects in FY25.

Tata Power is exploring how it can enter Small Modular Reactor sector, which has been articulated by the finance minister during the Budget. The government wants to have five of these up and running by the year 2033. Tata Power is waiting for policy reforms that will pave the way for private investment in India’s nuclear sector. According to reports, Tata Power has declined about 11% in the past one year due to lackluster performance on the operational and financial performance. The share was trading at Rs 387.45, up Rs 3.65 0.95% after midday.

Power Mech Projects

This company is a 26-year old firm engaged in the business of providing integrated services in erection, testing, and commissioning (ETC) of boilers, turbines and generators. Its core competence includes ultra mega power projects, super critical thermal power projects as well as sub critical power projects. According to Ace Capital, Power Mech can benefit from the proposed capex to build India’s energy security. The company’s client list includes Adani power, BHEL, Larsen & Toubro, Tata Power, NTPC, Mitsubishi, Siemens and Hyundai.

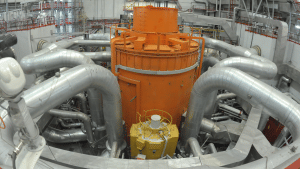

Nuclear energy accounts for only 3% of India’s power generation and the Centre is trying to increase its share. (Picture Credit: Getty Images)

Power Mech Project sunk its teeth in the nuclear energy equipment domain when it entered a contract to construct civil infrastructure for turbine island packages at the Kaiga Atomic Power Project. It is expected to do civil, structural and architectural work of various parts of the project including the turbine generator building and equipment foundations.

Like Tata Power, the Power Mech stock is down 10% in the past one year. The reason: sluggish financial performance. The Power Mech Projects stock was trading at Rs 2,700, up Rs 15.90 or 0.59% on Monday afternoon.

Bharat Heavy Electricals

PSU Bharat Heavy Electricals is an integrated power plant equipment player which is an expert in design, engineering, manufacture, erection, testing, commissioning, and servicing of power plants and other sectors of the economy. The power sector accounts for 76% of BHEL’s revenues and 24% comes from different industries. It can manufacture the entire range of power plant equipment for all sectors — thermal, gas, hydro, and nuclear power projects.

Recently while Prime Minister Narendra Modi was in Russia, it was made public that India and Russia are discussing construction of half a dozen nuclear power plants. BHEL is one of the principal stakeholders in this construction as is Power Mech Projects. BHEL manufactures critical equipment such as steam turbines, generators, heat exchangers and reactor components like headers and end shields. Reports state that BHELs capabilities include work in Turbine Island including the turbine, generator, condenser, and associated equipment as well as primary side of the Nuclear Steam Supply System.

Like tata Power and Powe Mech stocks, the shares of BHEL have taken a beating of 12% in the past one year. On Monday afternoon, BHEL shares were trading at Rs 234.96, up Rs 3.95 or 1.71%.

Walchandnagar Industries

The core competence of Walchandnagar Industries lies in heavy engineering and project execution and it is active in EPC (engineering, procurement, construction)/ turnkey projects, hi-tech manufacturing, engineering products and engineering services. It takes on projects and supplies equipment in nuclear power projects as well as aerospace, missile, defence, oil and gas, steam generation plants, independent power projects etc. It has a trcak record of working in close cooperation with the Department of Atomic Energy, Nuclear Power Corporation of India and Bhabha Atomic Research Centre.

It manufactures critical core equipment for Indian nuclear power plants. These equipment include end shields, heat exchangers, dump tanks for Pressurized Heavy Water Reactors and Fast Breeder Reactors. It had a significant role in the Kalpakkam nuclear plant.

Shares of Walchandnagar Industries have crashed by as much as 30% in the past one year, though it has staged a recovery of more than 22% in the past one month, say reports. The shares of Walchandnagar Industries were trading at Rs 186.16, down Rs 2.75 or 1.46% on Monday afternoon.

(Disclaimer: This article is only meant to provide information. TV9 does not recommend buying or selling shares or subscriptions of any IPO, Mutual Funds, precious metals, commodity, REITs, INVITs, any form of alternative investment instruments and crypto assets.)