The board emphasized that Musk will receive no salary or cash bonus under the new plan, with compensation fully dependent on meeting market capitalization and operational milestones.

Tesla’s stock rally stretched into a seventh straight session on Wednesday as the company’s board threw its weight behind CEO Elon Musk’s proposed 2025 compensation package, describing it as a plan fully tied to shareholder value creation.

Board Chair Robyn Denholm, in a regulatory filing, called Musk a “once-in-a-generation visionary” who has repeatedly proven his ability to deliver extraordinary growth.

Shares of Tesla rose 1% to $424.24 during regular trading and gained 0.7% after hours. Shares of the company have jumped about 23% over the seven-day stretch — marking their longest rally since July 10, when they rose for 11 straight sessions — mainly driven by Musk’s purchase of roughly $1 billion in stock, lifting his stake to about 13%.

The board has also advanced a new $1 trillion pay plan that could further boost his holdings if targets are achieved, alongside a $29 billion interim award after his 2018 package was struck down in court. After struggling for most of this year, Tesla is up 5.5% so far in 2025.

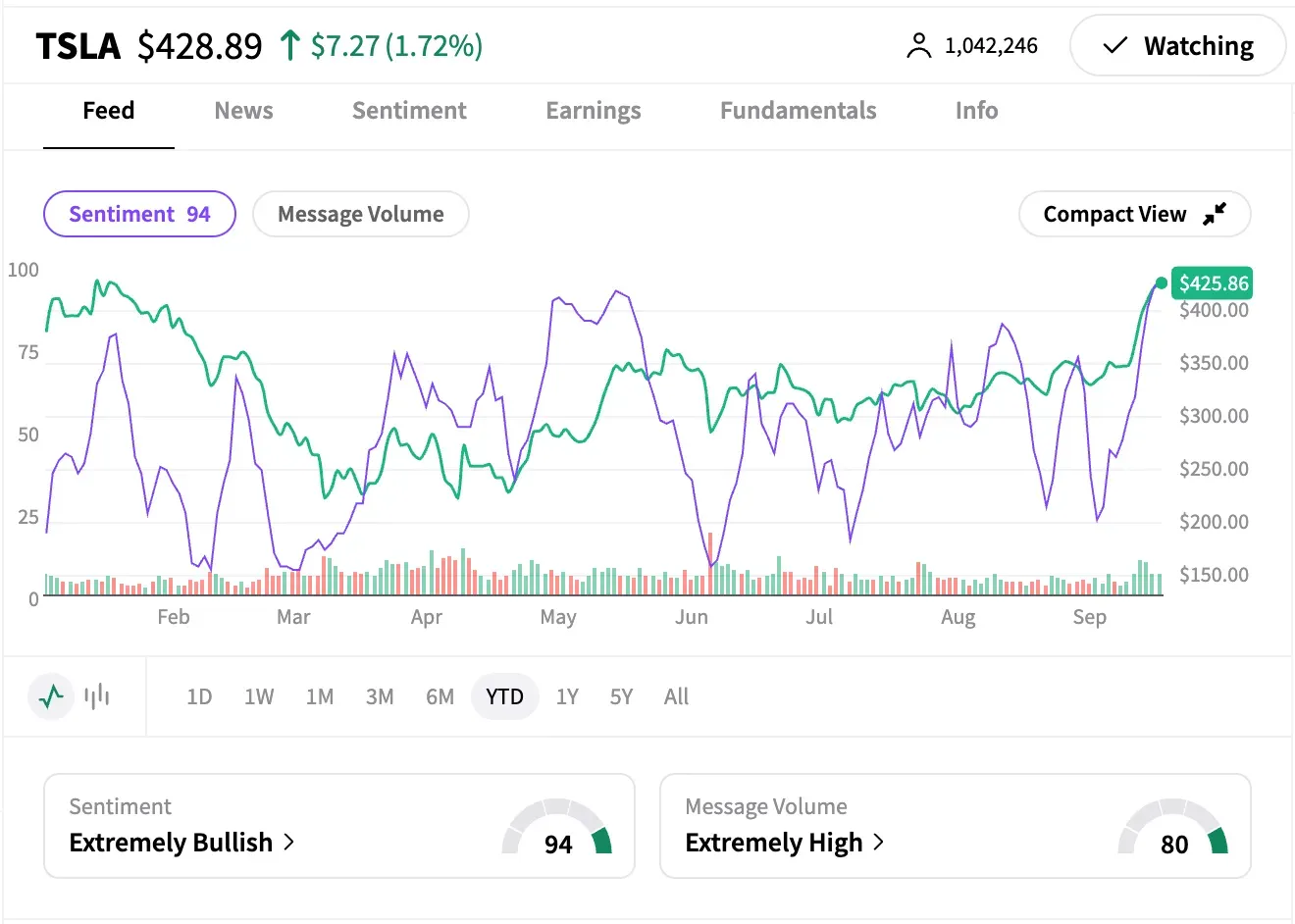

On Stocktwits, retail sentiment for Tesla was at its 2025 peak (94/100) while message activity remained ‘extremely high’.

One user pointed to $450 as the next milestone for Tesla’s shares, while another suggested the stock could approach $500 as momentum builds.

Denholm said the new performance award is modeled on the framework of Tesla’s 2018 CEO plan but with even more ambitious hurdles. “Elon only gets compensated if shareholders win — and win big,” she wrote, stressing that Musk receives zero salary and zero cash bonus.

For him to unlock the full award, Tesla must deliver an additional $7.5 trillion in shareholder value, which she said would make Tesla more valuable than any company in history.

The board described the package as “100% at risk.” If Musk fails to hit the required market capitalization and operational milestones, he earns nothing. The plan also has only two potential vesting points, at 7.5 years and 10 years after the grant date, meaning Musk must remain in continuous service and fully invested in Tesla’s long-term vision.

Denholm framed the award as essential for both retention and motivation, arguing that it ensures Musk is incentivized to make Tesla’s vision a reality. “The targets and your upside are extraordinary,” she said.

The board urged shareholders to vote “FOR” the package at Tesla’s upcoming annual meeting, alongside proposals to elect three Class III directors and approve amendments to the 2019 equity incentive plan.

“We have hugely ambitious goals for Tesla, and Elon’s singular leadership is vital,” Denholm wrote, adding that the board’s active directors would continue overseeing strategy to “create outsized value” for investors.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<