Edward Yardeni, president, Yardeni Research is seeing a lot of optimism for Indian economy. He said that the US and China is required to reach a trade deal soon.

Wall Street’s quantitative trader, Jan Street, made a massive profit of over Rs 43,000 crore trading in the Indian options market. The US trader’s strategy came into focus during a court case where it was alleged the firm made over $1 billion in options trading in Indian options.

That set the ball rolling in India and the Indian market regulator Sebi began an investigation into the trading patterns of the US delta trader.

Read the full article here.

On National Stock Exchange, nine sectoral indices advanced, four declined, and two remained flat out of 15. The NSE Nifty Defence advanced the most, and the NSE Nifty Consumption declined the most.

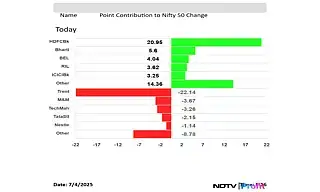

HDFC Bank Ltd., Bharti Airtel Ltd., Bharat Electronics Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. added to the Nifty 50 index.

HDFC Bank Ltd., Bharti Airtel Ltd., Bharat Electronics Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. added to the Nifty 50 index.

Trent Ltd., Mahindra & Mahindra Ltd., Tech Mahindra Ltd., Tata Steel Ltd., and Nestle India Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Friday tracking a rise in HDFC Bank Ltd. and Bharti Airtel Ltd. shares. The indices were trading 0.03% and 0.10% higher, respectively as of 9:19 a.m.

The NSE Nifty 50 and BSE Sensex opened higher on Friday tracking a rise in HDFC Bank Ltd. and Bharti Airtel Ltd. shares. The indices were trading 0.03% and 0.10% higher, respectively as of 9:19 a.m.

The Securities and Exchange Board of India has barred Jane Street Group entities from accessing the Indian securities market and directed the impounding of Rs 4,843.57 crore in alleged unlawful gains from the group.

According to SEBI’s order, Jane Street earned Rs 43,289.33 crore in profits through trading in index options on Indian exchanges between Jan. 1, 2023, and March 31, 2025.

Read the full article here.

At pre-open, the NSE Nifty 50 rose 0.09% or 23.55 points higher at 25,428.85, and the BSE Sensex rose 0.08% or 70.12 points higher at 83,306.81.

- The 10-year bond yield opened flat at 6.30%

Source: Bloomberg

- Rupee opened 8 paise weaker against US Dollar at 85.39

- It closed at 85.31 a dollar on Thursday.

Source: Cogencis

Edward Yardeni, president, Yardeni Research is seeing a lot of optimism for Indian economy. He said that the US and China is required to reach a trade deal soon. The two biggest economies will soon recognize that they are dependent on each other.

A weak dollar index has become a consensus. Higher US Treasury yields will threaten the US economy, Yardeni said.

Defence-related stocks like Bharat Electronics Ltd., Bharat Forge Ltd., BEML Ltd. and Bharat Dynamics Ltd. will be in focus on Friday after the Defence Acquisition Council approved 10 capital-acquisition proposals worth Rs 1.05 lakh crore.

Read the full article here.

- June client base rose 1.6% to Rs 3.2 core

- June orders fell 5.4% at 11.5 crore

- June average daily orders fell 5.4% to 54.7 lakh

- June gross client acquisition fell 9.3% to 5.5 lakh

- Downgrade Trent to ‘HOLD’ with a revised TP of Rs. 5,884 (earlier INR6,627)

- Disappointed on near-term growth expectations in core fashion business

- Cutting FY26E/27E revenue by -5%/-6% and EBITDA by -9%/-12%

- Pickup in Zudio Beauty and the Star business can become the next big growth levers

Oil prices extended losses to second session ahead of Organization of Petroleum Exporting Countries and allies in the upcoming weekend. Market participants are expecting that OPEC+ will deliver another output hike.

Brent crude was trading 0.23% down at $68.64 a barrel as of 7:36 a.m.

Most Asia-Pacific markets declined Friday with the Hang Seng index falling over 1%. Markets in Japan, and Australia advanced as upbeat US jobs data nullified some concerns about the US economy.

The Hang Seng and KOSPI were trading 1.34% and 1.05% down, respectively as of 7:28 a.m. The Nikkei 225 and S&P ASX 200 were trading 0.27% and 0.19% higher, respectively.

The S&P 500 and Nasdaq Composite indices hit record high as US upbeatjobs data assured traders about the world’s largest economy’s labour market.

US non-farm payroll advanced 147,000 for June compared to 110,000 expectation for the month. Jobs advanced on the back of aggressive government hiring.

The Dow Jones Industrial Average rose 0.77% to 44,828.53. The S&P 500 rose 0.83% to 6,279.35. The Nasdaq Composite rose 1.02% at 20,601.10

The GIFT Nifty was trading 0.14% or 35 points lower at 25,525.50 as of 6:48 a.m., which implied a lower open for the NSE Nifty 50 index.

Investors may monitor prices of Vedanta Ltd., Bajaj Finance Ltd., Yes Bank Ltd., and Oil and Natural Gas Corp Ltd. because of the overnight news flow.

The Indian benchmark equity indices erased the intraday gains to close lower for the second consecutive day on Thursday, dragged by share prices of Kotak Mahindra Bank Ltd. and Bharti Airtel Ltd.

The NSE Nifty 50 ended 48.1 points or 0.19% lower at 25,405.30, while the BSE Sensex closed 170.22 points or 0.2% down at 83,239.47.