Investors are optimistic about the company’s growth in market share and cost reductions.

Retail sentiment for Stitch Fix climbed higher early Thursday, following upbeat results and forecasts from the company.

Over the last few quarters, the personalized clothing company has reduced costs, refreshed its brand, and introduced new tools to enhance client-stylist engagement as part of its turnaround effort.

“We’re picking up share from all of the retailers that are letting consumers down,” CEO Matt Baer said on the post-earnings analyst call on Wednesday.

He said customer interest is peaking due to the new features, including one that allows clients to request a fix around an item they choose themselves, and an AI-powered assistant that helps customers better articulate the styles they require.

Stitch Fix forecast its fiscal first-quarter revenue to be between $333 million and $338 million, and fiscal 2026 revenue to be between $1.28 billion and $1.33 billion, both of which are above analysts’ expectations.

In the fourth quarter, revenue declined 2.6% to $311.2 million, although the fall was better than feared. Its $0.70 per share adjusted loss was also better than the expected $0.10 loss.

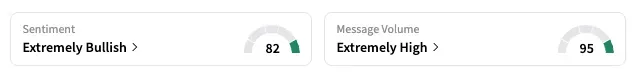

On Stocktwits, the retail sentiment for the company shifted to ‘extremely bullish’ as of early Thursday, from ‘bullish’ the previous day, and 24-hour message volume rose over 5,000%.

Users reviewed the 6.4% after-hours fall in the stock, although many said it presents a buying opportunity.

“$SFIX This after hours is a shakeout,” a user said. “Stitch Fix is returning to growth, cutting costs, and using advanced tech to bring [the] human element back to shopping. Stockholders will be rewarded as they continue to take market share and grow.”

Notably, SFIX shares have risen sharply recently, climbing about 26% since their Aug. 8 low and pushing year-to-date gains to 30%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<