The industrial machinery maker has risen 28% since its listing in June. On Stocktwits, the retail chatter is increasing even as sentiment turns ‘extremely bearish’.

Since its mainboard listing on June 20, industrial machinery maker Oswal Pumps has gained more than 28%, significantly outperforming the broader markets.

At a time when the markets are reeling from the uncertainties surrounding the tariffs imposed by US President Donald Trump, Oswal Pumps quietly gained around 7% over the past week.

At the time of writing, Oswald Pumps’ stock was trading 1.4% higher at ₹787.30, just shy of its record high of ₹794.95 hit earlier in the session.

Retail attention has been rising, as seen with the ‘extremely high’ message volumes on the Stocktwits platform. However, despite posting robust quarterly earnings, retail sentiment for the stock shifted to ‘extremely bearish’ from ‘bearish’ a day earlier.

Record-breaking Q1 Performance

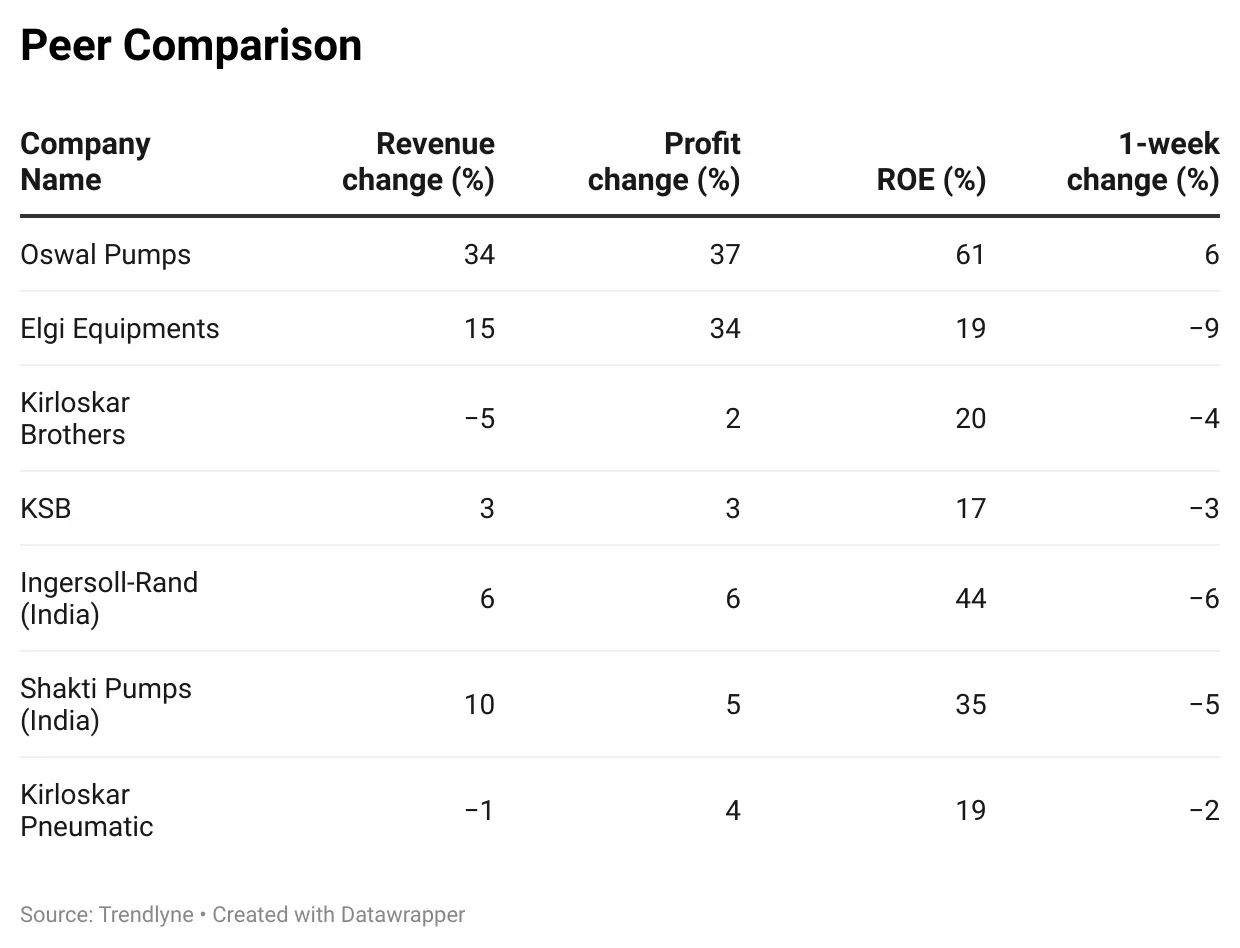

On August 4, Oswal Pumps reported a 34.2% year-on-year increase in profit after tax to ₹94.7 crore, while total income rose 37% to ₹515 crore. On a sequential basis, profit surged 48.2% and revenue climbed 40.9%. EBITDA grew 39.2% to ₹141.9 crore, while margins remained steady at 27.5%.

The company credited the performance to strong demand from the PM-KUSUM scheme for solar pumps. As of June 30, Oswal Pumps executed 48,915 turnkey solar pumping orders under the scheme, holding a 31% market share.

Management also projected a revenue growth of 50% – 60% for FY26.

Brokerage Watch

It is the fastest-growing vertically integrated solar pump manufacturer in India. In a note ahead of its IPO, SBI Securities had flagged concerns over its dependence on government projects/policy, as well as concentrated geographical risk, with Haryana and Maharashtra essentially driving revenues.

IPO Details

Oswal Pumps made a modest debut on the mainboard. It closed at ₹624 on the NSE, up 1.63% from its IPO price, after listing at a 3% premium. The ₹1,387.34-crore IPO, priced in the ₹584–₹614 band, was subscribed 34.42 times between June 13 – 17.

For updates and corrections, email newsroom[at]stocktwits[dot]com<