Technology giants like Infosys, TCS, and Tech Mahindra fell over 3% after Trump’s executive order increased H-1B fees to $100,000, triggering a market-wide sell-off.

Indian equity markets ended at the day’s low, with the Nifty index closing at 25,200 levels. The sell-off was led by technology stocks after US President Donald Trump imposed a hefty $100,000 charge on all new H-1B visa applications.

On Monday, the Sensex closed 466 points lower at 82,159, while the Nifty 50 ended down 124 points at 25,202. Broader markets saw a deeper selloff, with the Nifty Midcap index ending 0.6% lower and the Smallcap index falling 1.1%.

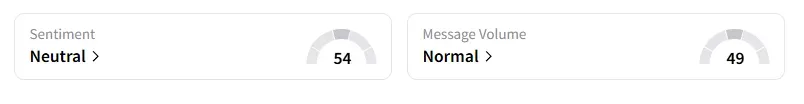

The retail investor sentiment surrounding the Nifty 50 remained ‘neutral’ by market close on Stocktwits.

Stock Moves

Sectorally, barring metals, other indices ended in the red, led by IT (-2.9%) and pharmaceuticals (-1.4%).

Technology stocks fell between 2% and 5% following Trump’s executive order on H1B visa fee hike. Mphasis, LTIMindtree, Coforge, Tech Mahindra, Infosys, and Tata Consultancy Services fell by over 3% each, while Wipro and HCL Technologies slid 2%.

Hindustan Copper rallied 5% as it executed a mining lease deed for the Rakha Copper Mine in Jamshedpur, extending the lease for another 20 years.

Swiggy ended 2% lower after brokerage firm JM Financial cut its rating to ‘Reduce’ from ‘Hold,’ and revised the target price lower to ₹440 due to a worsening balance sheet and intensifying competition.

Netweb Technologies surged 7% after securing an order worth about ₹450 crore from one of India’s largest global providers of technology distribution and integrated supply chain solutions. And Garden Reach Shipbuilders’ rallied to a 11-week high on order wins.

Stock Calls

Sunil Kotak said that PNC Infra crossed the 50-day simple moving average last week, which is a positive sign, but unless the stock closed above ₹330-₹335, it will remain in a consolidation zone.

Kavita Agrawal noted that Chambal Fertilizers had just bounced off its 250-day EMA with an RSI positive divergence, indicating that momentum may be shifting back up. Its weekly charts now suggest another leg higher, with a potential 50–80% upside in the next 1–2 years. She identified support around ₹496 with resistance around ₹806. She recommended adding this stock to a long-term portfolio.

Markets: What Next?

Kush Ghodasara noted that the index has seen strong resistance at 25,331. If it closes below this level and sustains tomorrow too, then we could see some weakness with a stop loss at 25,335-25,350.

And Ashish Kyal said that Nifty index broke 25,190 levels. He advised traders to avoid carrying longs as short term move between 25,050-25,280 is likely tomorrow.

Globally, European markets traded lower, while US stock futures indicate a negative start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <