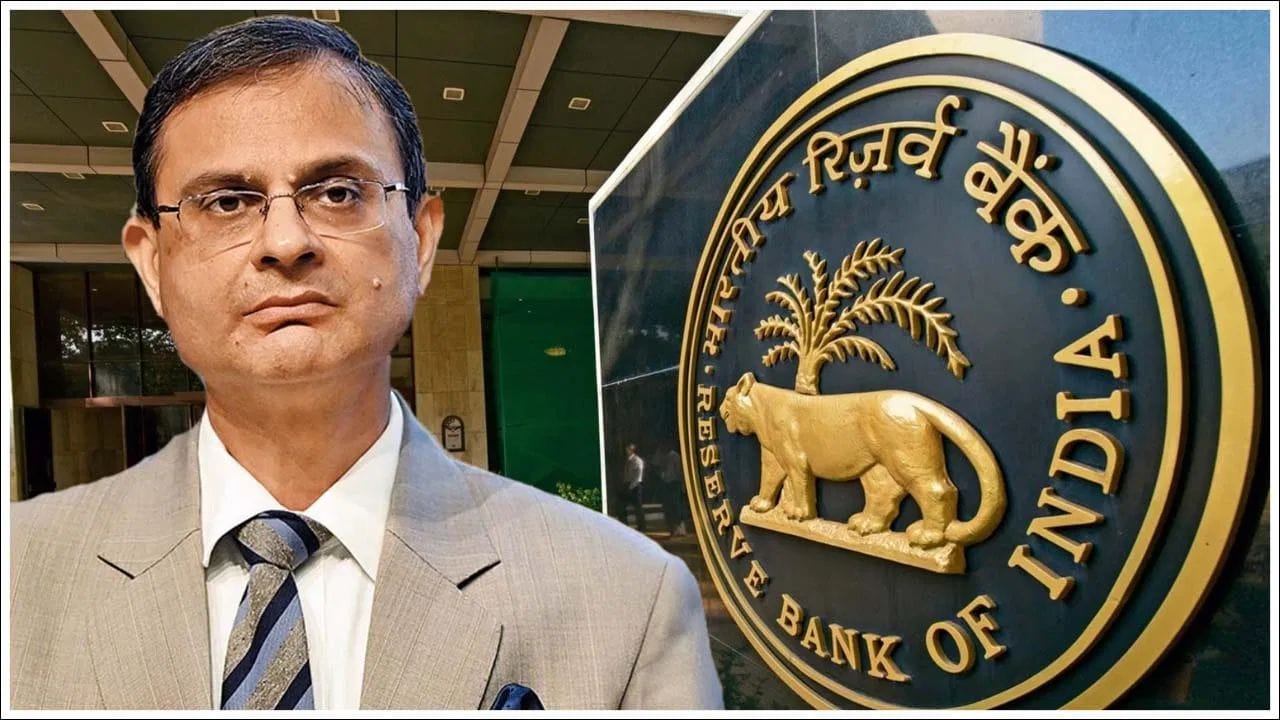

Reserve Bank of India

The three-day meeting of the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has started from Wednesday. Today is its third and last day. RBI Governor Sanjay Malhotra, who is also the MPC chairman, will announce the policy outcome at 10 am on Friday. There are divided opinions in the market on whether RBI will resume rate cuts or continue the pause for now, especially when the GDP of the last quarter has been stronger than expected.

What are GDP and inflation figures saying?

India’s GDP grew by 8.2% in the September quarter, which is more than expected and strengthens the argument for continuing policy support. But on the other hand, inflation has come down faster than expected. Inflation has remained below the RBI target band of 26% for two months. Retail inflation remained only 0.25% in October due to GST cut, base effect and huge fall in the prices of vegetables and fruits. RBI has cut the repo rate by a total of 100 basis points since February last year and brought it to 5.5%, but the rates were kept stable in August and October.

Different opinions of experts

Many economists believe that RBI will be cautious this time because the current rate level is also giving a good “positive real rate”. Madan Sabnavis (Bank of Baroda) said that this is a close call and considering the circumstances, there is no need to change the policy rate. On the other hand, some experts are expecting another rate cut, because inflation has come down significantly and there may be some pressure on growth going forward. According to HDFC Bank, inflation may remain below 4% till the third quarter of FY27, hence there is a possibility of 25 bps cut.

CRISIL Chief Economist Dharamkirti Joshi said that core inflation stood at 2.6% in October and this leaves scope for a 25 bps cut in December. Sandeep Vempati (BJP) said that India is among the few big economies of the world where growth is increasing and inflation is decreasing, hence the decision should not be difficult for RBI. According to him, MPC can cut rates by 25 or even 50 bps to increase growth.

What will be the big focus?

Even if RBI does not change the rates, the market will carefully watch its guidance to see what signals it gives on liquidity, future rate policy and the economic picture. Some experts believe that there are risks due to excessive cuts like impact on BP (Balance of Payments) and problems in raising funds of banks. According to ICRA’s Aditi Nair, GDP is continuously coming in higher than expected, so there is no immediate need for a rate cut, although good inflation figures provide relief. RBI’s target is that inflation should remain around 4%, in the range of +/- 2%.