SEBI Chief Tuhin Kanta Pandey said the process for changes to LODR rules has begun with consultations. Clarity on the NSE IPO NoC will be provided in due time. He also defended the dual purpose of IPOs for fundraising and investor exits.

SEBI on LODR changes and NSE IPO

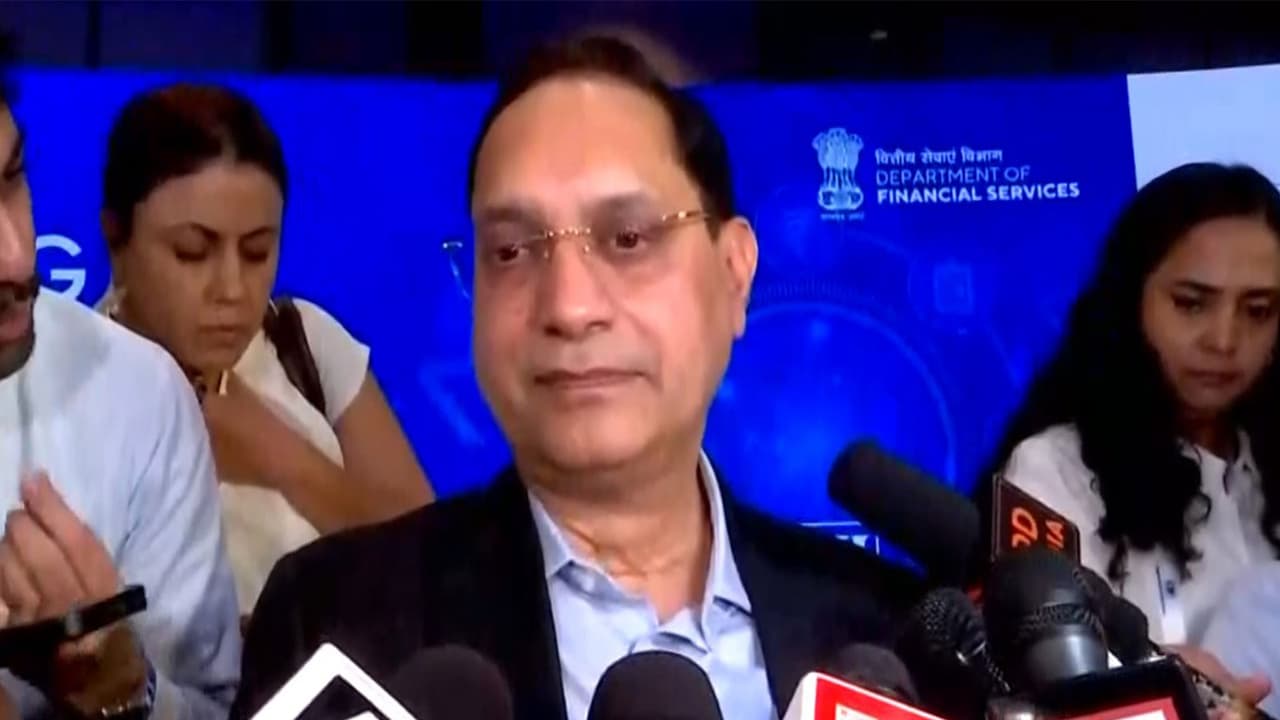

Securities and Exchange Board of India (SEBI) Chairperson Tuhin Kanta Pandey on Monday said that the process on the proposed changes to the Listing Obligations and Disclosure Requirements (LODR) regulations has begun, and will involve extensive consultations before a final decision is taken. He also indicated that clarity on the No Objection Certificate (NoC) for the NSE IPO will be provided at the appropriate time.

Addressing media on the sidelines of the CII Financing National Summit in Mumbai, Pandey said, “That is a big regulation and the process has begun. We will have lots of consultations and put out a consultation paper. It will take some time… You will know when the NoC (for NSE IPO) is issued.”

SEBI Chief on purpose of IPOs

During the interaction, Pandey was also asked about the comments made by Chief Economic Adviser V Anantha Nageswaran, who said that IPOs today are becoming less about fundraising and more about providing exits to existing investors. Responding to this, the SEBI Chief said that the regulator has already made certain changes to strengthen the framework.

Regulatory framework strengthened

He explained that SEBI has revised some of the metrics used in regulations. “The metrics have also been revised — earlier, open interest was used, but now we have introduced the delta metric. With delta, the assessment becomes more accurate. They were also talking about premium versus open interest,” he said.

‘Both exit and fundraising possible’

Pandey added that IPOs naturally serve different purposes depending on the company and its stage of growth. “An IPO allows both exit and fundraising. It depends on the specific IPO. Many companies are already well-established by the time they come to the market. When they become mature, it is natural that some investors will choose to exit because a premium has already been created,” he noted.

At the same time, he said, there are companies that launch IPOs to raise fresh capital for greenfield projects and business expansion. “These are a different kind of IPO,” he added.

Emphasising SEBI’s broader approach, Pandey said, “From our perspective, every variety of IPO should exist in the capital market, and all kinds of possibilities should remain open in the capital market.”

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)