The defense and tech company’s adjusted earnings per share of $2.58 beat analyst estimates by over $0.50.

- SAIC’s third-quarter adjusted earnings per share of $2.58 beat analyst estimates of $2.06.

- Revenue for the quarter came in line with estimates at $1.87 billion.

- The company also raised its adjusted diluted EPS guidance to $9.80 to $10.00, up from $9.40 to $9.60 earlier.

Science Applications International Corporation (SAIC) shares traded over 16% higher on Thursday following upbeat third-quarter results and improved guidance.

The defense and technology company posted adjusted earnings per share (EPS) of $2.58, far beating the analyst consensus of $2.06, according to Fiscal.ai data. Revenue for the quarter was $1.87 billion, in line with estimates, although 6% lower than the same period last year.

SAIC also raised its adjusted earnings before interest, tax, depreciation and amortization (EBITDA) guidance to about $695 million, up from between $680 million and $690 million previously. It is also projecting adjusted diluted EPS of $9.80 to $10.00, up from $9.40 to $9.60 reported before.

“Our third quarter results reflect a 5.6% revenue contraction, slightly ahead of our guidance when adjusting for the approximate 1% headwind from the government shutdown, and strong margins due to continued sound program execution,” said Jim Reagan, SAIC Interim Chief Executive Officer, in the statement.

Against The Odds

SAIC’s stellar performance comes despite the recent government shutdown, which has affected several federal contractors this quarter. About 98% of the company’s total revenues come from government contracts or subcontracts, the company had said earlier in a filing.

Its operating income as a percentage of revenues decreased in the quarter compared with the same period last year, which it attributed to executive transition costs related to a contract termination.

SAIC also acquired SilverEdge Government Solutions, a provider of technology solutions and products, last month. The company said that the deal enhanced its strategy to provide mission-focused, IP-based solutions and commercial products to its customers.

How Did Stocktwits Users React?

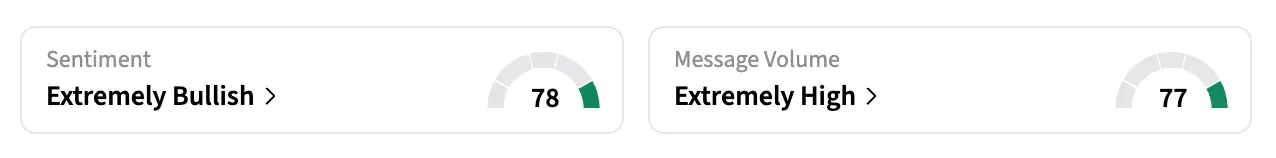

On Stocktwits, retail sentiment surrounding the stock shifted to ‘extremely bullish’ from ‘neutral’ while message volume jumped to ‘extremely high’.

SAIC shares have lost over 9% this year.

Also Read: Wedbush Backs Snowflake After Q3 Print, Suggests Buying The Dip

For updates and corrections, email newsroom[at]stocktwits[dot]com.<