RBI Repo Rate: The Reserve Bank of India has established the stability of the home loan and real estate sector by keeping the repo rate stable at 5.5%. This decision increases the trust of investors and can make home shopping easier, which keeps the market boom.

Rbi repo rate unchanged: The Reserve Bank of India (RBI) on Wednesday retained the major repo rate at 5.5%. There has been no change in it. RBI has adopted a policy and watch policy amid growing optimism about India’s economic progress. Announcing the results of the meeting of MPC (Monetary Policy Committee), RBI Governor Sanjay Malhotra said, “MPC has decided to maintain the policy repo rate at 5.5%.” Prominent people of the real estate sector have given positive response to this decision of RBI. It is said that this will increase the trust of investors.

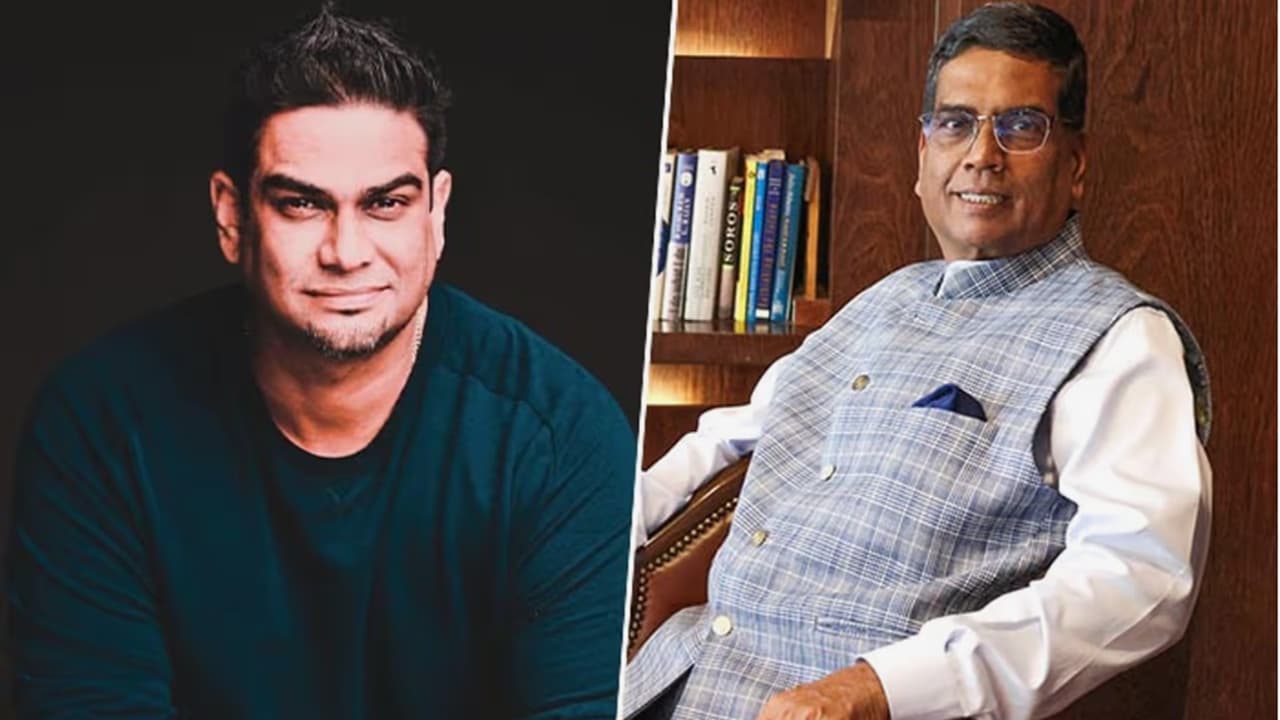

Housing area will get speed by maintaining repo rate at 5.5%: Mahendra Nagraj

M5 Mahendra Group Vice President Mahendra Nagraj appreciated the RBI’s decision. Said,

The RBI’s decision to maintain the repo rate at 5.5% is a prudent and assured step. This will promote speed in India’s housing area.

He said that low rates of home loans are maintaining strong perception of buyers in both affordable and premium housing areas. Policy direction is able to make better plans and work more efficiently. Cuts in interest rates help the market, but overall this stance strengthens the long -term regional stability.

There was hope of stability in interest rates: Lincoln Bennett Rodrigues

Chairman and founder of Bennett & Bernard, Lincoln Bennett Rodrigues said stable interest rates were expected. This will not affect luxury real estate buyers. They said,

“Interest rates are not the main factor in luxury real estate. Buyers are investing for long -lasting prices, heritage and quality of life.”

Rodrigues said that rich people in a market like Goa, non -resident Indian and experienced investors are more interested in the property being special and stability than just cutting interest rates. The decision of RBI confirms this feeling of stability.

The cut in interest rates could increase the beauty

Sterling Developers Chairman and MD Ramani Shastri said that the region has already been adapted to the atmosphere of current interest rates and is constantly performing strong. Shastri said,

We have seen a strong demand due to low interest rates, especially in mid, premium and luxury segment. The cut in interest rates could have increased the brightness in the festive season, but maintaining the status quo will keep the current pace of sales intact.

He said that this decision gives home buyers confident of stable conditions of debt. At the same time, developers get clarity in making further plans. With continuous demand and continuous policy support, the real estate sector is in a good position to remain a major pillar of India’s economic growth.