Tesla has already delivered Semi trucks to select customers, including DHL, which operates the vehicle on roughly 100-mile California routes.

- Tesla published final specifications for the Semi, detailing two trims with up to 500 miles of range.

- Musk confirmed the electric truck will enter high-volume production this year.

- Vanguard Group disclosed that it added 6.54 million Tesla shares in the fourth quarter of 2025.

Shares of Tesla rose nearly 1% in premarket trading on Monday after the automaker published final specifications for its long-awaited Semi truck and CEO Elon Musk signaled a production ramp later this year.

Tesla Reveals Semi Specs And Two-Trim Lineup

Tesla updated its official website to show that the Semi will be offered in two trims. The Standard version delivers up to 325 miles of range at an 82,000-pound gross combination weight, while the Long Range variant pushes range to 500 miles with a higher curb weight of 23,000 pounds, likely reflecting a larger battery.

Both trims deliver an energy consumption of 1.7 kWh per mile and can recover about 60% of their driving range in roughly 30 minutes. The trucks feature three rear-axle motors delivering up to 800 kW of power, support MCS 3.2 fast charging, and electric power take-off up to 25 kW.

Musk also said on X, “Tesla Semi starts high volume production this year.” He agreed with a post arguing the Semi’s total cost of ownership undercuts diesel economics, citing lower electricity costs per mile, minimal maintenance, over-the-air updates, and improved fleet uptime compared with diesel trucks.

Tesla Leans Into Semi And Model Y

Tesla has already delivered Semi units to select customers, including logistics firm DHL, which said its truck operates in California on routes of about 100 miles per day and requires charging once a week.

Last week, Tesla expanded its U.S. Model Y lineup with a new Model Y AWD priced at $41,990 and renamed the cheaper Model Y Standard as Model Y RWD, taking the total Model Y variants to five with prices ranging from $39,990 to $57,490. The changes follow Musk’s announcement that Tesla will wind down production of the Model S and Model X next quarter as part of its push toward autonomy, with the Fremont factory set to transition to Optimus robot production.

Once those models exit, Tesla’s lineup will focus on the Model 3, Model Y, and Cybertruck. Tesla currently sells four Model 3 variants, five Model Y variants, and two Cybertruck trims, with the Model 3 starting at $36,990. Musk has said Tesla has no plans to pull back on the Cybertruck and is also considering autonomy features for it.

Looking ahead, Tesla plans to unveil the next-generation Roadster in April and start production of its Cybercab robotaxi.

Vanguard Boosts Tesla Stake

Adding to investor focus, Vanguard Group disclosed that it added 6.54 million Tesla shares in the fourth quarter of 2025. The move lifted Vanguard’s stake by about 2.6% to roughly 258.9 million shares, valued at around $102.85 billion at year-end.

Vanguard remains Tesla’s largest institutional shareholder, ahead of BlackRock. The latest purchase marked its biggest quarterly addition since late 2022 and capped a steady build-up over the past two years, during which the firm has more than quadrupled its Tesla holdings.

How Did Stocktwits Users React?

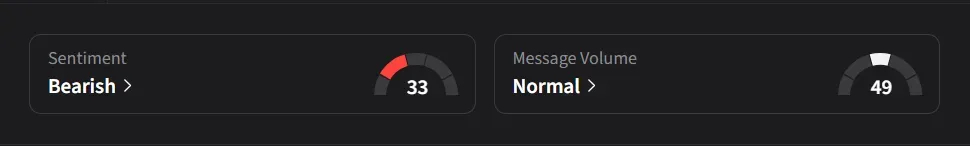

On Stocktwits, retail sentiment for Tesla was ‘bearish’ amid ‘normal’ message volume.

One user expects TSLA stock to reach $600 soon.

However, another user said, “The loss of model x and s income wont be overcome by semi sales.”

Tesla’s stock has risen 10% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<