Crescent Biopharma announced a strategic partnership with the Chinese firm Sichuan Kelun-Biotech Biopharmaceutical Co. to fast-track its global oncology pipeline.

- Crescent Biopharma is partnering with the Chinese firm Kelun-Biotech to expand its oncology drug pipeline and accelerate its combination strategy.

- The company also announced a $185 million private placement, expected to close around December 8.

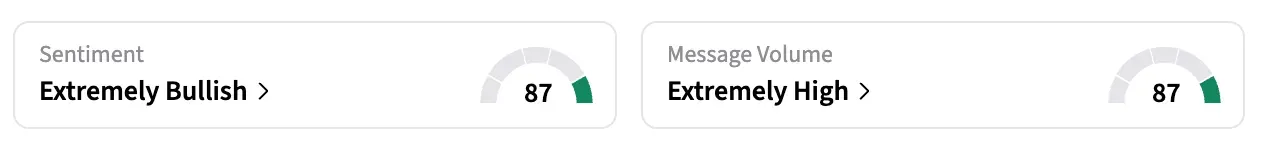

- Stocktwits retail sentiment for the stock was ‘extremely bullish’.

Crescent Biopharma (CBIO) announced a strategic partnership with Sichuan Kelun-Biotech Biopharmaceutical Co. to expand its pipeline of oncology drugs and speed up its combination strategy. The company also announced a $185 million private placement, expected to close around December 8.

Shares of Crescent were up over 40% in pre-market trading.

The company said it has three distinct programs that are expected to enter the clinic in 2026. In addition, the private financing will boost its cash runway.

“We’re excited to share the tremendous progress we’ve made executing on our strategy of building a robust portfolio of next-generation oncology therapeutics,” said Joshua Brumm, chief executive officer of Crescent.

Partnership Details

The deal will allow Crescent exclusive rights to research, develop, and commercialize SKB105 (also known as CR-003) in the United States, Europe, and all markets excluding Greater China. This is an integrin beta-6 (ITGB6)-directed antibody-drug conjugate (ADC) with a topoisomerase payload.

Meanwhile, Kelun-Biotech will obtain exclusive rights to research, develop, and commercialize CR-001 in Greater China, including mainland China, Hong Kong, Macau, and Taiwan. The drug is Crescent’s bispecific antibody that the company says has the potential to be foundational in immuno-oncology.

Both Crescent and Kelun-Biotech will retain the right to independently develop CR-001 in combination with proprietary ADC pipeline assets.

“CR-001, our PD-1 x VEGF bispecific antibody, has the potential to be a foundational immuno-oncology backbone and the partnership we announced with Kelun-Biotech today has enhanced our pipeline of ADCs and accelerated our efforts to deliver potentially best-in-class novel combination therapies,” said Brumm.

Retail Reaction

Stocktwits retail sentiment for the stock changed from ‘neutral’ to ‘extremely bullish’ while message volume jumped to ‘extremely high’.

One user noted they were ‘bullish’ on the stock, adding “In with a starter!”

Another said that the stock was long forgotten in their portfolio.

Shares of Crescent Biopharma were down about 47% year-to-date but have gained almost 8% in the last month.

Also Read: Here’s Why TIGR Stock Rose In Premarket Today – And Retail Traders Think The Rally’s Just Starting

For updates and corrections, email newsroom[at]stocktwits[dot]com.<