The move comes after Truist updated its long-term outlook for automotive, semiconductor, and artificial intelligence sectors.

- Analyst William Stein highlighted industry concerns around securing sufficient power and capital to build artificial intelligence infrastructure.

- Truist stated that AI infrastructure and semiconductor stocks “remain cheap” relative to their expected expansion.

- Dan Ives predicted that Tesla’s market capitalization could double to $3 trillion by the end of 2026.

Tesla Inc. (TSLA) received backing from Truist Securities, which increased its price target to $444 per share from $406 and maintained a ‘Hold’ rating on the stock.

The move comes after Truist updated its long-term outlook for automotive, semiconductor, and artificial intelligence sectors.

AI Infrastructure Challenges

In the research note, analyst William Stein highlighted industry concerns about securing sufficient power and capital to build artificial intelligence infrastructure, which remain hurdles even as demand for high-performance computing grows.

Despite these obstacles, he stated that AI infrastructure and semiconductor stocks “remain cheap” relative to their expected expansion.

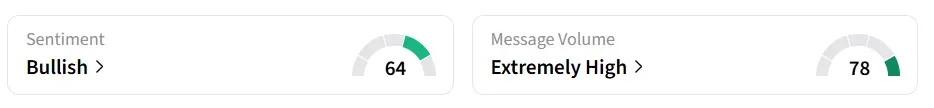

Tesla stock traded over 1% in Thursday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘extremely high’ message volume levels.

A bullish Stocktwits user said, “With this strong momentum, it will for sure reach 500 within [a] short [time].”

Robotaxi Optimism

Tesla’s stock hit a year-high on Monday, after CEO Elon Musk said the company was testing its robotaxis without safety monitors in the front passenger seat.

Dan Ives, Managing Director and senior equity research analyst at Wedbush Securities, predicted that Tesla’s market capitalization could double to $3 trillion by the end of 2026. On Friday, Ives said he expects Tesla to roll out its long-awaited Robotaxi service in over 30 cities next year while beginning scaled production of its Cybercab fleet.

Ives believes these developments could mark a turning point for autonomous transportation, assigning Tesla a base-case valuation of $600 per share with an upside scenario reaching $800.

TSLA stock has gained over 19% year-to-date and over 10% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<