Analysts warn EV sales from Tesla, GM and Ford could slump once federal incentives end Sept. 30, while Lucid is countering with its own $7,500 leasing credit on the Gravity SUV.

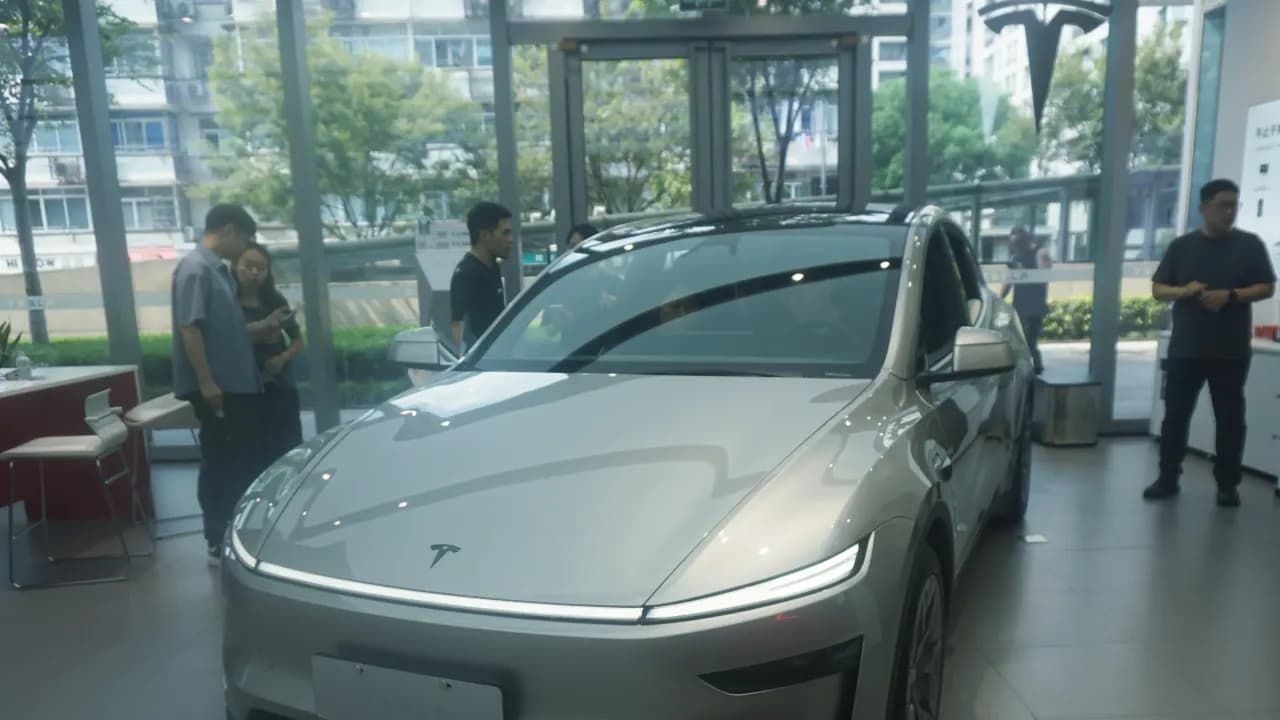

Tesla will raise U.S. lease prices on Sept. 21, with costs set to climb by $50 a month for the Model 3 and $80 a month for the Model Y.

Customers must order and apply for leasing before the deadline to lock in current pricing, Tesla investor and influencer Sawyer Merritt posted on X.

The changes come as demand accelerates ahead of the Sept.30 expiration of the $7,500 federal EV tax credit under U.S. President Donald Trump’s “One Big Beautiful Bill Act,” which ends Biden-era subsidies originally slated to run through 2032.

Analysts say U.S. electric vehicle sales from Tesla, General Motors, Ford and others could take a steep hit once the federal tax credit disappears.

Karl Brauer of iSeeCars.com told Yahoo Finance he expects market share to tumble from 9.1% in July to well below 4% right after the incentive ends, before slowly recovering by 2026. He added that automakers may resort to discounts to keep demand steady once incentives expire.

CEO Elon Musk has stressed that customers must take delivery, not just place an order, before Sept.30 to qualify for the credit. Both the Model 3 and Model Y remain eligible for the $7,500 incentive on qualifying cash and financed purchases delivered before the cutoff, as well as on leases.

Tesla has also offered temporary promotions, including $1,000 off for military personnel, first responders, teachers, and students, a one-month Full Self-Driving (Supervised) trial, and the ability to transfer FSD from an existing vehicle.

Other companies, like Lucid, are taking a different tack as the federal credit winds down. The EV maker said it will provide a $7,500 “Lucid Advantage Credit” to qualifying customers who lease its new Gravity SUV between Oct. 1 and Dec. 31, effectively offsetting the loss of the federal tax credit.

On Stocktwits, retail sentiment for Tesla was ‘extremely bearish’ amid ‘normal’ message volume.

Tesla’s stock has declined 17% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<