Tata Capital IPO Listing: India’s largest initial public offering (IPO) of 2025 by Tata Capital made a tepid debut on the Indian stock market on Monday, October 13. On both BSE and NSE, Tata Capital share price got listed at ₹ 330 – a premium of 1.23% over the issue price of ₹ 326.

However, after listing, Tata Capital share price slipped marginally to ₹326.85 on NSE, but remained above the IPO price.

Should you buy Tata Capital shares?

Ahead of the Tata Capital IPO listing today, brokerages Emkay Global and JM Financial initiated coverage on the counter with ‘Add’ ratings. However, their target prices for Tata Capital shares are pegged at ₹360, signalling limited upside from hereon.

Emkay Global said its positive stance on the Tata group company is based on various factors, like: 1) the Tata parentage and brand name providing the vital ingredients, 2) diversified product range, geographical reach, and various sourcing channels minimizing concentration risk and 3) improving credit costs and operating leverage likely driving sustained RoA/RoE improvement to ~2.2%/15.4% in FY28E and >30% EPS growth in FY25-28E, aided by turnaround in the vehicle finance business and a high secured share in the product mix.

Meanwhile, JM Financial noted that at IPO upper price band of INR 326, the current expected valuation multiple of TCL is ~2.7x FY27E P/BV. “Based on its AUM growth and RoE profile, TCL should trade between CIFC and HDB, which have a valuation multiple of 3.7x and 2.5x FY27E P/BV, respectively. We assign TCL a target multiple of 2.9x FY27E BVPS reflecting a ~10%- 12% premium/discount to HDB Financial/CIFC,” JM Financial said.

Tata Capital IPO Details

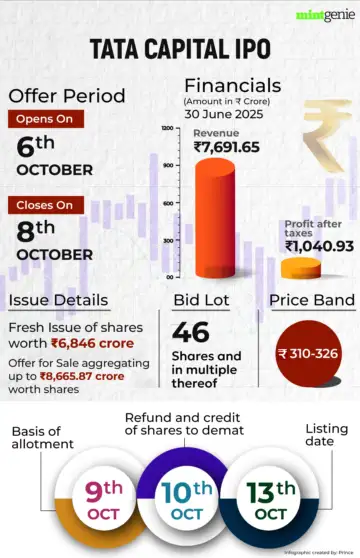

Tata Capital IPO was booked 1.95 times during the bidding period, which was open from October 6 to October 8. The ₹15,512 crore share sale received bids for 65,12,29,590 shares against 33,34,36,996 shares on offer.

The qualified institutional buyers (QIBs) segment got subscribed 3.42 times, while the portion meant for non-institutional investors (NIIs) received 1.98 times subscription. The retail category was booked 1.10 times.

Tata Capital IPO price band was set at ₹310-326 per share, valuing the non-banking finance company at ₹1.38 lakh crore at the upper end of the price band.

The issue was a mix of fresh share sale of 21 crore equity shares and an offer for sale (OFS) of 26.58 crore shares. The company plans to use the IPO proceeds from the fresh issue to strengthen the company’s Tier-1 capital base, supporting future capital requirements, including onward lending.

Established in 2007, Tata Capital is one of the leading, diversified NBFCs in India with the strong backing of the Tata group. The company operates largely in secured business segments (80% secured mix).

Tata Capital has a highly diversified product mix, offering 25+ distinct lending products broadly classified into three businesses: 61% of its loan book comprising retail finance, 26% SME and 13% corporate loans.