Top news

GST council’s 56th meeting – Major tax reforms

The Goods and Services Tax (GST) Council, in its 56th meeting held on 4th September 2025, approved significant reforms aimed at simplifying the indirect tax system, now eight years old.

These reforms will be effective from 22nd September 2025. The primary goal is to ease the tax burden on citizens by reducing slabs and rates, thereby encouraging business growth and smoother compliance.

The government has now moved to a two-slab tax structure – 5% and 18%, replacing the earlier four slabs of 5%, 12%, 18%, and 28%. The Finance Minister shared these updates on Twitter, supported with infographics for clarity.

Key changes include:

- Agriculture: Tax reduced to 5% (earlier 12% & 18%)

- Healthcare: Tax reduced to 5% (earlier 12% & 18%)

- Automobile sector: Reduced to 18% (earlier 28%)

- Electronic appliances: Reduced to 18% (earlier 28%)

No revisions have been made in the education sector.

Amanta Healthcare Ltd IPO

The IPO of Amanta Healthcare Ltd witnessed an impressive subscription of 82.60 times by 3rd September 2025. The issue was a main-board offering comprising 10 million equity shares with a face value of ₹10 each, aiming to raise up to ₹126 crore.

Shares were priced at ₹126 per share, with a minimum lot size of 119 shares. The IPO was open between 1st September and 3rd September 2025, and received an overwhelming response, leading to its massive oversubscription.

Bandhan AMC & Baroda BNP Paribas NFOs

Two new NFOs (New Fund Offers) have been launched:

- Bandhan BSE India Sector Leaders Index Growth Direct Plan

- Baroda BNP Paribas Business Conglomerates Growth Direct Plan

The Bandhan BSE India Sector Leaders Index Growth Direct Plan is an open-ended scheme, available from 3rd September 2025 to 17th September 2025. Managed by Abhishek Jain, its objective is to mirror the performance of the BSE India Sector Leaders Index by investing in its constituent securities in the same weightage, aiming to deliver returns before expenses while accounting for tracking errors.

The Baroda BNP Paribas Business Conglomerates Growth Direct Plan is also an open-ended scheme, available between 2nd September 2025 and 15th September 2025. Managed by Jitendra Sriram and Kushant Arora, the scheme seeks long-term capital appreciation by investing in equities and equity-related instruments of Indian business conglomerates. The fund does not assure or indicate guaranteed returns.

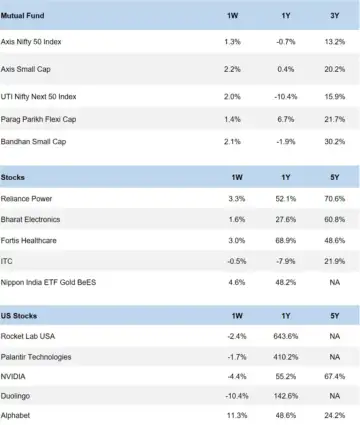

That is a wrap on the news for the week ended September 05. Let’s have a look at how the markets responded and actually moved this week, from indices and mutual funds to stocks. Let’s dig into the market movers to see how it all played out.