Currently, the base variant of the Model Y in the U.S. starts at $44,990 without tax credits, while the more premium long-range all-wheel drive variant starts at $48,990.

Tesla Inc. (TSLA) executive Raj Jegannathan hinted at a possible price hike on the company’s best-selling Model Y SUV in the coming days, citing increased demand.

“Trending toward a need to expedite output even further, which could mean adjusting pricing upward in the coming days. Trying hard not to, will see,” Jegannathan wrote in a post on X.

The executive was responding to an X user who noted that Tesla Model Y inventory is running low across the U.S. Tesla has urged customers to make their vehicle purchase soon on its website, citing limited inventory. Currently, the base variant of the Model Y in the U.S. starts at $44,990 without tax credits, while the more premium long-range all-wheel drive variant starts at $48,990.

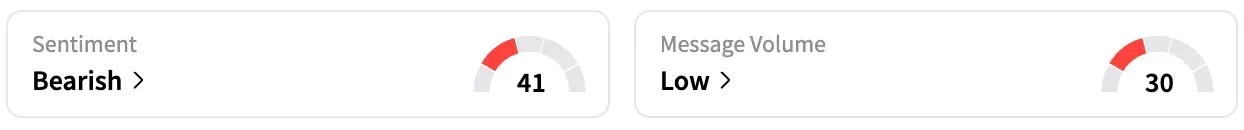

On Stocktwits, retail sentiment around Tesla stock trended in the ‘bearish’ territory over the past 24 hours, coupled with ‘low’ message volume. According to Stocktwits data, retail chatter around Tesla jumped 96% over the past 24 hours and by 61% over the past seven days.

A Stocktwits user highlighted that multiple negative catalysts are incoming for the stock.

Another user believes the stock could rally to $400 mark, once it passes $344 to $346 levels.

President Donald Trump signed the Republican tax bill into law on the Fourth of July. Under the new law, tax credits for the purchase of electric vehicles will expire on September 30. This includes the $7,500 federal tax credit on the purchase of new EVs and the $4,000 credit on buying used ones.

All variants of Tesla’s Model 3 and Model Y are currently eligible for the $7,500 tax credit. This brings the effective starting price of the Model 3 sedan down to $34,990 and of the Model Y down to $37,490 for eligible customers.

The Model 3 and Y are Tesla’s best-selling vehicles across the globe. Model 3 and Y sales accounted for about 97% of the company’s total 384,122 global deliveries in the three months through the end of June.

The expiry of tax credits follows Tesla reporting a drop in deliveries for the second consecutive quarter. In the second quarter, Tesla reported deliveries of 384,122 units, marking a year-on-year decline of 13.5%.

In the first quarter, Tesla reported deliveries of 336,681 units, marking a dip of nearly 13% from the corresponding quarter of 2024.

TSLA stock is down by 15% this year and up by about 62% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com<