The analyst expects the split to unlock shareholder value but warns of near-term volatility.

Tata Motors’ highly anticipated demerger takes effect on October 1, which marks the restructuring of the Mumbai-based automaker into two independently listed entities.

The demerger divides the company into Tata Motors Commercial Vehicles (TMLCV), which manages trucks, buses, and logistics platforms under the leadership of Girish Wagh, and Tata Motors Passenger Vehicles (TMPV), which retains passenger cars, electric vehicles, Jaguar Land Rover (JLR), and related investments, led by Shailesh Chandra.

SEBI-registered analyst Vishal Trehan explained the Tata Motors demerger and its implications for retail investors on Stocktwits.

What Does This Mean For Investors?

Accounting and valuation for the demerger commenced on July 1, the appointed date, but the transaction will become legally effective as of October 1. Following this, shareholders of Tata Motors will receive shares in the new commercial vehicle company on a 1:1 basis. This means that for every share held in Tata Motors, one share will be allotted in the newly listed entity.

Therefore, if you own 50 shares of Tata Motors on the record date, you will now hold 50 shares of the passenger vehicle company and 50 shares of the newly listed commercial vehicle company at no additional cost.

According to news reports, Tata Motors announced at an analyst meeting that the record date for the demerger of its Commercial Vehicles business is set for mid-October, with the business expected to be listed in November.

Why The Demerger?

Trehan highlighted that this demerger allowed each business unit to pursue distinct strategies, capital allocation, and growth paths tailored to their market dynamics. Additionally, independent boards and leadership sharpen execution.

This move also unlocks tremendous value for retail investors as they can now benchmark each business separately.

Market Impact

Some volatility in Tata Motors’ stock is expected following the implementation of the demerger, Trehan said. He added that analysts expect valuations to likely adjust, reflecting segmental profitability and growth prospects, particularly in the electric vehicle sector.

According to him, this split positions TMPV as a pure-play electric vehicle and luxury automotive company, while TMLCV is closely tied to India’s infrastructure and logistics-led CV companies. This allows retail investors to explore these themes through the two plays.

What Is The Retail Mood?

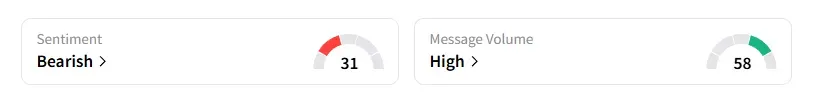

Data on Stocktwits shows that retail sentiment has been ‘bearish’ for a month amid ‘high’ message volumes on Tata Motors. This is after its British unit, Jaguar Land Rover (JLR) halted production at its three UK plants from August 31 following a cyber-attack. Earlier this week, it announced a phased restart, but a full recovery is expected to take several weeks.

Tata Motors’ shares have declined 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<