Shareholders approved Elon Musk’s $1 trillion performance-based pay plan with about 75% support, giving him 25% voting control.

- Shareholders approved Elon Musk’s $1 trillion performance-based pay plan with about 75% support, giving him 25% voting control.

- Musk outlined plans to ramp production of the Optimus robot, Cybercab, and Semi as Tesla pivots toward artificial intelligence and robotics.

- Wedbush Securities maintained its ‘Outperform’ rating and $600 price target, forecasting a potential $2–3 trillion valuation as Tesla’s AI roadmap scales.

Tesla Inc. shareholders approved CEO Elon Musk’s $1 trillion pay package with about 75% support, granting him 25% voting control and reaffirming investor confidence in his leadership as the company expands deeper into artificial intelligence and robotics. The vote, one of the largest compensation approvals in corporate history, keeps Musk in charge as Tesla shifts beyond electric vehicles.

Wedbush Securities said the 2019 and 2025 packages passed with strong backing, adding that the result cements Musk’s position as Tesla’s leader during what it described as the “AI revolution.” The firm said the vote opens what it considers the most important phase in Tesla’s history and increases its confidence in the company’s outlook.

Wedbush Maintains ‘Outperform’ Rating

Wedbush, led by Daniel Ives, maintained an ‘Outperform’ rating and a $600 price target on Tesla. The firm said the shareholder approval ensures leadership stability and begins Tesla’s transition toward an AI-driven valuation built on full self-driving (FSD), the Cybercab program, and the Optimus robot.

The performance-based package requires Tesla to meet ambitious operational and financial milestones, including 20 million vehicle deliveries, 10 million active FSD subscriptions, 1 million Optimus robots, and 1 million robotaxis in commercial service. Profit targets include $50 billion in adjusted EBITDA and $400 billion across four consecutive quarters, alongside significant R&D investment to expand its robotics and AI operations.

Wedbush said Tesla could reach a $2 trillion market capitalization by early 2026 and $3 trillion by the end of that year if production of its autonomous and robotics roadmap scales as planned.

Optimus Central To Musk’s Trillion-Dollar Goal

Gene Munster, managing partner at Deepwater Asset Management, noted in a post on X that Musk began the event by emphasizing the Optimus humanoid robot, describing it as Tesla’s next major product and the primary driver behind the compensation plan.

Musk said Optimus production would begin in Fremont, with capacity for a million units, before expanding to 10 million in Austin, according to Munster. Musk referred to the shift as the start of a new phase for Tesla, with Optimus, Cybercab, and Semi scheduled to enter production next year. Munster said large-scale manufacturing would be the key challenge, with Cybercab and Semi expected to reach volume production in 2027.

Cybercab And FSD Timelines

Munster said Musk disclosed that Cybercab production would begin in April 2026, a year earlier than previously indicated, and could be ramped by year-end. He said Musk targets a 50% increase in overall vehicle production next year, with output rising to an annualized 2.7 million vehicles, potentially 4 million by 2027, and 5 million by 2028.

Munster added that Musk expects supervised FSD to be solved within months and believes the feature will allow drivers to perform basic tasks such as texting while driving. He expects a broader rollout around mid-2026, ahead of rivals. Musk also outlined plans for a Robo Van within a few years, though Munster said it is unlikely to be a major revenue driver.

Regulatory And Chip Challenges

Munster said regulatory approvals remain a constraint on Tesla’s autonomous-vehicle rollout even as data show safety improvements. He added that supply-chain pressures could slow expansion.

He noted that Musk confirmed plans to develop an inference chip to reduce reliance on Nvidia hardware, with manufacturing in Taiwan and the U.S. and possible collaboration with Intel. Munster said earlier attempts to move away from Nvidia were difficult and that building a chip fabrication facility would be an “extremely hard” endeavor.

Stocktwits Users Stay Upbeat

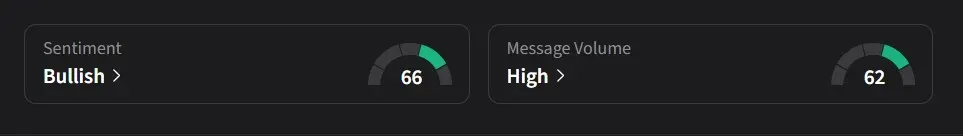

On Stocktwits, retail sentiment for Tesla turned ‘bullish’ amid ‘high’ message volume.

One user said they wouldn’t be surprised if the stock opened above $500, while another hoped to “catch it early” if prices dipped at the open.

A third user predicted a “massive increase come morning,” and a fourth echoed the $500-plus forecast, underscoring bullish retail sentiment heading into the next session.

Tesla’s stock has risen 10% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<