Barclays analyst Benjamin Budish noted that Robinhood is accelerating the rollout of features, describing the updates as modern and user-friendly.

Robinhood Markets Inc. (HOOD) stock gained attention in Thursday’s premarket session, drawing significant investor interest after the launch of the new social media platform and other tools at its HOOD summit 2025 in Las Vegas.

The company introduced a range of new tools and features, including short selling, futures trading, and artificial intelligence integrations, all designed to deepen user engagement. Following the summit, Wall Street analysts took a positive stance on the fintech company and its fresh products.

Barclays analyst Benjamin Budish noted that Robinhood is accelerating the rollout of features, describing the updates as modern and user-friendly. Meanwhile, Piper Sandler analyst Patrick Moley highlighted the importance of short selling and social trading capabilities.

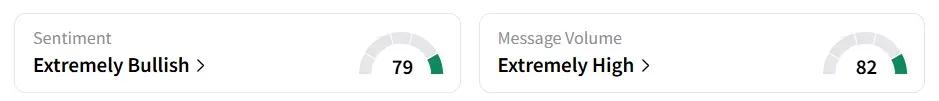

Robinhood Markets’ stock inched 0.4% higher in Thursday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock saw a 95% increase in user message count over the past week.

One of the most talked-about additions is “Robinhood Social,” a new platform feature set to launch in early 2026. The feature aims to turn trading into a more interactive experience, allowing users to share strategies and view peer activity. Piper Sandler analyst Patrick Moley believes this concept could unlock huge potential, especially among younger, community-driven investors.

The company is also integrating new artificial intelligence tools, branded as “Cortex,” aimed at providing traders with real-time data insights and more personalized recommendations.

KeyBanc’s Alex Markgraff raised the price target on the stock to $135 from $120, maintaining an ‘Overweight’ rating. He sees the platform’s expansion as a catalyst for increased trading volume and deeper wallet share among users.

Robinhood Markets’ stock has gained over 215% in 2025 and over 469% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<