The U.S. move is in response to China halting purchases of American soybeans months ago.

Sadot Group Inc. shares surged over 200% in early Wednesday premarket trading, ranking top on Stocktwits’ trending list, after President Donald Trump signaled plans to halt U.S. cooking oil imports from China in response to Beijing’s suspension of soybean purchases from the U.S.

Shares of Australian Oilseeds Holdings Ltd skyrocketed 229% in the premarket session. The two stocks were top gainers among U.S. equities and are likely to notch their best days on record if premarket gains sustain in the regular trading session.

The latest trade escalation is likely to impact the prices of key agricultural commodities, thereby affecting agri-trading firms. Sadot Group produces and trades grains, oilseeds, pulses, fruits, and rice across the world.

To adapt to the latest policy shift, Sadot Group might have to adjust its sourcing strategies, increase domestic production, or seek new suppliers to maintain stable operations.

Trump on Tuesday said his administration is considering “terminating business with China having to do with Cooking Oil” in retaliation for Beijing refusing to buy U.S. soybeans.

The U.S. was China’s top market for used cooking oil (UCO), according to a Reuters report. A record 1.27 million metric tons worth $1.1 billion were imported last year, but imports plunged to 290,690 tons, or $286.7 million, from January to August 2025 amid tariff announcements.

China has been the top buyer of U.S. soybeans. Beijing stopped American soybean purchases in May and turned to South American producers.

“Trump’s comments spotlighted vulnerabilities in global cooking oil and soybean supply chains, sparking speculative buying in U.S.-aligned or alternative agribusiness firms,” a Stocktwits user said. “While the broader market dipped slightly on trade war fears, the oilseeds niche exploded.”

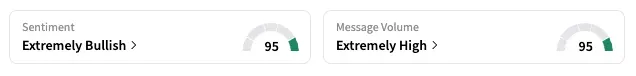

The retail sentiment for SDOT shifted to ‘extremely bullish’ as of early Wednesday, from ‘bearish’ the previous day. Up till the last close, the stock was down 86% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<