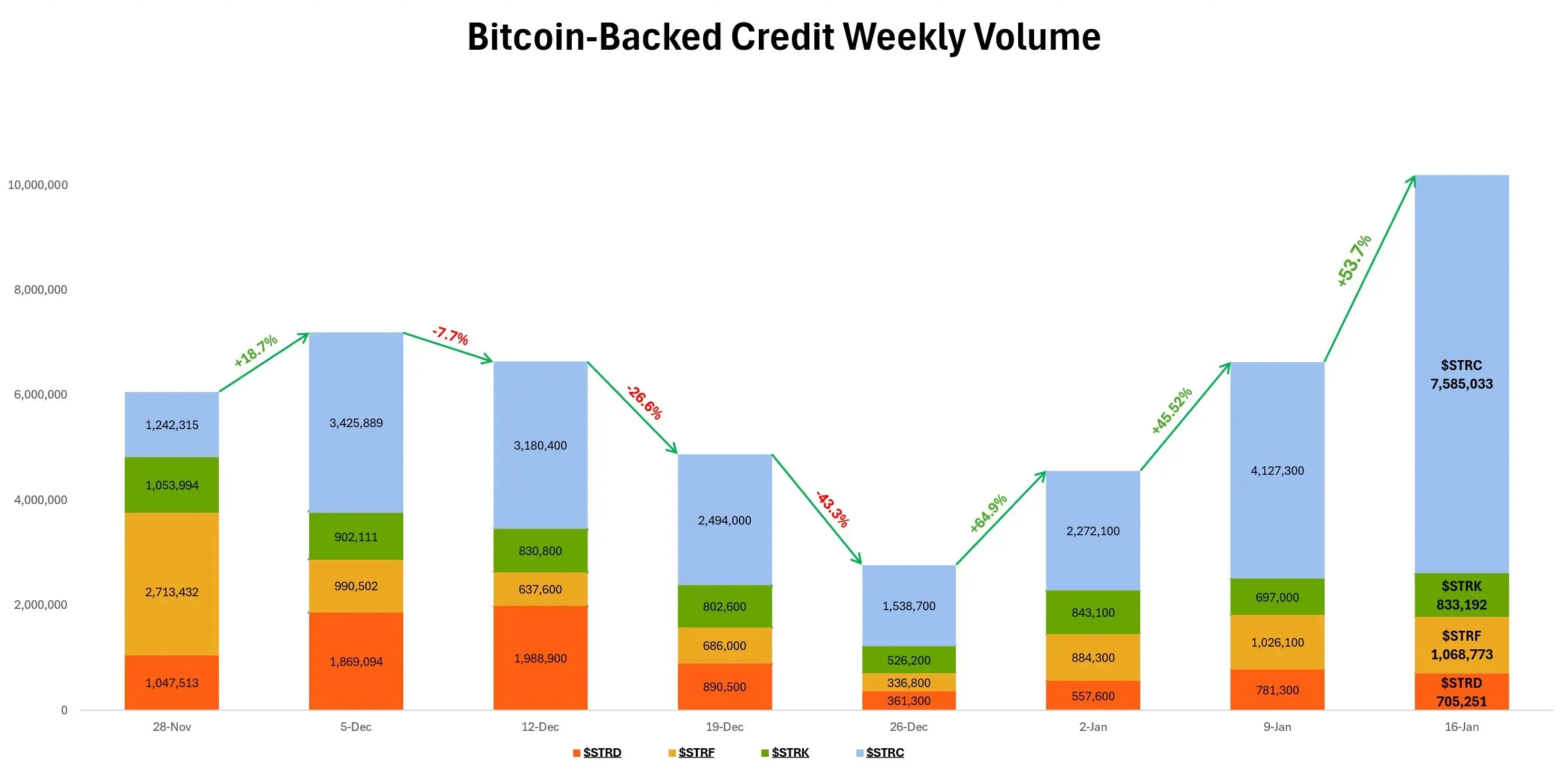

Strategy’s STRC hits record volume as preferred product demand jumps 53.7%, fueling debate over Bitcoin-backed yield structure.

- Weekly volume for Strategy’s preferred products jumped 53.7% week over week, with Strategy Inc Variable Rate Series A Perpetual Stretch Preferred tied to the highest-volume week cited by Jackson Fairbanks.

- A market watcher named MarylandHODL21 argued that the stock is being misread as just yield, calling it a structure built to monetize Bitcoin growth.

- In the Miami event, Michael Saylor described the preffered stock as a “digital credit instrument” that pays a monthly cash dividend, funded by Bitcoin appreciation.

Weekly volume for Strategy’s preferred products jumped 53.7% week over week, as Strategy preferred stock Short Duration High Yield Credit (STRC) saw its highest volume week in mid-January.

On X, Director of Marketing of Strive, Jackson Fairbanks, shared market data that pointed to rising activity in Strategy’s preferred products, among which the digital credit liquidity rose 53.7% week over week. He also added that STRC held the $100 level during its “highest-volume week ever” seen during January 9 to January 16.

Fairbanks referenced an earlier update that showed digital credit liquidity rising 18.7% week over week, underscoring how sharply Strategy’s preferred products have accelerated since December.

Broader commentary also emerged around the product’s purpose, where market watchers like @marylandhodl21 said most observers were mistaking STRC as only a yield instrument, whereas he argued that STRC allows capital providers to accept a “known fiat coupon” in exchange for Bitcoin-backed exposures. If the price of Bitcoin appreciates faster than the coupon cost, then the ‘spread’ goes to Strategy. This method, the user said, is not by chance but is “the system” that is consciously implemented.

Strategy’s Common Class A stock (MSTR) is different from how STRC functions. MSTR is an uncapped pure equity exposure stock that does not provide any ‘yield’ to stockholders. MSTR was trading at $173.71 and closed 1.64% up on Friday. On Stocktwits, retail sentiment around Strategy remained in ‘extremely bullish’ territory, as chatter remained at ‘high’ levels over the past day.

Michael Saylor On STRC’s Bitcoin-Funded Yield Model

At the Economic Club of Miami’s winter event, Saylor said STRC’s monthly dividend was funded by capital deployed into Bitcoin, which he described as “digital capital.” He compared the structure to annuities and other credit products designed to limit volatility for income-focused investors, while Strategy retained exposure to Bitcoin’s long-term appreciation. The comments came as inflation and currency debasement continued to pressure traditional savings, leaving many fixed-income products struggling to deliver positive real returns.

Read also: a16z Executive Urges CLARITY Act To Move Forward, Despite The Flaws

For updates and corrections, email newsroom[at]stocktwits[dot]com.<