Schwab Asset Management said it will vote in favor of Elon Musk’s 2025 CEO Performance Award, calling the proposal aligned with shareholder interests.

- Schwab Asset Management said it will vote in favor of Elon Musk’s 2025 CEO Performance Award, calling the proposal aligned with shareholder interests.

- Major institutional investors including CalPERS, the New York State and City Comptrollers, and proxy advisers ISS and Glass Lewis have opposed the $1 trillion pay package.

- On Stocktwits, several retail users said they expect the vote to pass but warned Tesla shares could still fall, with some predicting a move below $300.

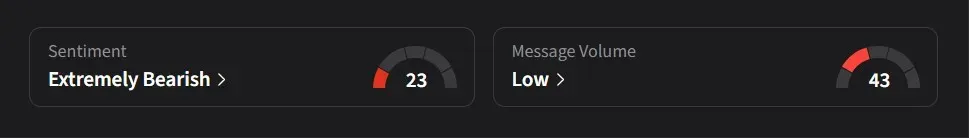

Retail sentiment around Tesla Inc. turned ‘extremely bearish’ on Stocktwits on Tuesday, suggesting Schwab Asset Management’s decision to back Elon Musk’s 2025 CEO performance-based award did little to boost investor confidence ahead of the company’s high-stakes shareholder on Thursday.

Investors on Stocktwits remained wary after months of growing tension between Tesla’s retail base, which holds more than 40% of the company’s float, and major institutional shareholders divided over Musk’s compensation plan.

The mood followed recent warnings from prominent Tesla investors Sawyer Merritt and Jason DeBolt, who said they might withdraw their holdings from Charles Schwab & Co. after reports that several of the brokerage’s ETF funds voted against management’s proposals at the 2024 annual meeting.

Schwab Says It Will Vote In Favor

Schwab Asset Management said Tuesday it will vote in favor of Musk’s 2025 CEO Performance Award, describing its proxy voting process as “thorough and deliberate” and rooted in promoting shareholder value.

“We firmly believe that supporting this proposal aligns both management and shareholder interests, ensuring the best outcome for all parties involved,” Schwab said in a statement.

The firm said it applies its own internal voting guidelines rather than relying solely on the recommendations of proxy advisers such as Glass Lewis or ISS. Schwab added that its decisions are based on assessments of board composition, strategic performance, risk management, and transparency.

Institutional Divide Deepens

While Schwab’s statement was seen as a win for Musk supporters, several major institutional investors have come out against the proposal. The California Public Employees’ Retirement System (CalPERS), which owns about 5 million Tesla shares, said it will vote against the plan, calling it excessive and warning it could concentrate too much power in one shareholder, Bloomberg reported.

Other opponents include the New York State and City Comptrollers, SOC Investment Group, ISS, and Glass Lewis. Supporters of the plan include Tesla Chair Robyn Denholm, who said Musk “gets nothing unless shareholders enjoy exceptional returns,” along with ARK Invest’s Cathie Wood, Wedbush analyst Dan Ives, and CNBC’s Jim Cramer.

Musk’s $1 Trillion Pay Proposal

The 10-year performance-based package ties Musk’s compensation to market capitalization, profitability, and innovation milestones. If all targets are met, Musk’s ownership stake could rise to roughly 25%.

Stocktwits Users Warn Tesla May Fall Further

One user said they expect the shareholder vote to pass but warned Tesla’s stock could still decline amid broader market weakness.

Another noted that many investors appear to be betting heavily on the outcome of the pay package vote, though they believe the stock remains due for a correction. A third user said they admire Elon Musk but see Tesla shares as overvalued, suggesting the stock should be trading below $300.

Tesla’s stock has risen 10% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<