The 12-tranche, performance-based package vests between 2033 and 2035, aligning Musk’s incentives with AI and autonomy milestones.

- Tesla’s board reaffirmed confidence in Elon Musk, calling the CEO’s award issuance the start of a “whole new book” for the company.

- The 12-tranche, performance-based package vests between 2033 and 2035, aligning Musk’s incentives with AI and autonomy milestones.

- Morgan Stanley maintained its ‘Overweight’ rating with a $410 target and an $800 bull case, citing Tesla’s expanding AI, robotics, and chip ambitions.

Tesla, Inc. has officially issued Elon Musk’s 2025 CEO Performance Award shares, split into 12 tranches totaling about 423.7 million shares.

According to a new SEC filing, each tranche can only be earned if Tesla meets defined performance goals. The shares, held in Musk’s revocable trust, will vest between 2033 and 2035, depending on when those conditions are achieved, and are currently voted by proxy, meaning Musk does not yet control them.

Board Calls It Start Of A ‘New Book’

Tesla Chairperson Robyn Denholm thanked shareholders in a letter, calling their approval of Musk’s compensation plan a “vote of confidence in our visionary leader.”

“You looked past the noise and reaffirmed your belief in a trailblazer who has turned Tesla into one of the most valuable companies in history,” Denholm wrote.

She described the moment as the beginning of a “whole new book” for Tesla, citing Robotaxi and Optimus as key drivers of what she called “the largest value-creation event in Tesla’s history, and quite possibly in the history of humanity.”

Musk’s $1 Trillion Package Sets The Benchmark

Last week, Tesla shareholders approved Elon Musk’s $1 trillion pay package with about 75% support, reaffirming confidence in his leadership as the company deepens its investment in AI and robotics.

The package ties rewards to ambitious milestones, including 20 million vehicle deliveries, 10 million FSD subscriptions, 1 million Optimus robots, and 1 million robotaxis in commercial service. Wedbush said Tesla could reach a $2 trillion market cap by early 2026 and $3 trillion by year-end if execution stays on track.

In a similar move, rival Rivian Automotive on Friday unveiled a 10-year, performance-based compensation plan for CEO R.J. Scaringe, valued at up to $4.6 billion and modeled on Tesla’s approach. The award links Scaringe’s payout to profit and share-price targets ranging from $40 to $140 per share through 2035, ahead of the company’s R2 SUV launch next year.

Morgan Stanley Sees ‘Steam Engine Moment’ For Tesla’s AI Push

In a post-AGM report, Morgan Stanley reiterated its ‘Overweight’ rating with a $410 base-case price target and an $800 bull-case target, highlighting several overlooked developments that could drive Tesla’s next growth phase beyond Musk’s compensation plan.

Analyst Adam Jonas said Tesla’s integration with xAI is “deterministic to the company’s long-term success,” pointing to alignments across data, software, and hardware that form the foundation of what he termed the “Muskonomy.”

Jonas pointed to Musk’s remark that FSD 14.3 could let drivers text while driving, calling it a “steam engine moment” for transportation as Tesla transfers driving responsibility from humans to the algorithm. He also noted Musk’s plans for a “gigantic chip fab” to secure AI supply, a distributed inference cloud that would allow idle Teslas to run AI workloads, and the potential for solar-powered AI satellites linking Tesla and SpaceX operations.

Stocktwits Retail Sentiment Turns ‘Extremely Bullish’

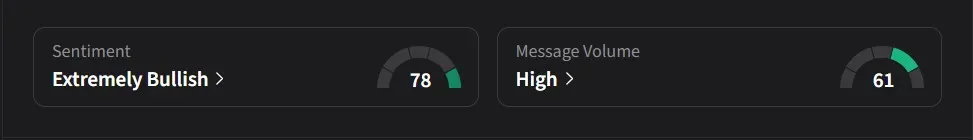

On Stocktwits, retail sentiment for Tesla turned ‘extremely bullish’ amid ‘high’ message volume.

One user wrote that Tesla could reach a $1,000 share price equivalent by 2028, contingent on the success of Optimus and Robotaxi. The user noted that while the energy division is thriving, the automotive segment remains under pressure overseas, yet added that Tesla “is probably ahead in autonomous driving” and that the Optimus robot platform holds enormous potential.

Another user pointed to Elon Musk’s acquisition of 423.7 million shares, calling it a bullish signal and predicting that Tesla could trade above $460 the following day.

Tesla’s stock has risen 10% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<