Stocks to buy: The Indian stock market is poised to close Samvat 2081 flat, amid persistent FII (foreign institutional investors) outflows, a global trade tussle, weak earnings, and geopolitical uncertainties.

However, the outlook for Samvat 2082 appears bright due to a combination of fiscal and monetary tailwinds.

Brokerage firm Motilal Oswal Financial Services believes that due to RBI rate cuts, income tax relief, low inflation, and GST reforms, it has set the stage for a turnaround in India’s domestic growth momentum, with a significant pick-up in consumption paving the way for a robust revival in the private capex cycle.

This, along with the improving earnings trajectory, is expected to lend support to Indian equities, the brokerage firm said.

Motilal perceives FY26 to mark the crossover from subdued low-single-digit earnings growth to more sustainable double-digit earnings growth.

“Nifty earnings growth is expected at a healthy 8 per cent and 16 per cent year-on-year (YoY) in FY26 and FY27, respectively, as compared to 1 per cent in FY25. Also, Nifty valuations are reasonable at about 20 times FY26 earnings, close to long-term averages,” Motilal Oswal said.

However, the brokerage firm emphasised that mid and small-cap trades at a slight premium. Therefore, it suggests one needs to follow a selective approach in stock picking.

For Samvat 2082, the brokerage firm anticipates that domestic cyclicals and structural growth themes will perform well.

“We are positive on sectors such as BFSI and capital markets, consumption, manufacturing (EMS/defence/industrial) and digital,” said Motilal Oswal.

Muhurat stock picks for long term

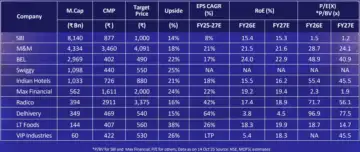

State Bank of India (SBI) | Target price: ₹1,000

Motilal Oswal said that structural tailwinds from government reforms such as GST 2.0, income tax reforms and the RBI’s liquidity infusion will lead to robust credit growth and support the profitability of the BFSI sector.

The brokerage firm noted that SBI stands out for its diversified growth momentum across retail, SME, and corporate segments, supported by a robust credit pipeline and digital transformation initiatives.

Mahindra and Mahindra (M&M) | Target price: ₹4,091

The brokerage firm stated that M&M is poised to deliver strong earnings growth, driven by a rural recovery and robust launches, further reinforced by improving tractor margins and the immediate pass-through of GST rates to consumers.

Bharat Electronics (BEL) | Target price: ₹490

The Indian Army’s ₹30,000 crore tender for ‘Anant Shastra’ project, with BEL as lead integrator, boosts its order book beyond ₹1 lakh crore and underscores its leadership in strategic defence programs, said Motilal Oswal.

Swiggy | Target price: ₹550

Motilal Oswal emphasised that Swiggy anticipates its quick commerce arm will achieve profitability sooner, thanks to easing competition, moderated dark store expansion, and lower acquisition costs.

“Swiggy has strengthened its food delivery outlook, with growth estimates raised to nearly 23 per cent for FY26-FY27 versus nearly 20 per cent earlier, driven by GST-led boost to disposable income and rising discretionary spending,” said the brokerage firm.

Indian Hotels | Target price: ₹880

Motilal believes the Indian hospitality industry is set for robust growth in FY26, driven by rising ARR, higher occupancy, and strong RevPAR (revenue per available room).

Increased MICE activity, cultural events, and a vibrant wedding season in 2HFY26 are expected to further boost performance, according to the brokerage firm.

“We expect strong momentum to continue, led by a strong room addition pipeline in owned/management hotels (3,770/16,430 rooms) and continued favourable demand-supply dynamics,” said Motilal.

Max Financial | Target price: ₹2,000

“Max Financial is poised for above-industry growth, supported by strong bancassurance traction, a resilient agency channel, and a favourable product mix,” said Motilal.

The brokerage firm underscored that Max Financial’s VNB margins are improving QoQ, aided by product mix shifts and rising rider penetration.

“The GST waiver is set to further boost affordability and insurance penetration. MFSL will maintain its premium valuations, driven by new product launches, robust growth trend and improving margin profile,” said Motilal Oswal.

Radico | Target price: ₹3,375

According to the brokerage firm, Radico Khaitan is well-positioned for long-term growth through aggressive expansion in the premium and luxury spirits segment, leveraging strong brand equity with leading products like 8PM, Magic Moments, and Rampur Single Malt.

“It commands an 8 per cent market share in the Prestige and Above (P&A) segment, with rising consumer premiumization. New launches like Morpheus Super Premium Whisky and Spirit of Kashmir support future growth. Lately, Radico acquired a 47.5 per cent equity stake in D’YAVOL Spirits B.V., aiming to take India to the World by building bottled-in-origin luxury brands, targeting Tequila and other niche categories,” said Motilal.

Delhivery | Target price: ₹540

Motilal highlighted that Delhivery has a market share of more than 20 per cent in the express logistics space and has rapidly increased its presence in the PTL segment after acquiring Spoton Logistics in 2021.

The recent ₹1400 crore Ecom Express acquisition enhances Delhivery’s rural coverage, strengthens network density, and drives cost synergies, said the brokerage firm.

“It is poised for sustained growth, supported by a rising user base, new category launches, and expanding e-commerce,” Motilal Oswal said.

LT Foods | Target price: ₹560

Motilal believes LT Foods is well-positioned for long-term growth, leveraging its strong brand equity with Daawat and Royal, and exporting to over 80 countries. The company commands nearly 30 per cent and 50 per cent shares in the Indian and US basmati markets, respectively.

“Growth drivers include expanding volumes in basmati and speciality rice and increasing focus on high-margin O&CH segments. Exports (66 per cent of revenue of FY25) offer better realisations and margins versus the domestic market, making the business structurally export-led,” said the brokerage firm.

VIP Industries | Target price: ₹530

“VIP Industries, a leading player in India’s ₹17,000 crore luggage market, has outpaced industry growth, delivering a revenue CAGR of 19 per cent over FY22-25,” Motilal Oswal observed.

The brokerage firm believes that with a scalable, profitable digital engine complementing its offline leadership, VIP is well-placed to capture long-term market share gains.

“We expect VIP to deliver industry-beating growth by leveraging the integrated strategy of premiumization, digital scale and margin accretive supply chain,” said Motilal Oswal.