Tesla’s long-simmering tensions with California have flared again after state regulators ruled its Autopilot and Full Self-Driving marketing misleading, threatening sales restrictions.

- Tesla’s roots in California, from Fremont manufacturing to headquarters, contrast with its current tensions amid Musk’s changed political ideology.

- Wall Street analysts remain skeptical despite investors reposing faith in the stock.

- The stock is on track to scale a fresh record in Wednesday’s session, possibly challenging the $500 psychological resistance.

Tesla faces yet another headwind in California, a state that was once its home before Texas, but investors aren’t losing sleep. The EV company’s stock appears on track to extend its record run, having risen modestly in Wednesday’s premarket trading.

The Blue state dropped a bombshell on Tuesday. In a 2023 complaint filed by the California Department of Motor Vehicles (DMV), alleging false advertisements with respect to “autopilot” and “full self-driving (FSD) capability, the administrative law judge has found that the company’s use of these terms to describe its vehicles’ Advanced Driving Assistance Features (ADAS) is misleading and violates state law. Tesla now has 60 days to either appeal the decision or come into compliance, or face a 30-day suspension of its dealer license, implying it can’t sell its EVs in California for that period.

Responding through its North America X handle, Tesla said:

“This was a “consumer protection” order about the use of the term “Autopilot” in a case where not one single customer came forward to say there’s a problem.”

The company also said sales in California will continue uninterrupted.

Driverless Drive Reignites Tesla Rally

Tesla’s California headwind concerns a technology core to its robotaxi ambitions that has fueled the stock’s record run in recent sessions. Earlier this week, a video shared on the X platform, owned by Musk, showed a Model Y driving around the streets of Austin with no driver or passengers, creating a flutter on social media.

The stock jumped 3.6% to close at $475.31 on Monday and added 3.07% on Tuesday to hit a new peak of $489.88.

Source: Koyfin<

Source: Koyfin<

Tesla’s Complicated Relationship With California

Tesla and Musk, in particular, have had a chequered history in California. The company’s first EV manufacturing plant was established in Fremont, California, which it acquired from the GM/Toyota joint venture named “New United Motor Manufacturing” in 2010. This plant served as a manufacturing hub that produced the Model S, 3, X, and Y vehicles. The state also served as the company’s headquarters before it relocated to Austin, Texas, in 2021. Even after the move, Tesla established its engineering headquarters in Palo Alto, a tech hub, in early 2023.

Tesla’s early days in California proved to be a strategic decision to capitalize on the state’s massive auto market. According to separate forecasts from the S&P Global and the California New Car Dealers Association, new vehicle sales in California (based on registrations) are expected to be 1.79 million units in 2025, accounting for roughly 11% of the estimated total vehicle sales of 16.15 million units in the U.S.

The incentive to focus on California was also due to the stricter zero-emission norms in place in the state, which envisaged a ban on new gas cars by 2035. Since then, they have been relaxed. In June, President Donald Trump signed a joint resolution to cancel the state’s EV mandate and similar norms adopted by 17 other states.

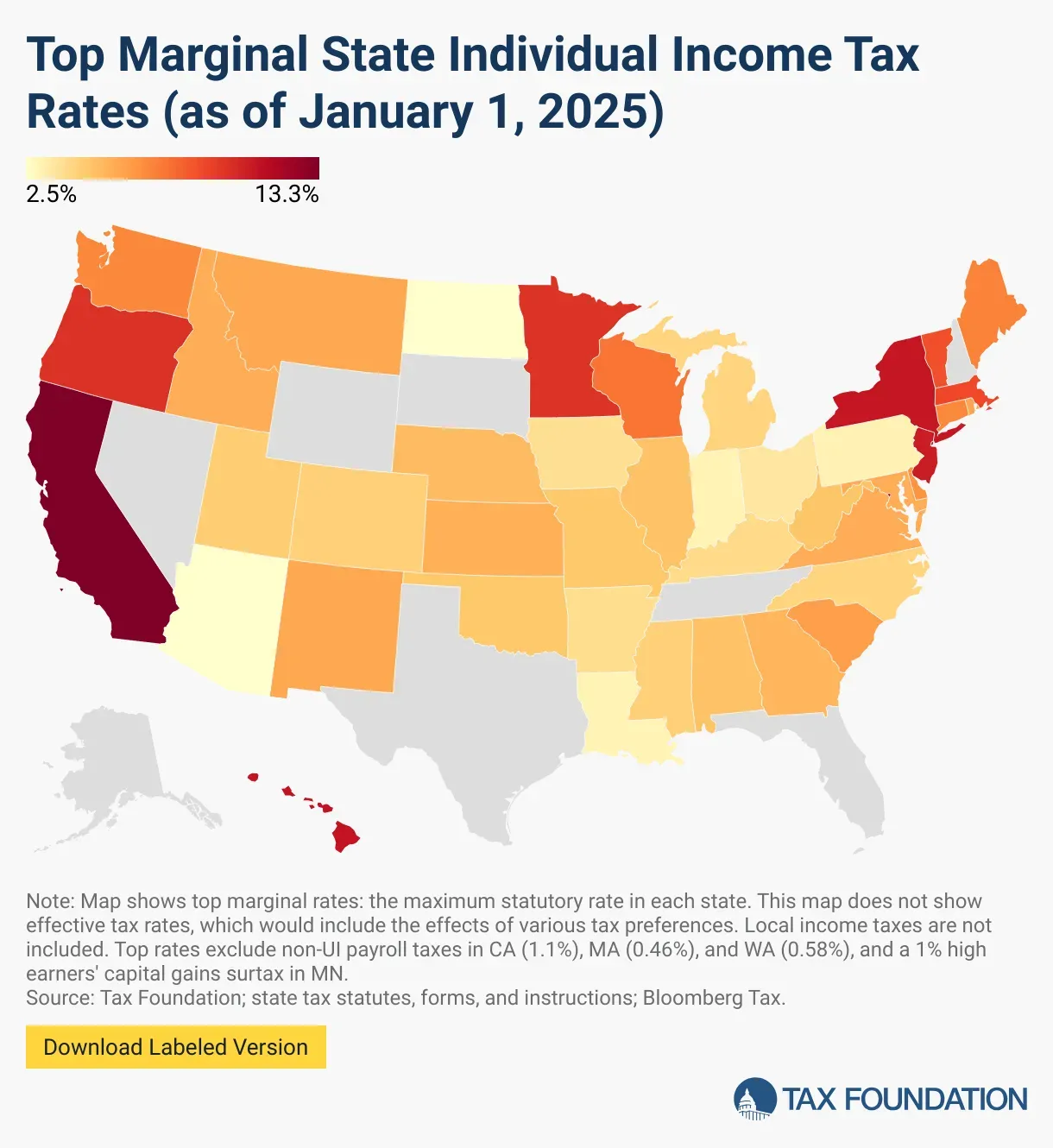

But Musk’s bonhomie with California suffered a setback as the state became less business-friendly with its relatively high taxation, stringent regulations, and high housing costs. According to Intuit, California has the highest income tax rate among the states, at 13.3%, followed by Hawaii and New York. The state’s corporate income tax rate of 8.84% is among the highest in the country.

Source: Tax Foundation<

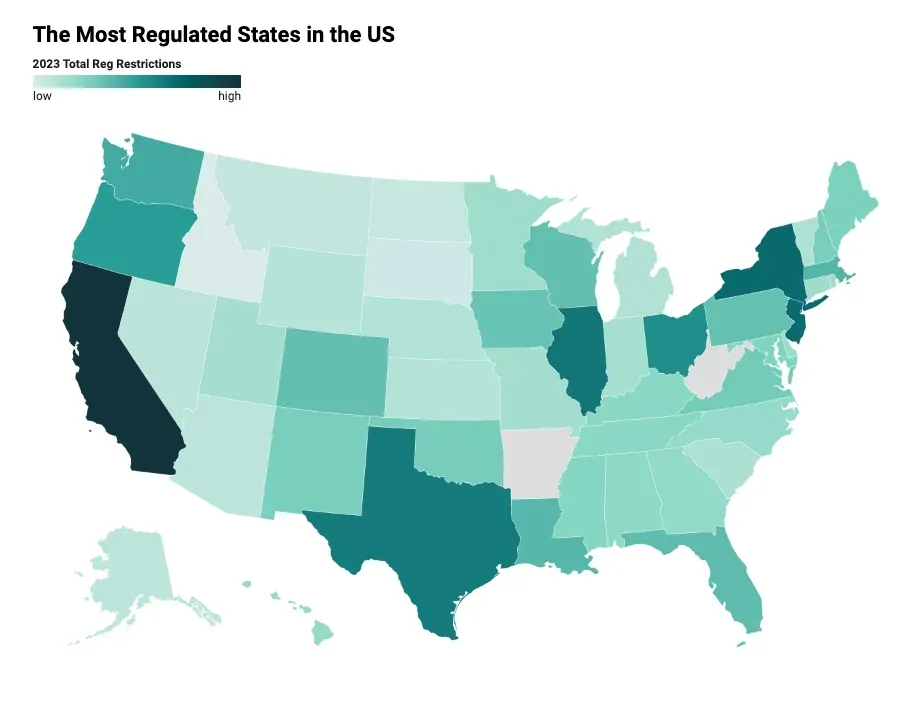

California is the most regulated state with 420,434 regulatory restrictions in 2023, according to a report released by the Mercatus Center of George Mason University in Aug. 2024.

Source: Mercatus Center<

Musk has had his run-ins with the state. When the COVID-19 pandemic struck, a year after the company launched its hugely successful Model Y vehicle, the state was among those that had imposed the most stringent restrictions. Tesla was asked to halt production at its Fremont facility in March 2020. Even as Alameda County, where the factory is located, continued stricter restrictions through May, Musk defied the orders and reopened the factory, and also filed a lawsuit against the county. Although the issue was resolved later, it served as a significant motivation for Musk to look elsewhere.

The billionaire’s relationship with the state’s Democratic Governor, Gavin Newsom, also soured as he shifted his political allegiance to the Republican Party. Coming down hard on the governor and the state, Musk said in a X post last year:

“The only thing stopping the California government and overbearing regulatory agencies from being even worse is that people and companies can move out of state.”

The state machinery also turned hostile toward Musk and his business ventures, including limiting SpaceX’s rocket launches from Vandenberg Air Force Base in Santa Barbara County.

How Many EVs Does Tesla Sell in California?

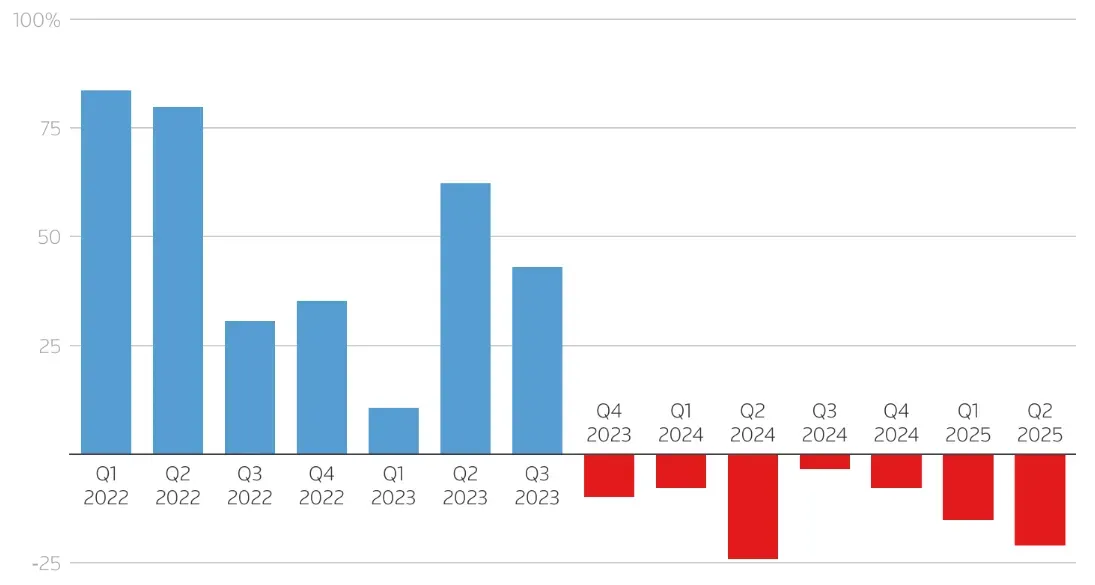

Tesla registrations in the state have declined year over year (YoY) for eight straight quarters. Citing data from Experian and the CNCDA, Tesla registrations totaled 52,114 in the third quarter of 2025, a 9.6% YoY drop. The 52,114 number made up 10.5% of the company’s total EV sales in the U.S. in Q3.

The sales were down for seven straight quarters, ahead of the Q3 drop. The only consolation is the sequential increase and a more modest YoY decline.

Source: CNCDA via Reuters<

What Retail Feels About Tesla Stock

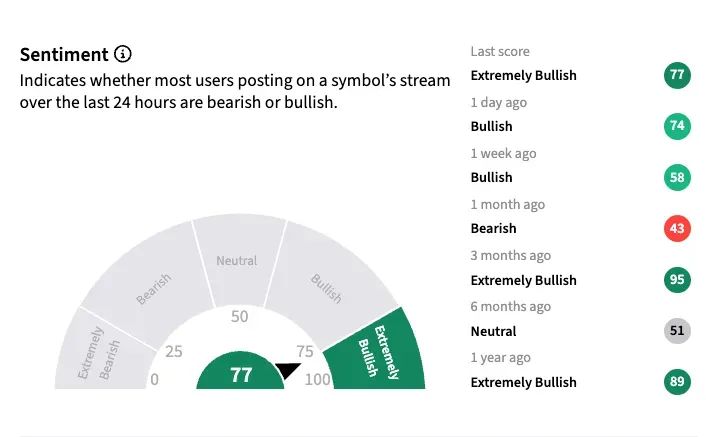

Sentiment toward Tesla among Stocktwits users has improved to ‘extremely bullish’ as of early Wednesday, even as the stock trades near all-time highs, despite shaky fundamentals. Tesla is the most-watched stock on the platform, with over a million followers.

The sell side is divided on the stock. According to Koyfin, 19 of the 46 analysts covering the stock are bullish, 17 remain on the sidelines, and 10 are bearish. The average analyst price target suggests roughly 20% downside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<