SoFi’s record run triggered increased activity in the stock, while underperformance proved positive for certain other names.

Stocks rebounded on Tuesday, with the defensives and small-caps once again coming to the market’s rescue. Rate hopes have been driving sector rotation out of overvalued growth stocks and into underperforming small caps.

The following stocks saw significant volume in the after-hours session:

SoFi Technologies, Inc. (SOFI)

After-hours move: +0.98%

Trading volume: 16.95 million

Shares of digital financial services company SoFi rallied to an all-time high of $26.60 in Tuesday’s regular session before pulling back and closing down over 2% at $25.62.

Last week, JPMorgan and Citi raised their price targets for SoFi stock. JPMorgan upped the price target to $24 from $22 and maintained its ‘Neutral’ rating on the stock, while Citi lifted the price target to $28 from $21 and maintained its ‘Buy’ rating.

JPMorgan based its optimism on its more positive stance toward fintech lenders, citing potential Fed rate cuts and stable credit trends. Citi said it expects SoFi’s momentum to continue with its crypto offerings that will likely boost margins. The firm also noted stable credit trends.

On Stocktwits, sentiment toward SoFi stock remained ‘bullish’ (65/100), although the degree of optimism had tempered from the previous day. The message volume, however, was at ‘normal’ levels.

SoFi stock has gained over 66% this year.

Warner Bros. Discovery, Inc. (WBD)

After-hours move: +0.17%

Trading volume: 16.42 million

Warner Bros. Discovery stock underperformed the broader market on Tuesday, dropping about 2% in the regular session. The frenzied after-hours activity came despite a lack of any solid catalysts.

The media conglomerate is pursuing plans to split into two: Warner Bros., focusing on streaming and studios and Discovery Global, comprising its TV networks, Discovery+ and other assets. The breakup is expected to be completed in mid-2026.

The company’s streaming business is in focus, given that its traditional businesses are suffering, and Apple recently raised its Apple TV+ prices in the U.S. and select international markets.

On Stocktwits, retail sentiment toward Warner Bros. Discovery stock stayed ‘bearish’ (34/100), with the message volume at ‘low’ levels.

The stock has risen nearly 12% this year.

Avantor, Inc. (AVTR)

After-hours move: +1.05%

Trading volume: 16.25 million

Shares of Avantor, which provides products and services to multiple end markets, including biopharma, healthcare, education and applied materials. The Randor, Pennsylvania-based company reported earlier this month a 1% drop in second-quarter revenue and adjusted earnings per share (EPS) of $0.24. Both metrics trailed expectations.

There has also been a change of guard at the company, with Emmanuel Ligner, a life sciences industry veteran, taking over as CEO on Aug. 18. Last Friday, the company disclosed that board member Gregory Summe bought shares in the company.

Avantor’s stock elicited ‘neutral’ sentiment (50/100) among retailers, and the message volume was ‘low.’

It has fallen nearly 37% this year.

Congra Brands, Inc. (CAG)

After-hours move: +0.11%

Trading volume: 14.63 million

The Chicago, Illinois-based consumer packaged foods company may have come on investors’ radar after its stock fell nearly 2% in Tuesday’s session amid the general weakness seen in the consumer staples space.

Retail sentiment toward ConAgra stock, however, remained ‘bullish’ (71/100), and the message volume was at ‘high’ levels.

The stock is down over 29% for the year-to-date period.

Nvidia Corp. (NVDA)

After-hours move: +0.32%

Trading volume: 11.19 million

Nvidia remains in the spotlight ahead of its earnings report, due on Wednesday. The stock has gained over 35% year-to-date.

On Tuesday, Broadcom announced that it is working to integrate Nvidia’s artificial intelligence (AI) technology into its VMware Cloud platform. Separately, Firefly Neuroscience (AIFF) unveiled its new CLEAR platform powered by Nvidia’s L40S GPU with Ada Lovelace architecture.

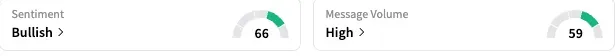

Sentiment toward Nvidia stock continued to be ‘bullish’ (66/100), with the buoyant mood accompanied by ‘high’ message volume levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.