Deutsche Bank also expects Tesla to sell about 53,000 vehicles in China this month, rebounding from July’s slump.

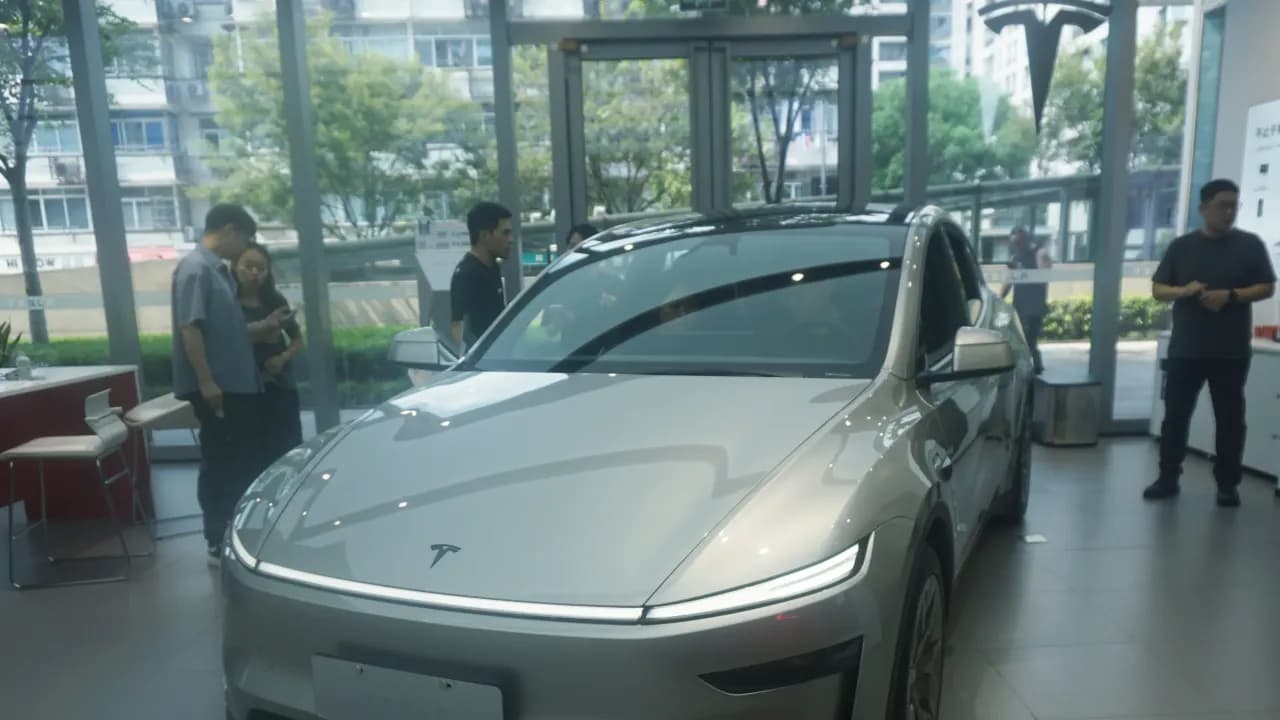

Tesla’s new long-wheelbase Model Y L SUV has driven a surge in demand in China, with Deutsche Bank projecting the company’s August new order flow to double month-on-month to about 130,000 units, citing dealer feedback.

The six-seat, three-row version of Tesla’s best-selling SUV was launched in China on Aug. 19, with initial deliveries scheduled for September and customer handovers beginning in October.

Deutsche Bank also forecasts 53,000 Tesla deliveries in China this month, up 29% from July but down 17% year-on-year. Tesla sold 40,617 vehicles in China in July, according to a CnEVPost report.

The Model Y L starts at 339,000 yuan ($46,700), about 8% more than the current shorter Model Y. It features an 82 kWh LG NMC battery pack with a 327-mile range, all-wheel drive, and new three-row seating with upgraded interior, suspension, and technology.

Other EV makers are also expected to post strong August results. Nio is expected to hit a record 32,000 deliveries in August, with Xiaomi close behind at 34,000 and Xpeng at 39,000.

BYD is projected to move about 345,000 vehicles on a wholesale basis, while Li Auto is expected to move 30,000, marking its third consecutive annual decline.

On Stocktwits, retail sentiment for Nio was last seen as ‘extremely bullish’ amid ‘extremely high’ message volume, while Xpeng also drew ‘bullish’ sentiment with ‘extremely high’ chatter.

Tesla and BYD were both ‘bullish’ on ‘normal’ volume, Li Auto was ‘bullish’ with ‘high’ engagement, and Xiaomi stood out with a ‘bearish’ tilt amid ‘low’ chatter.

So far in 2025, Nio’s stock has gained 53.7%, Xiaomi is up 58%, Xpeng has more than doubled, and BYD has climbed 35.5%.

Li Auto has inched up 2.8% year-to-date, while Tesla has declined 13%.

($1=7.15)

For updates and corrections, email newsroom[at]stocktwits[dot]com.<