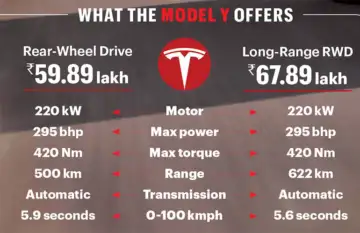

After years of speculation, US electric carmaker Tesla Inc., led by billionaire entrepreneur Elon Musk, has finally driven into India with its best-selling Model Y. The electric vehicle (EV) will be available in two variants-the Rear-Wheel Drive (RWD), priced at Rs 59.89 lakh, and the Long Range RWD, with a price tag of Rs 67.89 lakh.

Tesla’s first showroom has opened in Mumbai’s Bandra Kurla Complex, and it is likely to announce more of these in a few other cities, with Delhi being a distinct possibility.

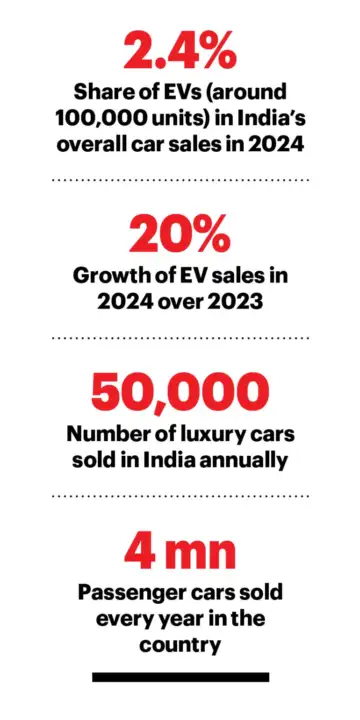

Both models will be imported into India as fully built-up units, likely from Tesla’s Gigafactory in Shanghai, which explains the steep price tag. The Model Y will compete in the luxury EV segment against established multinational carmakers such as Mercedes-Benz, BMW, Volvo and Audi, as well as top-end EV models from Hyundai, Kia and BYD (see Tesla’s Rivals in India). Mercedes-Benz currently offers eight EV models in India, priced between Rs 67.20 lakh and Rs 3 crore. BMW has five models ranging from Rs 49 lakh to Rs 2.5 crore, while Audi offers four, priced between Rs 1.15 crore and Rs 2.05 crore. These rivals not only offer strong electric performance with luxury features, they are also backed by established dealership networks, accessible service centres and reliable after-sales support. The overall luxury car segment in India sees annual sales of 40,000-50,000 units, accounting for just 1 per cent of the more than four million passenger cars sold each year. Most luxury EV manufacturers do not disclose their sales figures in India.

The Indian electric car market at present is relatively small, accounting for only 2.4 per cent of all cars sold in 2024-around 100,000 units. However, this is a 20 per cent jump from 2023. Tata Motors, with models such as the Nexon EV, Tiago EV and Tigor EV, was the top seller with 61,496 units, and commanded a 62 per cent share of the market, according to data from the Federation of Indian Automotive Dealers Associations. Other players include Mahindra & Mahindra, JSW MG Motor India, Hyundai, Kia, BYD and Citroen, along with luxury brands mentioned earlier. Experts say that for Tesla to gain volumes, it needs to launch affordable models in the Rs 25-35 lakh range. Without that, it will struggle to compete with established players like Tata Motors, Mahindra and JSW MG Motor.

The Indian electric car market at present is relatively small, accounting for only 2.4 per cent of all cars sold in 2024-around 100,000 units. However, this is a 20 per cent jump from 2023. Tata Motors, with models such as the Nexon EV, Tiago EV and Tigor EV, was the top seller with 61,496 units, and commanded a 62 per cent share of the market, according to data from the Federation of Indian Automotive Dealers Associations. Other players include Mahindra & Mahindra, JSW MG Motor India, Hyundai, Kia, BYD and Citroen, along with luxury brands mentioned earlier. Experts say that for Tesla to gain volumes, it needs to launch affordable models in the Rs 25-35 lakh range. Without that, it will struggle to compete with established players like Tata Motors, Mahindra and JSW MG Motor.

MUSK’S INDIA MOVES

Tesla’s launch in India coincides with the upcoming debut of Starlink, Musk’s satellite internet company, which has recently received the necessary approvals. The entry of both companies comes at a time when trade relations between the US and China are more strained than ever. However, while Starlink is expected to shake up India’s telecom services market, it may take Tesla much longer to make a significant impact in the country.

Experts say Tesla is testing the waters by entering the Indian market through the luxury segment. “Tesla aims to evaluate the aspirations of Indians before making deeper investments in the market. The launch was expected to be in the luxury segment,” says Gaurav Vangaal, associate director at S&P Global Mobility. The car will remain expensive due to the high import duties imposed on luxury vehicles in India, which currently attract a basic customs duty of 70 per cent. “This entry barrier is likely to remain, unless there is a positive outcome from the ongoing trade negotiations with the US,” he adds.

Experts say Tesla is testing the waters by entering the Indian market through the luxury segment. “Tesla aims to evaluate the aspirations of Indians before making deeper investments in the market. The launch was expected to be in the luxury segment,” says Gaurav Vangaal, associate director at S&P Global Mobility. The car will remain expensive due to the high import duties imposed on luxury vehicles in India, which currently attract a basic customs duty of 70 per cent. “This entry barrier is likely to remain, unless there is a positive outcome from the ongoing trade negotiations with the US,” he adds.

India is currently in talks with the US to shape the contours of a bilateral trade agreement. The US had earlier imposed what it described as “reciprocal tariffs” on several countries. For India, these tariffs, set at 26 per cent, are set to kick in by August 1. India is aiming to finalise the agreement with the US by the end of the year, but talks on market access for goods have yet to reach a conclusion. “The automotive market and Tesla give India a good tool to negotiate with the US in future,” Vangaal notes.

POSSIBLE IMPORT SHIFT

Tesla may also eye importing the Model Y from its facility in Germany, officially called the Gigafactory Berlin-Brandenburg. It is the company’s first manufacturing location in Europe and produces Model Y cars, battery cells and electric drive trains, according to industry sources. India and the European Union are also actively negotiating a free trade agreement, expected to be finalised by the end of this year. If that fructifies, Tesla would look at imports from Germany, sources say. This would provide an alternative to China for sourcing vehicles, especially as the Indian government may not be inclined to favour Chinese imports in the long term, they add.

“We anticipate rapid expansion driven by more affordable EVs, an extensive charging infrastructure and a shrinking price gap between traditional vehicles and EVs,” S&P Global says in a report. The Indian government has set an ambitious target for EVs to make up 30 per cent of total passenger vehicle sales by FY30, supported by plans for subsidies, financing options and infrastructure development. However, achieving this goal will be a formidable task. Setting up adequate charging stations and maintaining policy support for EVs will be crucial for a more rapid adoption of such vehicles in the mass market.