Rivian reported $1.6 billion in Q3 revenue and reaffirmed its 2025 delivery guidance of up to 43,500 vehicles.

- Rivian reported $1.6 billion in Q3 revenue and reaffirmed its 2025 delivery guidance of up to 43,500 vehicles.

- The company said its R2 SUV will start at about $45,000, with validation builds set to begin by year-end and production ramping in 2026.

- Rivian expects to receive up to $2.5 billion from its Volkswagen joint venture, with $2 billion anticipated in 2026.

Retail chatter spiked around Rivian Automotive on Tuesday after key updates from the company’s Q3 2025 earnings call fueled optimism about its upcoming R2 model and manufacturing expansion, driving the stock 2.4% higher in after-hours trading.

Key Updates On R2 Launch

CEO R.J. Scaringe provided an update on the R2 during the earnings call, stating the vehicle will be cheaper for customers. He said the R2 is set to begin at $45,000 and be a mid-sized SUV of the “most popular” size.

He also noted that the R2 was refactored from the performance and utility of the R1, but at a lower cost. Rivian plans to start manufacturing R2’s validation builds by the end of the year, with full production ramping up in 2026.

Manufacturing Expansion Plans

In terms of manufacturing capacity, Rivian is making significant strides with its infrastructure. Scaringe revealed that the company recently completed construction of its 1.1 million-square-foot R2 Body Shop and General Assembly Building, as well as a 1.2 million-square-foot Supplier Park and Logistics Center.

In addition, Rivian is planning for future growth with its new manufacturing plant under construction in Georgia, which will provide a further 400,000 annual units of capacity for the R2, R3 and derivatives.

Volkswagen Partnership Update

On the financial side, Rivian confirmed it is set to receive up to $2.5 billion in capital from its joint venture with Volkswagen Group, with $2 billion expected in 2026. Rivian also touched on its joint venture with Volkswagen, noting that the partnership will integrate Rivian’s technology into vehicles such as the Volkswagen ID.1.

Q3 Earnings Review

Rivian reported $1.6 billion in consolidated revenue for Q3, up 78% from a year earlier, driven by the automotive and software and services segments. The company posted an automotive gross loss of $130 million, attributed to low fixed cost absorption during planned plant shutdowns. Despite this, Rivian highlighted improving unit economics as it continues preparing for the R2 production ramp.

Net loss widened year over year to $1.17 billion from $1.1 billion, while loss per share narrowed to $0.96 from $1.08. On an adjusted basis, the company lost $0.65 a share, and the automotive cost of revenue per vehicle fell by nearly $19,000 year over year.

The software and services segment delivered $416 million in revenue and $154 million in gross profit. Around 50% of this revenue came from Rivian’s joint venture with Volkswagen, further bolstered by growth in remarketing and vehicle repair.

Rivian closed the quarter with $7.1 billion in cash, cash equivalents, and investments, down from 7.5 billion at the end of the second quarter. The company posted an adjusted EBITDA loss of $602 million, mainly driven by increased R&D and SG&A expenses related to the R2 launch and the development of its autonomy platform.

The company reaffirmed its 2025 vehicle delivery guidance of 41,500 to 43,500 units, with continued ramp-up expected in the fourth quarter and into 2026.

Stocktwits Users Discuss Rivian’s R2 Launch Plans

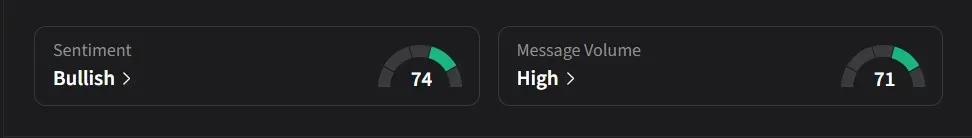

On Stocktwits, retail sentiment for Rivian was ‘bullish’ amid ‘high’ message volume.

One user said that the R2 could be Rivian’s best product to date, jokingly noting that it seemed to be a repackage of the company’s flagship vehicle.

Another user urged others to “load up” on the stock while prices were still low. A third user echoed a positive outlook, saying that Rivian was “executing as planned” with the R2 on track and sticking to its guidance, suggesting the company was in a solid position moving forward.

Rivian’s stock has declined 6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<