Clear Street pointed to strength in RGX-202 data for Duchenne and early results from Sura-Vec in wet AMD.

- Clear Street kept a ‘Buy’ rating, cut its price target to $45 from $50, and said its core thesis remains intact.

- The FDA said more evidence is needed to support approval of RGX-121 for Hunter syndrome.

- Regenxbio plans a Type A meeting with the FDA and aims to resubmit the BLA with additional expert input and longer-term data.

Shares of Regenxbio, Inc. plunged about 16% after hours on Monday after the FDA issued a Complete Response Letter (CRL) for its Hunter syndrome gene therapy. Still, Clear Street kept a ‘Buy’ rating and said its core thesis on RGNX remains intact.

Clear Street’s Take On RGNX

Clear Street lowered its price target on Regenxbio to $45 from $50, implying over a 300% upside from the stock’s last close.

The firm said the FDA cited insufficient evidence of effectiveness for RGX-121, and pointed to the strength of existing data from RGX-202 in Duchenne muscular dystrophy (DMD), the clear unmet need in the market, early data from sura-vec in wet age-related macular degeneration.

Clear Street also reiterated its conviction in Adeno-associated virus (AAV) gene therapy and Regenxbio’s ability to develop “best-in-class” AAV programs.

FDA Pushes Back Approval Of RGX-121

On Monday, Regenxbio said the U.S. Food and Drug Administration (FDA) issued a CRL for its Biologics License Application (BLA) for RGX-121 to treat Hunter syndrome, also known as Mucopolysaccharidosis Type II (MPS II).

The BLA had been accepted under the accelerated approval pathway in May 2025. In the CRL, the FDA said it agreed with the study protocol in principle but outlined reasons for not approving the application at this stage. These included uncertainty about study eligibility criteria for clearly defining patients with neuronopathic disease, questions about the comparability of the external natural history control, and whether the biomarker used in the study can reliably predict meaningful benefit for patients.

The FDA also outlined potential paths forward, including a new study, treating additional patients with longer-term follow-up, or using an untreated control arm, all of which the company noted would be challenging in an ultra-rare disease such as MPS II.

In January, the FDA placed clinical holds on RGX-121 and RGX-111 after identifying a single case of a central nervous system tumor in a participant treated with RGX-111.

Regenxbio Targets BLA Resubmission

Regenxbio said it plans to request a Type A meeting with the FDA to discuss the CRL and a potential resubmission strategy. The company said it intends to provide additional evidence from global MPS II experts, further clarify the neuronopathic patient population, and include longer-term clinical data to support evidence of effectiveness, with the goal of resubmitting the BLA as quickly as possible.

CEO Curran Simpson said the company remains confident in the quality and volume of evidence supporting RGX-121’s long-term potential and described the FDA’s decision as “devastating” for families affected by the disease.

How RGX-121 Works

RGX-121 is a one-time gene therapy designed to deliver a functional copy of a missing gene directly to the brain, enabling the body to produce the required enzyme on an ongoing basis. The approval application was supported by lab results, patient function data, and safety findings from the Campsiite clinical trial program, with follow-up data extending to 12 months. The company has said the treatment has been well-tolerated by all patients to date.

The program has received Orphan Drug, Rare Pediatric Disease, Fast Track, and Regenerative Medicine Advanced Therapy (RMAT) designations from the FDA, as well as Advanced Therapy Medicinal Products (ATMP) classification from the European Medicines Agency.

How Did Stocktwits Users React?

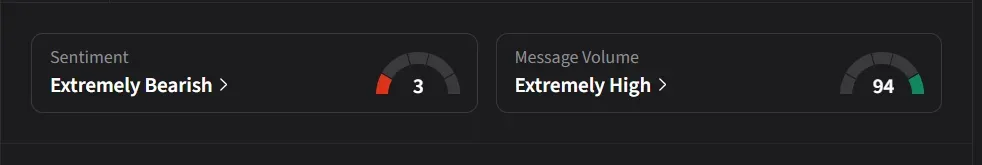

On Stocktwits, retail sentiment for RGNX was ‘extremely bearish’ amid ‘extremely high’ message volume.

One user questioned, “My concern now is that RGX-202 for Duchenne also does not have a control arm,” noting that companies using natural history controls have faced FDA pushback even when initially agreed. They also pointed out that Sarepta’s Elevidys included a placebo arm.

Another user said, “This one is done. They will need to dilute & raise then meet FDA. Do whole new arm. Stock is dead in the water.”

RGNX stock has risen 26% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<