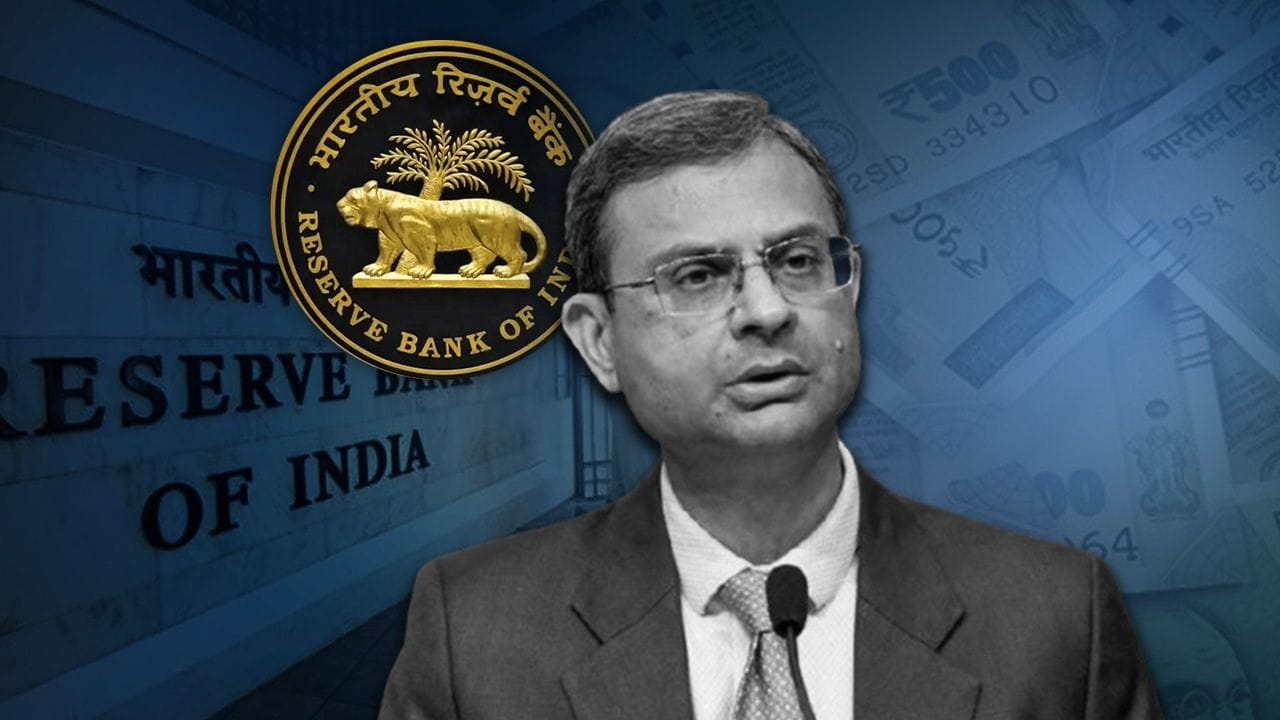

reserve Bank of India

Reserve Bank of India has made a big announcement after the monetary policy meeting. RBI has not cut the repo rate this time. The rate will still remain 5.25 percent. Before this, in the last one year, RBI had reduced the rate by 125 basis points. But this time the repo rate has been maintained in the meeting held in February 2026. There has been no change in that.

The Monetary Policy Committee (MPC) of the Reserve Bank of India on Friday raised its inflation estimates for the first and second quarter of FY27 to 4% and 4.2%, indicating a departure from earlier expectations of a sharp decline in inflation.

The change came at the end of the MPC’s three-day policy review, in which the central bank kept the repo rate unchanged at 5.25%. This move suggests that the RBI is becoming more cautious about the inflation outlook, even as it is maintaining a stable stance on interest rates. RBI Governor Sanjay Malhotra said that the growth outlook remains positive due to the deals done in recent times. The Governor said that the Indian economy remains strong.

Reduction was not anticipated

RBI Governor has announced not to cut the repo rate after the meeting but its estimates were made even before that. Experts believed that there was little possibility of a repo rate cut in February and that is exactly what happened. Because in the Union Budget 2026, a target has been set to increase the capex by 12% and keep the fiscal deficit at 4.3%. The external environment is also looking a little better. America has reduced tariffs on India to 18% and the India-EU FTA is expected to support trade and capital flows. Keeping all these positive signs in mind, RBI has taken this decision.

There were cuts 4 times in a year

Last year, RBI had reduced the EMI of General Income a lot. Between February 2025 and December 2025, the rate was reduced 4 times i.e. by 125 basis points. There was a reduction of 0.25% in February 2025, 0.25% in April and 0.5% in June. After the ban in August and October, there was again a cut of 0.25% in December.