- Our retail market share recovered this quarter

- Onam and Ganpati will be key festivals leading to growth in Q2

- Company temporarily paused production in April 2025 due to maintenance and has now normalized

- We have a forthcoming launch of 125 cc

- Reached highest market share in June in scooter share at 9.4%

- Market share in EV stood at 7% in June, double from last year

- The NSE Nifty 50 at 3 month Low , 46 out of 50 Scrips trade in red

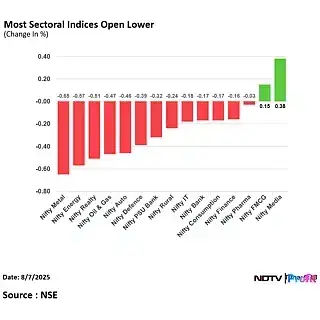

- The NSE Nifty Metal and Realty remain Top losers

- Most sectoral indices trade in red

- The NSE Nifty media showcasing some gains led by PVR INOX

Fineotex Chemical commenced new manufacturing facility at Ambernath to expand production capacity, the company said in the exchange filing.

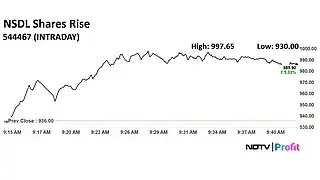

Shares of National Securities Depository Ltd. rose for a second session on Thursday after an impressive debut on Dalal Street with a 10% premium over the IPO price a day prior.

The NSDL stock rose as much as 6.56% to Rs 997.65 apiece on the BSE. The benchmark Sensex was down 0.3%. The scrip was trading 5.3% higher as of 9:45 a.m.

LTIMindtree Ltd. received order worth Rs 792 crore to design, build, and operate full technology backbone for PAN 2.0 project, the company said in the exchange filing.

LTIMindtree Ltd. received order worth Rs 792 crore to design, build, and operate full technology backbone for PAN 2.0 project, the company said in the exchange filing.

It may be dangerous to be America’s enemy, but to be their friend is fatal, said Nilesh Shah, Managing Director at Kotak Mutual Fund. “It is always difficult to predict America,” he added, as US President Donald Trump announced additional 25% tariffs on India on Wednesday.

At a time when the common Indian is warming up to the capital markets, market regulator SEBI seems inclined that they stay off the equity street. The regulator has been curtailing futures and options as well as day trading but an attempt to reduce retail participation in the primary market is likely to hurt the equity culture and financial inclusion push seen in recent years.

Transrail Lighting Ltd. share price hit a record high in Thursday’s session as it net profit doubled in April-June. Its consolidated net profit advanced 105.02% on the year to Rs 106 crore from Rs 51.7 crore.

Transrail Lighting share price advanced 3.28% to a record high of Rs 825 apiece.

Sigachi Industries Ltd. initiated work on 12,000 million ton per annum Microcrystalline Cellulose Project at Dahej Investigation in to company’s pashamylaram incident ongoing, the company said in the exchange filing

Sigachi Industries Ltd. initiated work on 12,000 million ton per annum Microcrystalline Cellulose Project at Dahej Investigation in to company’s pashamylaram incident ongoing, the company said in the exchange filing

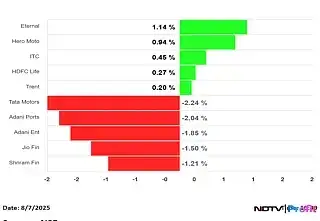

Trading about 0.50% lower, the benchmark index was dragged by names like Tata Motors, Jio Finance and Shriram Finance, as they marked losses of over 1%.

Meanwhile, players like Zomato, ITC, Trent were among the names holding up the index with over 1% gains.

Tata Motors Ltd. is set to announce its financial results for the first quarter of the current financial year later this week. Last month, the leading automaker informed the stock exchanges about its upcoming Board meeting to consider and approve the financial results for the quarter ended June 30, 2025.

Tata Motors Ltd. is set to announce its financial results for the first quarter of the current financial year later this week. Last month, the leading automaker informed the stock exchanges about its upcoming Board meeting to consider and approve the financial results for the quarter ended June 30, 2025.

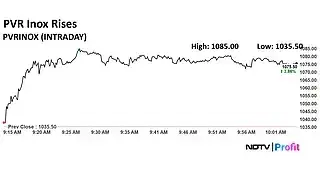

PVR Inox Ltd. share price rose to the highest level in nearly six months after its net loss shrinks because of good operating profit. It has reported Ebitda in line with estimates because of its good cost control initiatives, the brokerage said.

- Interests of farmers are a top national priority, Prime Minister Narendra Modi said.

- India will never compromise on the interests of farmers, livestock holders and fishermen, he said.

- “I know I’ll have to pay the price for it personally, but I’m ready to do it for the farmers,” Modi said.

Jefferies cut Container Corporation of India Ltd.’s target price as weak domestic volume growth weighed on its operating profit. Its consolidated Ebitda declined 2% on the year to Rs 432.68 crore in April-June from Rs 441.63 crore.

However, Container Corp’s reported Ebitda is 7% below Jefferies estimates due to weak domestic volumes and realisations. Even if the brokerage adjusts the Rs 21 crore one-time expense, the operating profit would have missed Jefferies estimates by 2%, the brokerage said.

On National Stock Exchange Ltd., 12 sectoral indices declined, two advanced, and one remained flat out of 15.

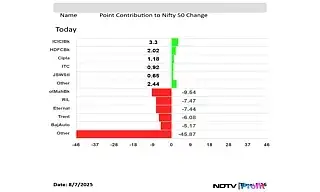

Kotak Mahindra Bank Ltd., Reliance Industries Ltd., Eternal Ltd., Trent Ltd., and Bajaj Auto Ltd. shares weighed on the NSE Nifty 50 index.

Kotak Mahindra Bank Ltd., Reliance Industries Ltd., Eternal Ltd., Trent Ltd., and Bajaj Auto Ltd. shares weighed on the NSE Nifty 50 index.

ICICI Bank Ltd., HDFC Bank Ltd., Cipla Ltd., ITC Ltd., and JSW Steel Ltd. added to the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex extended losses at open as Kotak Mahindra Bank Ltd., and Bharti Airtel Ltd. share prices weighed. The indices were trading 0.35% and 0.25% down, respectively as of 9:20 a.m.

The NSE Nifty 50 and BSE Sensex extended losses at open as Kotak Mahindra Bank Ltd., and Bharti Airtel Ltd. share prices weighed. The indices were trading 0.35% and 0.25% down, respectively as of 9:20 a.m.

The NSE Nifty 50 fell 0.35% to 24,489.40, and the BSE Sensex declined 0.25% to 80,339.4.

- The yield on the 10-year bond opened flat at 6.41%

Source: Cogencis

- Rupee opened 5 paise stronger at 87.68 against US Dollar

- It closed at 87.73 a dollar on Wednesday.

Source: Cogencis

The GIFT Nifty indicates that the NSE Nifty 50 may open 75.90 points lower for Thursday’s session.

RIR Power Electronics received Odisha Government’s fiscal support for phase 1 of its semiconductor plant in Bhubaneswar, the company said in the exchange filing.

Adani Power Ltd. received letter of intent to build a 2,400-megawatt thermal power project in Bihar. It will set up a greenfield plant in Bihar for nearly $3 billion, the company said in the exchange filing.

Regaal Resources has set price band at Rs 96-102 apiece for initial public offer, the company said in a statement.

The US President Donald Trump imposed an additional 25% tariff on Indian goods, citing India’s purchase of Russian crude oil. This has raised the total tariff burden on the nation up to 50%, placing the country just next to Brazil in terms of the highest US tariff rate without a bilateral agreement.

Apparel, Textiles, Diamonds, gold, Carpets, Organic chemicals, furniture, shrimps, machinery and mechanical appliances are among the sectors that will be the most affected by additional 25% tariffs imposed by the United States of America. With this hike, the cumulative tariff on India adds up to 50%. This additional 25% tariff will come into effect from Aug. 27, as per the order.

Read the full article here.

Most markets in Asia-Pacific region rose on Thursday amid tariff threats as US President Donald Trump also plans to give concession companies moving back production to the US.

The Nikkei 225 and CSI 300 were trading 0.87% and 0.32% higher, respectively as of 7:38 a.m.

The Dow Jones Industrial Average and S&P 500 futures rose in early trade on Thursday despite US President Donald Trump’s threat to impose 100% tariff on semiconductors.

The Dow Jones Industrial Average and S&P 500 futures were trading 0.31% and 0.30% higher, respectively as of 7:34 a.m.

The GIFT Nifty was trading 0.08% or 20 points higher at 24,556.50 as of 6:40 a.m., which implied a positive open for the NSE Nifty 50.

Traders will keep a close eye on automobile and original equipment manufacturing stocks because of tariff uncertainty on semiconductors. Sanghvi Movers, Jindal Stainless, and Hero MotoCorp likely be in focus because of first quarter earnings.

The Indian equity benchmark indices closed lower for the second consecutive day as Wipro, Sun Pharma, Jio Finance along with others weighed on the index. The NSE Nifty 50 benchmark ended 75 points, or 0.31% lower at 24,574, and the 30-stock BSE Sensex ended 166.26 points, or 0.21% lower at 80,543.