Sidus Space shares are rallying after the company gained a major defense contract and announced a public offering of 19 million shares this month.

- The company has been selected as one of the contract awardees under the Missile Defense Agency’s Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) contract with a ceiling of $151 billion.

- Sidus Space announced the closing of a public offering of about 19 million shares, raising approximately $25 million.

- Retail investors remain bullish on the stock, with some eyeing a share price above $10.

Shares of Sidus Space Inc. (SIDU) have gained over 218% in the past month, but despite the massive rally, retail investors continue to remain bullish on the stock.

Some investors expect the shares to cross the $10 mark. At the time of writing, SIDU shares traded near $2.9. The optimism around the company comes largely from two major headlines this month – the company won a contract from the Missile Defense Agency (MDA), and almost immediately, it announced the pricing of a public offering of 19 million shares.

The Defense Contract

On Dec. 22, 2025, Sidus Space announced that it was selected as one of the contract awardees under the Missile Defense Agency’s Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) contract. The SHIELD contract is part of the broader Golden Dome missile defense strategy in the U.S., which focuses on building protection against air, missile, space, cyber, and hybrid threats.

The indefinite-delivery/indefinite-quantity (IDIQ) contract was awarded with a $151 billion ceiling. While an IDIQ is not a guarantee, it does make Sidus Space eligible to compete for future task orders issued under the contract.

The space company currently has a market capitalization of about $119 million.

Public Stock Offering

Shortly after the defense contract announcement, on Dec. 24, 2025, Sidus Space announced the closing of a public offering of about 19 million shares, raising approximately $25 million. The company said that it intends to use the proceeds for sales and marketing, operational costs, product development, manufacturing expansion, working capital, and general corporate needs.

The sale announcement came amid growing interest in space technology companies following President Donald Trump’s announcement of a new U.S. space policy.

While most retail optimism surrounded the defense contract and public stock offering, Sidus Space also completed the initial bus-level commissioning of its LizzieSat-3 satellite this month. The company said it would enable payload operations and delivery of autonomous, AI-enabled sensor data to government and commercial customers.

Separately, the company announced that it would act as a subcontractor on a NASA-funded Small Business Innovation Research (SBIR) design study to integrate a space-based radar payload onto its LizzieSat platform, supporting orbital debris tracking and space domain awareness.

What Are Stocktwits Users Saying?

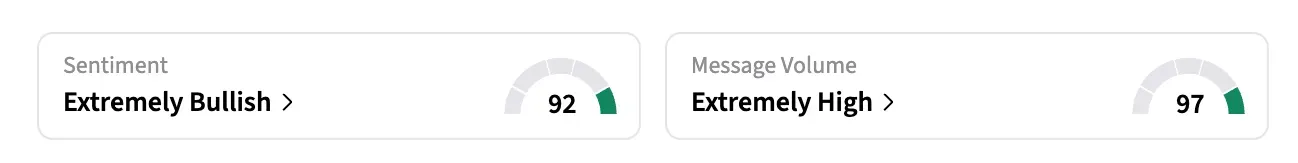

On Stocktwits, retail sentiment around SIDU stock has remained in the ‘extremely bullish’ territory over the past week. A month ago, retail sentiment on the stock was in the ‘bearish’ territory. At the same time, message volume around the stock has been ‘extremely high’ over the past week.

One user called the company ‘baby Palantir’ because it’s a multi-day runner. They added that their bullish sentiment on the company stems from its long-term upside driven by converging space, defense, and AI-driven data benefits.

Another bullish user predicted that its shares would rise to over $10.

However, one bearish user warned that Sidus Space is just among many companies selected for the Golden Dome contract, and that there was ‘nothing special’.

Shares of SIDU are down over 53% in the last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<