While November is typically a strong month for equities, a decline in major technology stocks has dragged markets lower, leaving both the Dow Jones Industrial Average and S&P 500 down about 2%.

- The firm pointed to several warning signals that emerged last week, including “mechanical sell” triggers across the S&P 500, Nasdaq-100, and Dow.

- It said weakening market breadth and deteriorating internal indicators are causes for concern, historically signaling poor performance in the intermediate term.

- Raymond James added that a correction would create attractive buying opportunities once markets stabilize.

Raymond James reportedly warned on Tuesday that the recent market declines may only be the beginning, with deeper losses likely ahead.

While November is typically a strong month for equities, a decline in major technology stocks has dragged markets lower, leaving both the Dow Jones Industrial Average and S&P 500 down about 2% so far. The tech-heavy Nasdaq Composite has declined by more than 4%.

According to a CNBC report that cited the firm, the pullback may accelerate over the next several months.

In a note published Monday, Javed Mirza, the firm’s managing director for quantitative and technical strategy, said the S&P 500 could fall 8% to 10% over the next three months. He pointed to several warning signals that emerged last week, including “mechanical sell” triggers across the S&P 500, Nasdaq-100, and Dow, following a similar signal in the Russell 2000 earlier.

Mirza said weakening market breadth and deteriorating internal indicators are also causes for concern, historically signaling poor performance in the intermediate term.

“Portfolio Managers should begin to manage risk control levels, as equity markets appear to be at risk of an intermediate-term (1-3 month) corrective phase taking hold, with downside potential of 8-10%,” according to a note published Monday by Mirza.

Buy The Dip?

However, Mirza emphasized that a correction would also create attractive buying opportunities once markets stabilize, particularly in technology, industrials, and basic materials.

For now, however, he expects any short-term rebound to be limited, likely running into resistance at the 50-day moving average.

“Warning signs have appeared for equity markets,” he cautioned, adding that the market may be transitioning into a more turbulent phase of its broader cycle.

What Is The Retail Sentiment?

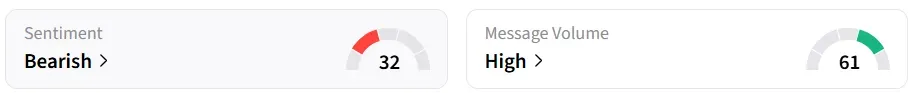

Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, is over 14% year-to-date, while the Invesco QQQ Trust ETF (QQQ) is up 18% during this period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<