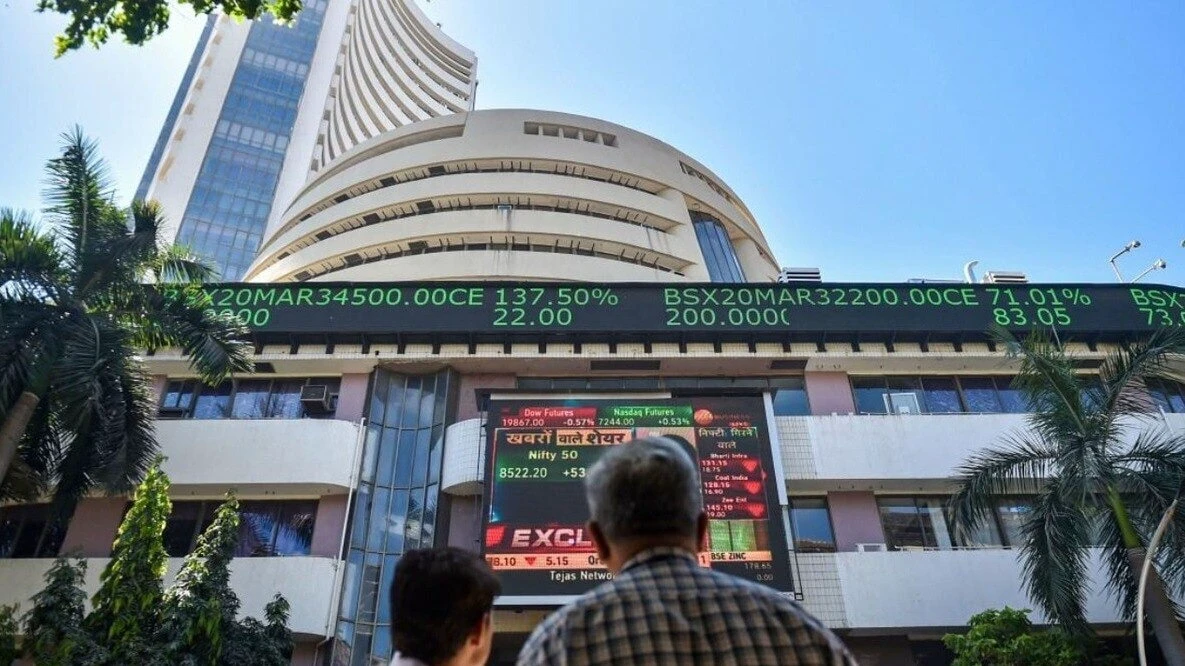

Domestic equity benchmarks, the Sensex and the Nifty, closed higher for the sixth straight session on Thursday, driven by optimism over a domestic earnings rebound, renewed foreign fund inflows, and hopes of a potential trade deal with the US.

At the closing bell, the Sensex jumped 130.06 points, or 0.15 per cent, to end at 84,556.40, extending its six-day winning streak to 2,526 points. The Nifty50 gained 22.80 points, or 0.09 per cent, to finish at 25,891.40.

Rupak De, Senior Technical Analyst at LKP Securities, said the 50-share index completely erased its morning gains during the session; however, the short-term trend remains strong.

“On the daily chart, a large red candle has formed, indicating the possibility of a pullback towards the 25,700 level in the next few days. However, the short-term trend remains intact, with the potential to revisit higher levels around 26,200 in the next 10-15 days. On the higher side, immediate resistance is placed at 26,000, above which the index may move towards 26,200,” De said.

Infosys emerged as the top gainer on Sensex, rising 3.86 per cent to close at Rs 1,528.85. It was followed by HCL Tech, which advanced 2.43 per cent, while TCS, Axis Bank, Kotak Mahindra Bank, and Titan rose 2.24 per cent, 1.37 per cent, 1.24 per cent, and 1.06 per cent, respectively.

Five stocks, namely, Infosys, TCS, Axis Bank, HCL Tech and Kotak Mahindra Bank, contributed heavily to the Sensex’s rise.

Among sectoral indices, the BSE IT rose 2.26 per cent to 35,347.18, while the BSE Bankex index added 0.36 per cent to close at 65,597.93.

Within the BSE Sensex pack, Axis Bank, Bajaj Finserv, Bajaj Finance, Bharti Airtel, HDFC Bank, L&T, Titan, Maruti Suzuki and SBI hit fresh 52-week highs

Overall, out of 4,385 actively traded stocks on the BSE, 1,837 ended higher, while 2,416 declined, and 132 closed unchanged. During the session, 221 stocks scaled their 52-week highs, whereas 60 slipped to 52-week lows. Meanwhile, 218 scrips were locked in their upper circuits and 154 in lower circuits.

Vinod Nair, Head of Research, Geojit Investments Limited, said domestic equities started on a positive note; however, they pared early gains as investors booked profits following sanctions on Russian oil and the possible postponement of India-US trade negotiations.

“Meanwhile, IT stocks advanced as sentiment improved after Trump’s softer tone on H1B visas. FIIs are gradually returning to Indian markets, encouraged by expectations of earnings rebound in H2FY26 supported by festive demand, tax benefits and GST reductions. As the undercurrent vibes of the domestic market have improved due to a possible India-US deal and a rise in consumer demand, the broad market is expected to do much better henceforth,” Nair said.