Bitcoin ETFs have seen over $2 billion in withdrawals since October 29, the second-worst streak on record.

- Ethereum funds lost nearly $1 billion over the same period, led by BlackRock’s ETHA.

- Solana ETFs continued to attract inflows, marking seven consecutive days of positive flows.

- Total crypto liquidations dropped sharply to $316 million from $1.7 billion the previous day.

Ripple’s XRP (XRP) led gains among major tokens in early Thursday trade, with the broader cryptocurrency market rebounding despite continued pressure from exchange-traded fund (ETF) outflows.

The move comes after six straight days of redemptions from spot Bitcoin (BTC) and Ethereum (ETH) ETFs, which have collectively drained billions in capital. Meanwhile, inflows continued into the Solana (SOL) and Hedera (HBAR) spot ETFs, though trading volumes have slowed.

Bitcoin ETFs Log Second-Worst Outflow Streak On Record

U.S. spot Bitcoin ETFs have seen over $2 billion in outflows since October 29, while Ethereum funds lost nearly $1 billion in the same period, according to SoSoValue data. The heaviest single-day redemption of Bitcoin occurred on Tuesday, when investors withdrew $566 million.

This marks the second-largest outflow streak in history, behind the late-February sell-off that saw more than $3 billion withdrawn in one week, including a record $1.11 billion on February 25.

Bitcoin’s price rose 1.7% in the last 24 hours, trading at around $103,000. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘neutral’ territory amid ‘high’ levels of chatter.

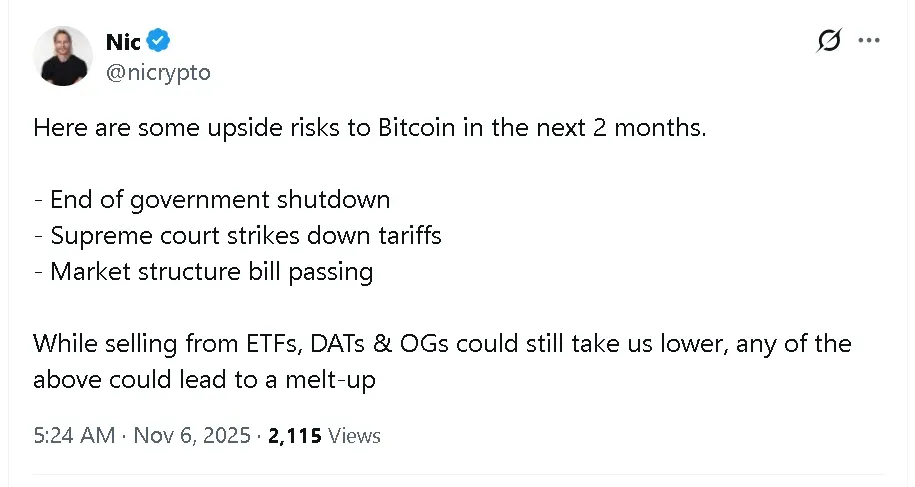

Nic Puckrin, founder of Coin Bureau, said potential upside catalysts in the coming months include an end to the government shutdown, a Supreme Court ruling striking down tariffs, or the passage of the Market Structure Bill. “While selling from ETFs, DATs & OGs could still take us lower, any of the above could lead to a melt-up,” he wrote in a post on X.

Ethereum ETFs Extend Outflows, Solana Funds Stay Resilient

Spot Ethereum ETFs posted $118.5 million in net outflows on Wednesday, led by $146.6 million from BlackRock’s ETHA.

Ethereum’s price rose 3.5% in the last 24 hours, trading at around $3,300. Retail sentiment on Stocktwits around the leading altcoin remained in ‘neutral’ territory with message volume at ‘high’ levels over the past day.

Meanwhile, Solana ETFs logged $9.7 million in inflows, marking their seventh consecutive day of positive flows and bringing the total net additions since launch to $294 million.

Solana’s price gained 2.6% in the last 24 hours, trading at around $158. On Stocktwits, retail sentiment around the token was in the ‘bearish’ zone, and chatter dipped to ‘normal’ from ‘high’ levels over the past day.

XRP, Crypto Stocks Gain Amid Market Rebound

XRP’s price gained 4.3% in the last 24 hours, with retail sentiment on Stocktwits improving to ‘neutral’ from ‘bearish’ territory. While the uptick comes amid a broader market recovery, XRP’s parent company also announced a slew of developments at its Ripple Swell event over the last two days, including a $500 million fundraise with a $40 billion valuation.

Meanwhile, Cardano (ADA) gained 1.9% in the last 24 hours, followed by Binance Coin (BNB), which gained 1.8% and Dogecoin (DOGE), which gained around 1%. CoinGlass data showed that total crypto liquidations were at around $316 million in the last 24 hours, down from $1.7 billion in the previous session. Around $127 million came from long positions and $189 million from shorts.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, edged up 1.2% in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) were up 3%. Crypto-exchange Coinbase (COIN) gained 1.3%.

Read also: Jensen Huang Warns China Just ‘Nanoseconds’ Behind US In AI Race After $85B Nvidia Selloff

For updates and corrections, email newsroom[at]stocktwits[dot]com.<