If you believe that history is a guide, you will always find periods of market volatility, marked by dramatic swings both down and up.

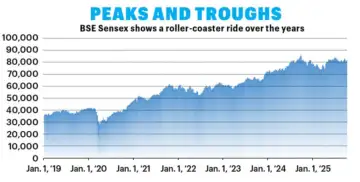

As much as you look back in history to draw out examples, it is a fact that uncertainty in markets makes investors jittery. Stock markets are volatile because nobody knows how policy changes or global events will affect a company’s ability to generate profits. A little over a year ago, on September 26, 2024, the BSE Sensex recorded its all-time high of 85,836.12 points. As expected, market optimists predicted that the Sensex could reach the 100,000 mark by the end of 2024.

Market players and several participants are perennial optimists, and understandably so, as stock markets tend to move upward in the long run. However, in the short run, there are always phases when the markets decline and even remain flat. Such phases cause anxiety among investors, especially when their portfolios turn negative. Some investors have experienced volatility and are successfully navigating these times when the markets aren’t rising or reclaiming their past highs. Many of these investors are those who have been investing in the stock market through mutual fund (MF) Systematic Investment Plans (SIPs).

They have developed a new way of thinking when it comes to investing and find small, regular investments through SIPs in MFs a less stressful way to invest. These investors have a strong commitment to saving money and a clear understanding of investing through SIPs. Some of them have experienced the convenience and ease of regular investment through SIPs, and have realised that this investment instrument best serves their interests. These experienced investors aren’t reacting emotionally to these cycles and are instead seeking ways to adjust their portfolio to accommodate this changing market scenario.

MARKET VOLATILITY

MARKET VOLATILITY

Stock markets often experience sharp and unpredictable price fluctuations, either upward or downward. These movements are usually referred to as a ‘volatile market’ and can occur over a period of days, weeks or even months. Although volatility applies to both upward and downward market movements, most investors tend to be more concerned about downside volatility. As an investor, it is essential to remember that volatility will always play a role in the performance of the stock market.

While market volatility can happen with little warning, it rarely occurs for no reason. Market volatility may be attributed to political developments, such as unexpected election results or economic factors, including changes in monetary policy and inflation. Then there are global events, such as the COVID-19 pandemic or geopolitical conflicts like wars, which can impact the global economy and markets. There could also be events such as scams in certain stock markets or a company reporting a surprisingly positive or negative earnings result.

In the case of MFs, volatility measures how widely a fund’s returns deviate from its average over a given period. Just like a roller coaster with steep climbs and sudden drops, an MF with high volatility may see its performance shoot up one month and fall sharply the next. In contrast, a fund with low volatility might appear much steadier, akin to a roller coaster for children, with slight dips and rises. In the financial world, volatility is typically expressed statistically in terms of standard deviation.

For instance, if you have an MF generating an average (mean) annual return of 6 per cent and it has a standard deviation of 2 per cent. This means that the fund’s returns often fluctuate between 4 per cent and 8 per cent, but not consistently. This is just an approximate range for one standard deviation from the mean. The larger the standard deviation becomes, the greater the expected swings away from the average or volatility. Volatility is like your heartbeat; you are alive because of it, and your investments have the potential to grow because of it.

MITIGATING VOLATILITY

There are ways to mitigate investment volatility by diversifying your portfolio through a mix of MFs. Then there are SIPs, which allow you to invest a fixed sum regularly in an MF scheme. This way, you need not wait for the right time to invest in the markets. This inculcates a regular investing habit, wherein you end up acquiring more MF units when the markets are down and fewer when the markets are up. This way, over long periods, you reduce the average investment cost of the MF units, mitigating volatility. This is known as rupee cost averaging, which is an in-built feature of investing through SIPs in volatile markets.

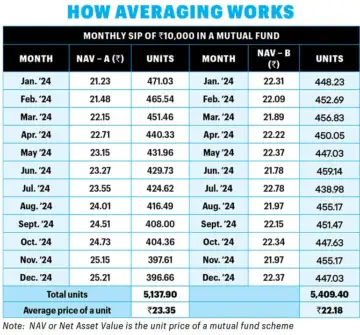

To understand the effect of averaging and its impact on containing volatility, let us consider a monthly SIP of Rs 10,000 in two different MF schemes, A and B (see How Averaging Works). Scheme A witnesses an upcycle, where the NAV of the fund for a period of 12 months is on the rise. Scheme B, in contrast, undergoes a volatile phase of fluctuations. It can be seen that the overall units acquired through Scheme B are higher than the number of units acquired by Scheme A. Importantly, the average cost of each unit is lower in the case of Scheme B compared to Scheme A. Investors must accept that market fluctuations are inevitable, and even the most experienced investors may struggle to predict market highs and lows accurately.

Investing through SIPs eliminates the guesswork and emotional bias associated with investing. What you get is a method to invest regularly, irrespective of market conditions. When investing through SIPs, you also benefit from affordability. SIPs allow you to invest Rs 500 or less per month or a much higher sum, running into lakhs. The historical performance of several MFs when investing through SIPs indicates higher returns compared to an equivalent lump sum investment during the same period. It is for this reason that you should continue to invest through market downs and ups to benefit from the full investment cycle.

VOLATILITY AS OPPORTUNITY

Just as you need your heart to beat to stay alive, stock markets need to be volatile to attract investors and perform well in the long run. You could adopt different investment strategies to benefit from volatility. For example, asset allocation-the bedrock of long-term, successful investing-is designed to reduce volatility by spreading investments across different asset classes. MFs are structurally designed to help achieve asset allocation by developing funds that have the investment mandate to spread investments across different asset classes within a specified range.

Through diversification, within different asset classes, you can benefit from spreading your investments. For example, when the prices of small-cap stocks are falling, large-cap stocks or international stocks within the portfolio may be moving up, along with bonds and other debt-related assets. You could also benefit from certain types of MF schemes (See Flexible Navigation), which are designed to benefit from volatility.

You can use volatility to revisit your portfolio and adjust it as needed. For example, during an upward fluctuation, you may wish to exit some investments from equities and reroute them to debt instruments. The same goes for the case when the markets are down, when you could consider it as an opportunity and move some of your money from debt instruments to equities. The rebalancing act also forces you to reconsider your investments based on your financial goals and prioritise them according to existing market conditions.

You can use volatility to revisit your portfolio and adjust it as needed. For example, during an upward fluctuation, you may wish to exit some investments from equities and reroute them to debt instruments. The same goes for the case when the markets are down, when you could consider it as an opportunity and move some of your money from debt instruments to equities. The rebalancing act also forces you to reconsider your investments based on your financial goals and prioritise them according to existing market conditions.

Looking back at the historical performance of stock markets, no matter how low they dipped (as seen in the early COVID months of 2020), they have bounced back and gone up to set new highs. As an investor, you need to remain calm and disciplined during a market downturn to capitalise on the potential benefits of future market growth. The longer you stay invested, the better your chances of coping with volatility and gaining from it.

FLEXIBLE NAVIGATION

Deft movement across market capitalisation within equities can make your investment returns profitable irrespective of market movements

The role of an all-rounder in cricket is gaining popularity, particularly in the shorter formats of the game. These players excel in both batting and bowling, making a noticeable impact and contributing immensely in each role. More teams are increasingly relying on these versatile players for success. Similarly, in the world of mutual fund investments, flexi-cap funds play a comparable role. According to SEBI guidelines, flexi-cap funds are equity funds that have the flexibility to invest across different market capitalisations, provided they allocate at least 65 per cent of their assets to equity and related instruments.

Fund managers have the discretion to allocate across large-cap, mid-cap, and small-cap stocks, allowing for a dynamic and flexible asset allocation. Investors seeking growth through equities will understand that this asset class has its own dynamics and complexities (see Cycles of Gain). The way each segment of the market performs makes it a challenge to categorise the equity asset class as a single entity. Over the past seven years, each segment of the market has fared differently. For instance, in 2019, when the small-cap index was down 10 per cent, the large-cap segment was up 10 per cent.

Cut to 2023, the large-cap index was up 20 per cent and the mid-cap index was twice that much with a 40 per cent gain. For any investor, the performance of their investments can change dramatically depending on the allocation made to each of these equity segments. For instance, if you had invested Rs 100 in a flexi-cap scheme, it would have internally divided this among Rs 40 allocated to mid-cap and the remaining Rs 60 equally between large- and small-cap as of January 1, 2025. Over the past 10 months, the value of the investment may appear to be static. However, if the same investment were divided 50-50 into large- and mid-cap stocks, the result would be an overall 2.5 per cent gain.

Cut to 2023, the large-cap index was up 20 per cent and the mid-cap index was twice that much with a 40 per cent gain. For any investor, the performance of their investments can change dramatically depending on the allocation made to each of these equity segments. For instance, if you had invested Rs 100 in a flexi-cap scheme, it would have internally divided this among Rs 40 allocated to mid-cap and the remaining Rs 60 equally between large- and small-cap as of January 1, 2025. Over the past 10 months, the value of the investment may appear to be static. However, if the same investment were divided 50-50 into large- and mid-cap stocks, the result would be an overall 2.5 per cent gain.

The flexi-cap fund’s ability to adapt to changing market movements makes it attractive. The role of the fund manager, especially the investment strategy on which the fund bases its allocation across market capitalisation, is key to the performance of this category of equity funds. Beyond the capitalisation, funds that have established their investment allocation to select sectors also play a role in the fund’s performance.

As fund managers managing these funds have greater flexibility to diversify within the equity asset class, these funds are better equipped to manage volatility. Think of these funds as all-weather, as fund managers may shift allocations towards large-cap stocks for relative stability in times of uncertainty and increase exposure to mid- and small-cap stocks for higher potential returns during bullish phases. While there may be phases when you may feel nothing much is happening, the performance of these funds in 2021 and 2023, when overall equities were up, could be significantly high because of a higher allocation to small-caps.

Having exposure to these funds can work favourably for your overall portfolio growth. You also have the flexibility to benefit whenever equities gain from the allocation made by these funds within the equity category. If there is one fund that you should consider in your portfolio for long-term growth, the flexi-cap category could be the one that would work in your favour over different market cycles.