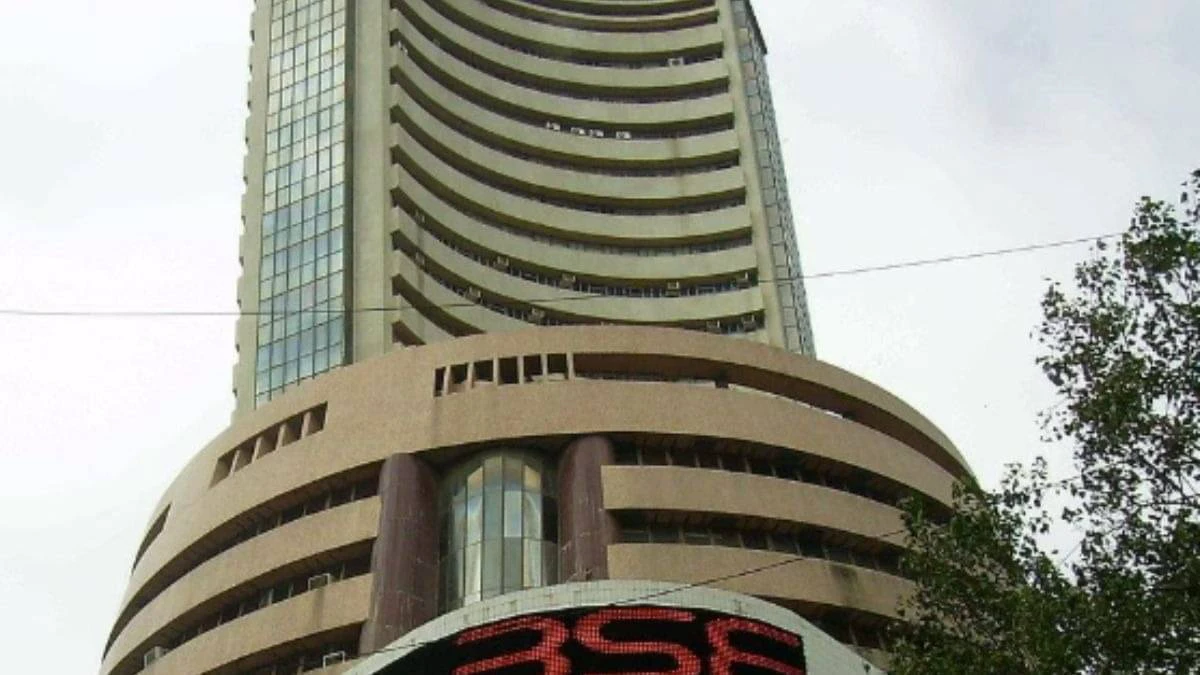

The global markets started trading on a higher note today, highlighting that the domestic markets will open with a positive tone.

On Thursday, the Sensex and Nifty stock indices ended lower due to selling of IT stocks.

Additionally, investors are also staying cautious before the US-India trade talks’ results.

Among factors that have hurt investor confidence are also new foreign withdrawals as well as weak quarterly earnings.

Many companies are also announcing their financial results for the quarter along with a few corporate developments.

To stay informed on all key developments in the Indian markets, check this list of all the stocks that will be in focus today:

Wipro: The tech giant reported a 10.9% year-on-year (YoY) rise in net profit to Rs 3,330.4 crore for the first quarter of FY26, up from Rs 3,003.2 crore in Q1 FY25. However, the company’s profit fell 6.7% sequentially from Rs 3,569.6 crore in the previous quarter. Additionally, the revenue from operations for Q1 FY26 stood at Rs 22,134.6 crore, up 0.8% YoY from Rs 21,963.8 crore. On a sequential basis, revenue declined 1.6% from Rs 22,504.2 crore in Q4 FY25.

Tech Mahindra: The shares of IT services firm Tech Mahindra declined more than 2% on Thursday after the company’s profit declined sequentially for the June quarter.

LTIMindtree: Larsen & Toubro’s IT services subsidiary, LTIMindtree has posted a strong result for Q1 FY26 with its net profit increasing 11.2% QoQ to Rs 1,254 crore. Additionally, the company’s revenue grew 0.7% to Rs 9,840.6 crore.

Vedanta: The Viceroy of US short seller has accused Vedanta on account of violating its agreement with the government on how the mining conglomerate collects ‘brand fees’ from Hindustan Zinc (HZL). As per the report, a whistleblower claims that the fees are not only unjustified but may also trigger legal clauses that could cost Vedanta billions of dollars. Both Vedanta and the government have shareholding in HZL.

ONGC: Oil and Natural Gas Corporation has signed a strategic Memorandum of Understanding with bp plc to collaborate on drilling stratigraphic wells in India’s Category II & III offshore sedimentary basins such as Andaman, Mahanadi, Saurashtra, and Bengal.

DLF: India’s largest listed real estate developer, DLF is considering entering Mumbai’s super-premium and ultra-luxury residential segments following its first premium project in the city.