Spot gold prices gained 1.7% to a record high of $4,179.48 per ounce, while spot silver surged to another record high of $53.60 per ounce.

Silver and gold prices hit an all-time high on Tuesday, before giving back some of the gains, amid renewed bets of fresh rate cuts by the Federal Reserve and ongoing tensions between the U.S. and China.

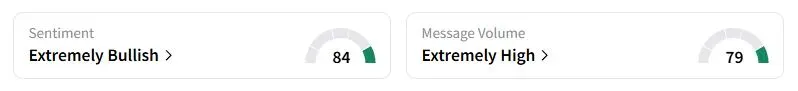

Spot gold prices gained 1.7% to a record high of $4,179.48 per ounce, while spot silver surged to another record high of $53.60 per ounce. Retail sentiment on Stocktwits about SPDR Gold Shares ETF (GLD) and iShares Silver Trust (SLV) was in the ‘extremely bullish’ territory at the time of writing.

According to a Reuters News report, Philadelphia Federal Reserve President Anna Paulson said on Monday that elevated risks in the job market are making the case for two more rate cuts this year.

“Given my views on tariffs and inflation, monetary policy should be focused on balancing risks to maximum employment and price stability, which means moving policy towards a more neutral stance,” Paulson reportedly said at a gathering of the National Association for Business Economics in Philadelphia.

According to CME Group’s FedWatch tool, traders have priced in a 25 basis point cut in benchmark interest rates in both of the U.S. central bank’s subsequent two meetings this year. Non-yielding bullion tends to thrive in low-interest-rate environments as a hedge against inflation.

Safe-haven flows continued to arrive for precious metals as the trade dispute between the U.S. and China threatened another tariff war. However, U.S. Treasury Secretary Scott Bessent assured that a scheduled meeting between President Donald Trump and his Chinese counterpart, Xi Jinping, is still expected to take place in South Korea later this month.

Silver’s Record Run

Silver prices soared past $51.20 per ounce, the highest level since U.S. billionaires Hunt brothers attempted to squeeze the market. So far this year, silver has outperformed gold, with over 83% gains compared to gold’s 56% surge.

Silver’s recent leap has been driven by a supply shortage in London, as producers fail to keep up with demand. London stocks were also diminished earlier this year when gold and silver bars were rushed to the U.S. in anticipation of tariffs imposed by Trump.

“Beyond safe-haven demand, diversification from the U.S. dollar and rate cut expectations, silver prices benefit from industrial demand, including solar panels and wind turbines. Supply has lagged demand over the past four years and is projected to continue this deficit through 2025,” said IG Bank analyst Fabien Yip.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<